(Bloomberg) -- Agricultural commodities are poised for a “mini supercycle” as China’s rampant demand keeps supplies tight, according to the head of a key Cargill Inc. trading unit that’s seeing its best results in a decade.

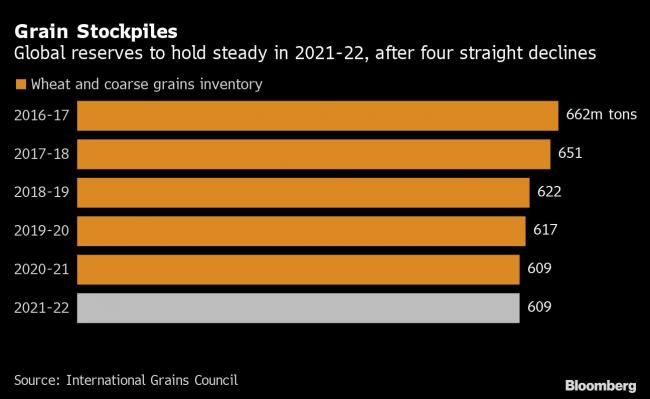

China’s crop-buying spree and dwindling stockpiles recently sent prices to multiyear highs, while also whipping up volatility that traders crave. A surprise smaller-than-expected U.S. planting report should help drive corn and soy prices even higher, said Alex Sanfeliu, who runs Cargill’s World Trading Group. The International Grains Council also sees supplies remaining tight.

“This opens the door for high prices, high volatility and a friendly outlook to be with us for longer,” Sanfeliu said in an interview from Geneva, where the global trade group is based. “Maybe this starts a mini supercycle.”

Like other top merchants, Cargill’s traders have thrived during the Covid-19 pandemic as price swings returned. It’s a big turnaround from previous years, when bumper harvests and oversupplied markets cut volatility and trading margins.

“We thought last year was good. This one is way better,” Sanfeliu said. “You have more opportunities to do well when you have a lot of volatility.”

The agribusiness giant recently stopped releasing its results publicly and has become less of a traditional trader as it shifts focus to meat, fish feed and human nutrition. Still, Chief Executive Officer Dave MacLennan has said trading activities are once again contributing some 30% to 40% of total earnings.

Data Analytics

To help make trading decisions, Cargill has invested significantly in tools such as artificial intelligence and machine learning. It hired data scientists, using information gathered from public sources and its own assets, such as crushing plants, refineries and feed lots. That gives it an edge during major events, such as gauging the impact on feed usage from African swine fever outbreaks, or how Covid-19 affects restaurants’ demand for edible oils.

“You are getting data giving you insight on where we are going,” Sanfeliu said. “That can give you enough conviction to trade around these kind of events.”

Looking forward, the trading veteran said Cargill’s bullish outlook is based on continued Chinese buying and consistent strong biofuels demand. Prices need to rise further to either curb consumption or incentivize production, and the weather will determine just how tight crop markets are.

“When you have markets that have no room for mistakes things can get pretty spicy when the weather turns,” he said.

©2021 Bloomberg L.P.