Video communications platform Zoom Video (NASDAQ:ZM) stock has been trading down (-36%) for the year but is staging a rally. The popular video teleconferencing platform has been a top benefactor during the pandemic as COVID lockdowns skyrocketed its top line and share price. The spread of COVID vaccinations and return to work trend has resulted in a normalization as a reversion in business is expected and a rebound from the overshoot. The key question for investors is how much of the pandemic gains will stick and if the growth cycle is over. The best days of triple digit percentage growth may be behind them for Zoom, but the Company is still growing. More importantly, the stock may be a good recession play as it is shielded against an economic downturn since it is a cost-effective communications tool that helps enterprises drive efficiencies. The Company completed its acquisition of Solvvy to help strengthen its contact center product with conversational AI technology for customer support teams. This is one segment of its drive to enable more business workflows on its platform horizontally and adjacently. The Company had some large enterprise wins in the quarter including health insurer Humana (NYSE:HUM) with 24,000 Zoom Phones and Avis Budget Group (NYSE:CAR) adding over 10,000 Zoom phones. Prudent investors looking for exposure in the migration to hybrid work forces can watch for opportunistic pullbacks in shares of Zoom.

Q1 Fiscal Year 2023 Earnings Release

On May 23, 2023, Zoom Video released its second-quarter fiscal 2023 results for the quarter ending June 2021. The Company reported earnings-per-share (EPS) profit of $1.03 beating consensus analyst estimates for a profit of $0.88 by $0.15. Revenues rose 12.3% year-over-year (YoY) to $1.07 billion, matching consensus analyst estimates for $1.07 billion. Enterprise customers rose 24% YoY to 198,900 with trailing 12-month net dollar expansion rate of 123%. Non-GAAP operating margins were 37.2% with net cash from operating activities of $526.2 million. Customers with over $100,000 in trailing 12 month revenues rose 46% YoY. Zoom Video CEO Eric Yuan commented:

“In Q1, we launched Zoom Contact Center, Zoom Whiteboard and Zoom IQ for Sales, demonstrating our continued focus on enhancing the customer experience and promoting hybrid work. We believe these innovative solutions will further expand our market opportunity for future growth and expansion with customers. Additionally in Q1, we delivered revenue of over one billion dollars driven by ongoing success in Enterprise, Zoom Rooms, and Zoom Phone, which reached 3 million seats during the quarter. We also maintained strong profitability and cash flow, including 17% in GAAP operating margin, approximately 37% non-GAAP operating margin, approximately 49% operating cash flow margin, and over 46% adjusted free cash flow margin.”

Mixed and Raised Guidance

Zoom issued both fiscal Q2 2023 and full-year 2023 guidance. For Q3 2021, the Company expects $0.90 to $0.92 EPS versus $0.87 consensus analyst expectations. Revenues for Q2 are expected between $1.115 billion to $1.120 billion beating analyst estimates for $1.11 billion. For full-year 2023, Zoom sees EPS between $3.70 to $3.77 range versus $3.57 analyst estimates. The Company sees revenues for fiscal 2023 to come in between $4.53 billion to $4.55 billion compared to $4.54 billion.

Conference Call Takeaways

CEO Yuan noted they closed its acquisition of Solvvy, a conversational AI technology provider instrumental in its contact center offering product. It’s part of the drive towards offering and expanding more workflows on its platform. This is backed by recent launches of Zoom Whiteboard and Zoom IQ for sales teams, which provides a conversational AI solution analyzing customers engagements to provide insights and actions. He reviewed some major wins in the quarter, including health insurer Humana and Avis Budget, to Zoom Chat customer Lumio, TeamHealth, and Frank Covey. He noted that Forrester Consulting ran a study that indicates Zoom unified communications (UCaaS) could generate a 261% ROI over three years. They can drive efficiencies while enabling enterprises to provide more flexibility in terms of workstyle and locations.

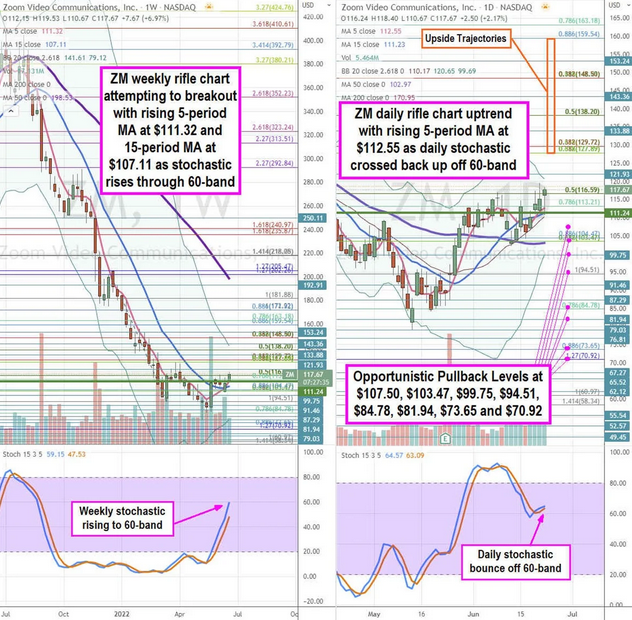

ZM Opportunistic Pullback Levels

Using the rifle charts on the weekly and daily time frames provides a near-term precision view of the price action playing field for ZM shares. The weekly rifle chart formed an inverse pup breakdown on the rejection off the $127.89 Fibonacci (fib) level. The weekly rifle chart bottomed out at $79.03 and staged a reversal breakout with a rising weekly 5-period moving average (MA) at $111.32 followed by the 15-period MA at $107.11. The weekly stochastic is rising to the 60-band stochastic. The weekly lower Bollinger Bands are rising at $79.12 and upper BBs falling at $141.61. The weekly market structure low (MSL) buy triggers above $117.67. The daily rifle chart formed another breakout with a rising 5-period MA at $112.55 and 15-period MA at $111.23 with the upper BBs at $120.95 and daily lower BBs at $99.69. The daily stochastic crossed back up off the 60-band. Prudent investors can watch for opportunistic pullbacks at the $107.50, $103.47 fib, $99.75 daily lower BBs, $94.51 fib, $84.78 fib, $81.94, $73.65 fib, and the $70.92 fib level. Upside trajectories range from the $127.89 fib level up towards the $159.54 fib level.