- Yen spikes after breaching the 150-per-dollar mark

- Markets suspect intervention, but officials do not confirm

- Dollar charges higher on more upbeat US data

- Wall Street and gold suffer as dollar and yields extend rally

Yen surges, stoking intervention speculation

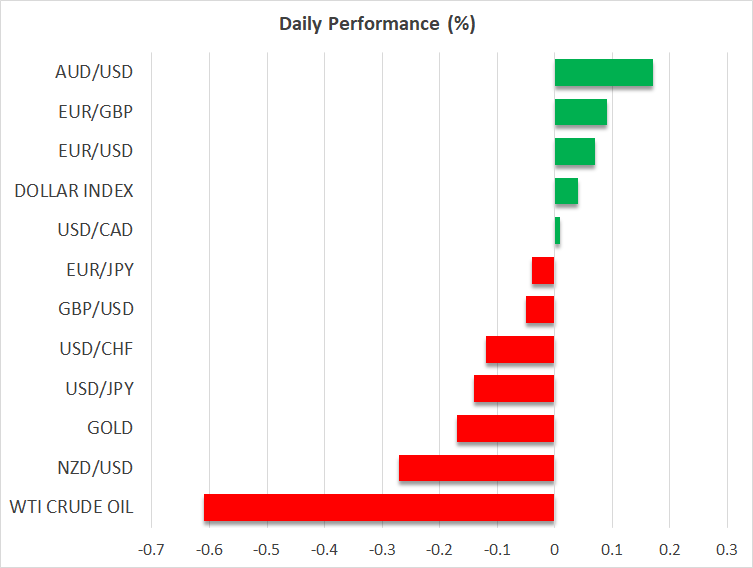

The yen was the sole major currency to end Tuesday with gains against the US dollar, unexpectedly and instantly surging after dollar/yen breached the 150 level.

That barrier was closely monitored by traders and considered as the line in the sand, which if breached could force Japanese authorities to intervene. Thus, yesterday’s move stoked speculation that this was the case, although Japan’s top currency diplomat Masato Kanda said today that he would not comment on whether they have intervened in the FX market.

Some say that the reaction was smaller than last year and that it may have been traders’ reaction on fear of intervention after dollar/yen moved past the 150 zone. However, to have such a synchronized response by all yen traders seems very unlikely. This is more of an intervention characteristic. In any case, even if there is no confirmation in the days to come, the Ministry of Finance will release official intervention data at the end of the month.

