Recode dubbed it “the most anticipated slide deck of the year.” And I agree.

Venture capitalist Mary Meeker’s annual Internet Trends report is an absolute must-read.

From M&A trends, to smartphone adoption, to cutting-edge innovations — the report is a comprehensive overview of all things tech.

And since we’re all about spotting big tech trends early here, I can’t stress enough how much the report is worth our time and attention.

There’s something about seeing data represented visually that drives home the significance of trends more powerfully. More importantly, it highlights their investment potential.

That said, this year’s report is 355 slides in length — up from 213 last year. And I know that many people can’t put in the time to fully digest the data.

So it’s become a tradition of ours to distill it down to the five or six most compelling and insightful charts each year.

With that in mind, here’s our annual “CliffsNotes” version of the report. (For those of you with ample free time and ambition, you can check out all the slides in their full glory here.)

Tech Takeaway #1: It’s STILL All About Mobile

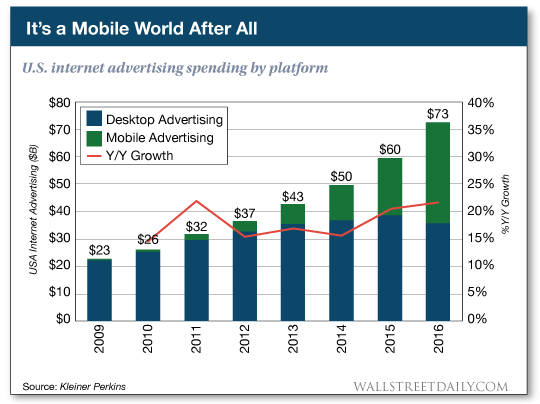

As the old saying goes, “Advertising follows eyeballs.”

Granted, there’s a lag between recognition and reallocation. But it’s an inevitability. And after years of mobile dominance, ad spending on mobile devices finally caught up and crossed the 50% threshold in the United States.

How should investors play this trend? By making sure you own a piece of the two tech giants that dominate the mobile and advertising worlds — Facebook (NASDAQ:FB) and Alphabet (NASDAQ:GOOGL) Inc C (NASDAQ:GOOG).

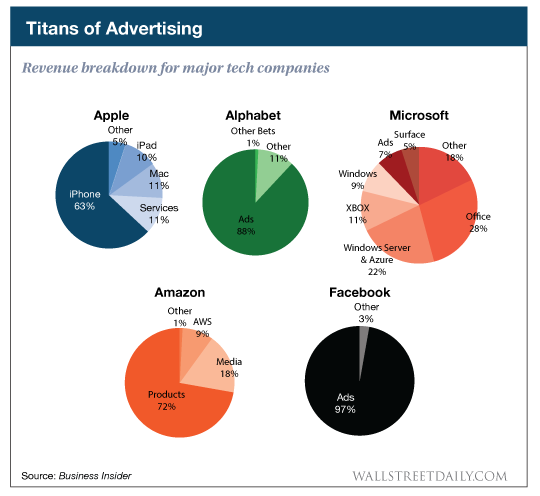

As you can see in this chart — not from Meeker’s report — both companies are essentially pure plays on ad spending.

What’s that? The stocks are too pricey at $151 and $964 per share, respectively? Well, then consider some long-dated call options instead.

You’ll benefit from reduced capital outlays (i.e., less risk) and increased upside potential. Win-win!

Tech Takeaway #2: Data, Data Everywhere

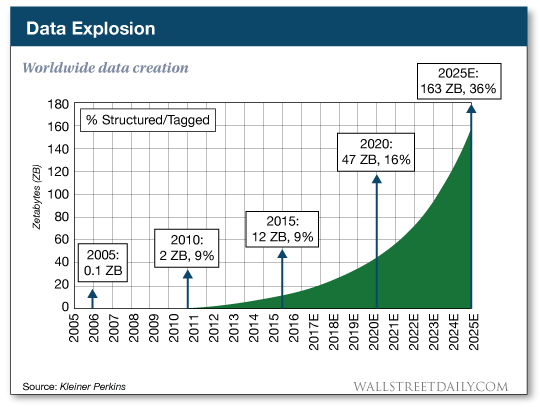

Our “always-on, always-connected” society means there’s an incredible amount of digital data being created.

And there’s no end in sight, either. Quite frankly, we’re just getting started.

Consider…

In the last two years, more data were created than the previous 5,000 years of humanity. Yet in 2017 alone, we will create even more data than that!

There are multiple ways to profit from this trend, including storage, security and business analytics.

After all, all these data need to be stored, secured and analyzed. Otherwise, what’s the point?

Datacenter real estate investment trusts (REITs), like Digital Realty Trust Inc (NYSE:DLR), have been reliable, steady performers. That should continue, even as the storage market becomes commoditized.

When it comes to security, I believe there’s unbounded upside. Why?

Because we’ve criminally underinvested in cybersecurity. That means we have billions and billions in spending and years and years of catching up to do.

At the same time, however, cybersecurity is a reactive, not proactive market. Criminals are always one step (or more) ahead of our defenses. Such a dynamic environment ensures we’ll never get ahead of the problem. Especially when we consider that the cyberattack “surface area” keeps expanding at a dizzying pace.

As I’ve shared before, I don’t believe a silver-bullet solution is possible. Therefore, the best investment approach is to own a dynamic basket of the leading and up-and-coming cybersecurity companies via the PureFunds ISE Cyber Security (NYSE:HACK).

Add it all up and there’s a good reason I labeled cybersecurity “the Trade of the Decade” in the April 2016 True Alpha issue. Don’t miss out!

Tech Takeaway #3: Mind the (Digital) Gap

This isn’t ageist. It’s reality…

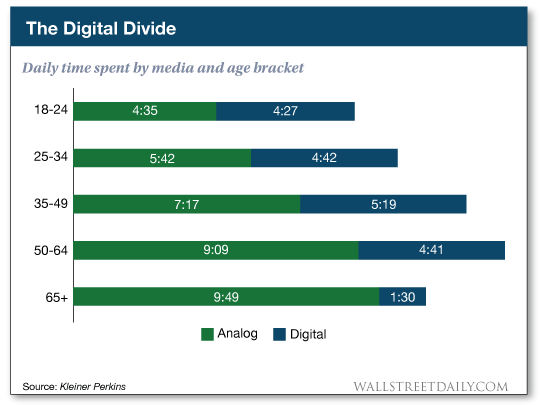

A digital divide exists in terms of technology adoption.

As we would expect, younger people embrace new technologies and platforms much more willingly than wiser people. (Notice I didn’t say “older people”?)

More specifically, daily time spent on mobile devices varies significantly based on age group. For instance, 18–24-year-olds spend 49% of their mobile device time on digital units, whereas the 65-plus group spends only 13%.

The investment implications here aren’t as obvious. That is, it’s not about buying a particular stock or ETF. It’s more about risk considerations.

If there’s a hyped-up technology company promising to revolutionize living for the baby boomers, check yourself before you wreck your portfolio. Chances are that adoption rates will be much slower than management’s rosy predictions.

By the same token, be wary of technology companies focusing exclusively on the youngest age bracket, like Snap Inc. (NYSE:SNAP).

Although early adoption rates promise to be through the roof, loyalty is fleeting. Once the next “big thing” comes along, this group will be just as eager (and quick) to abandon one and adopt the other.

That’s it for today. I’ll be back with three more key takeaways from Meeker’s 2017 Internet Trends report in next week’s column. Stay tuned!