In Janet Yellen’s semi-annual testimony on Capitol Hill yesterday, she made reference to the ongoing strength of employment as one of the reasons for continuing to “normalize” monetary policy by lifting interest rates and reducing the existing bond holdings of the Federal Reserve. To wit:

“Since my appearance before this committee in February, the labor market has continued to strengthen. Job gains have averaged 180,000 per month so far this year, down only slightly from the average in 2016 and still well above the pace we estimate would be sufficient, on average, to provide jobs for new entrants to the labor force. Indeed, the unemployment rate has fallen about 1/4 percentage point since the start of the year, and, at 4.4 percent in June, is 5‑1/2 percentage points below its peak in 2010 and modestly below the median of Federal Open Market Committee (FOMC) participants’ assessments of its longer-run normal level.”

However, while the Fed is talking about normalizing interest rates, to a level of 2% which would be in-line with their long-term economic growth forecasts, the issues with employment likely don’t support such a move.

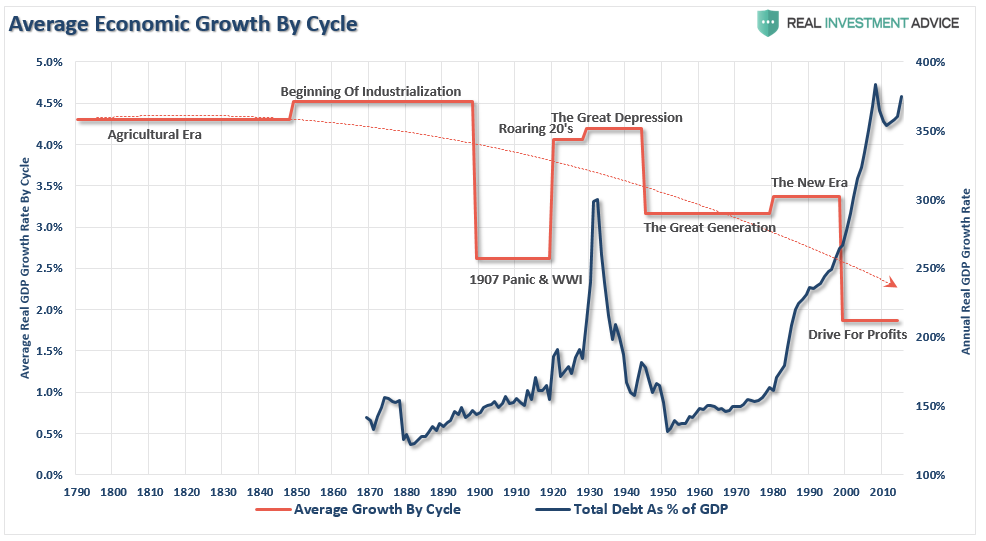

Note: What is often missed in this discussion is that while the Fed talks about the “economy growing at a moderate pace,” that pace of growth is at the lowest average rate since WW-I.

While Ms. Yellen remains focused on the “official unemployment rate” as a reason to continue her rate hiking campaign, there are several reasons she might want to reconsider her aggressiveness. Furthermore, this also goes to the very reason why sub-5% unemployment rates aren’t leading to surges in wage growth or economic prosperity.