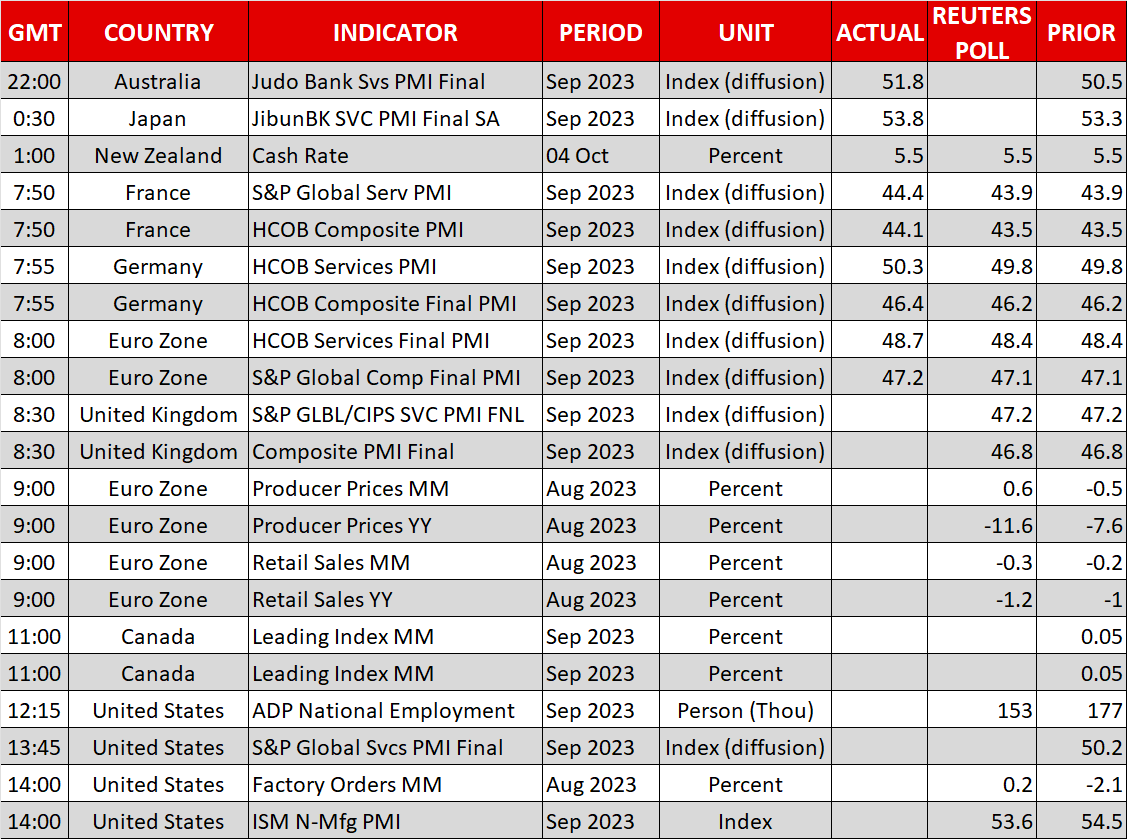

Upbeat JOLTS add more fuel to the dollar’s engine

Now the big question is whether dollar/yen could hold below 150 as there are still several key US data that could add more fuel to the dollar’s engine. Following the better-than-expected ISM manufacturing PMI on Monday and the unexpected increase in JOLTS job openings yesterday, the focus today is likely to turn to the ISM non-manufacturing index, though the highlight of the week is likely to be Friday’s nonfarm payrolls.

More data corroborating the Fed’s ‘higher for longer’ mentality is likely to push Treasury yields and the US dollar higher, which combined with the BoJ’s decision to maintain a lid on Japanese government bond yields, may drive dollar/yen higher. With the pair now resting only 80 pips below the 150 level, it will be interesting to see whether another breach will trigger a second round of intervention by Japanese authorities.

Even if it doesn’t happen this week, another breach above the 150 zone may be inevitable as long as the BoJ stays dovish and Fed officials keep appearing in their hawkish suits. Just yesterday, Atlanta Fed President Bostic said that the rise in bond yields has not yet shown signs of slowing the economy more than would be expected, while Cleveland Fed President Mester said she is open to raising rates again.

The risk-linked aussie and kiwi were the main losers as apart from a strong dollar and concerns surrounding China, they were sold following the decisions of their own central banks. Early on Tuesday, the RBA held rates unchanged and although it kept the door to more hikes open, it struck a cautious tone, while overnight, the RBNZ stayed sidelined and offered no hints on whether they are considering additional rate increases following the much-better-than-expected GDP data for Q2. Perhaps officials decided to keep their cards close to their chests due to the nation’s election in 10 days and/or they preferred to wait for the Q3 inflation data.

Wall Street dives, gold continues to suffer

All three of Wall Street’s main indices slid more than 1% yesterday, with the Nasdaq losing the most and the Dow Jones turning negative for the year for the first time since June. With investors not yet fully convinced that the Fed would proceed with another hike this year and that fewer cuts may be on the table for 2024, there is room for further upside adjustment should data continue to support the Fed’s view. This means that there may be more declines in store for equities.

Gold continued to suffer yesterday, getting closer to the $1,810 zone that offered strong support back in February and March. The continued surge in Treasury yields and the US dollar are exerting massive pressure on bullion, which has lost nearly 6% in less than 10 days.