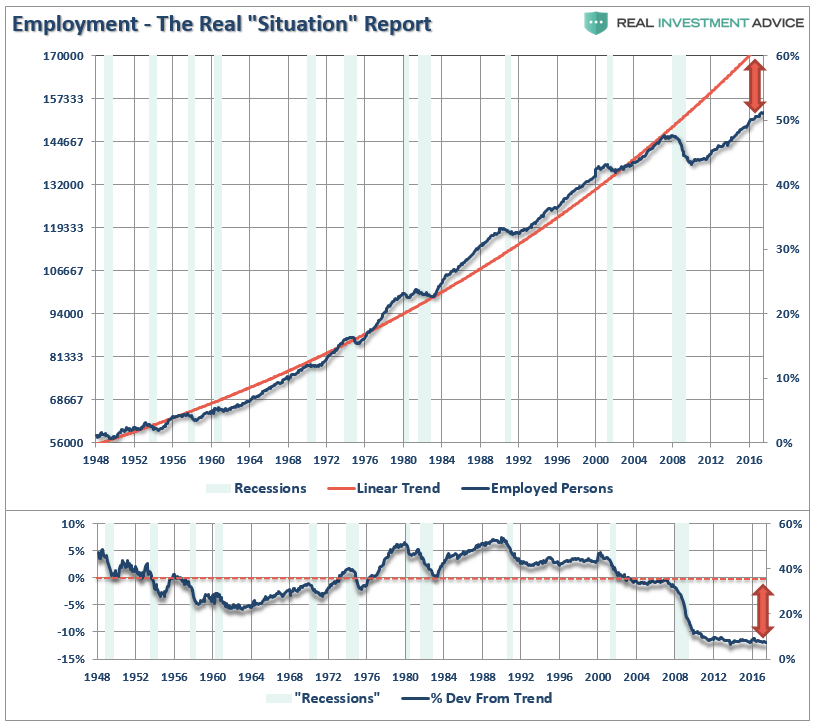

The chart below shows the “real situation” with respect employment.

Has there been “job creation” since the last recession? Absolutely.

If you take a look at the actual number of those “counted” as employed, that number has risen from the recessionary trough. Unfortunately, employment remains far below the long-term historical trend that would suggest healthy levels of economic growth. Currently, the deviation from the long-term trend is the widest on record and has made NO improvement since the recessionary lows.

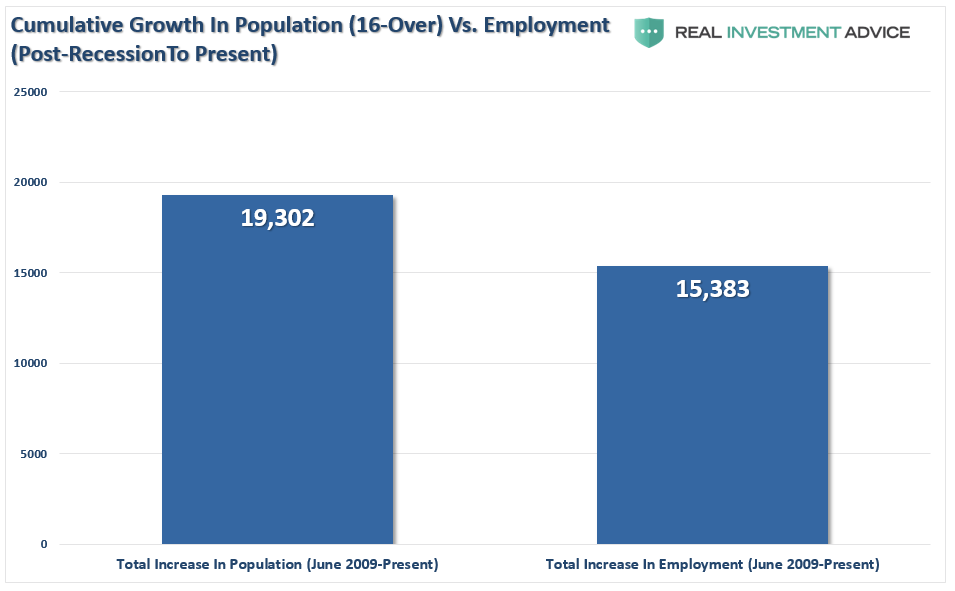

However, as it relates to economic growth, what is always overlooked is the number of new entrants into the working-age population each month.

As you can see in the chart above, while total employment has grown by 15-million, the working age population has grown by 19-million leaving a 4-million person deficit sitting idle in the economy. Of course, after a period of time, these individuals are no longer counted as part of the labor force. This is why, despite monthly headlines of employment growth, those no longer in the labor force (NILF) continues its pace higher.

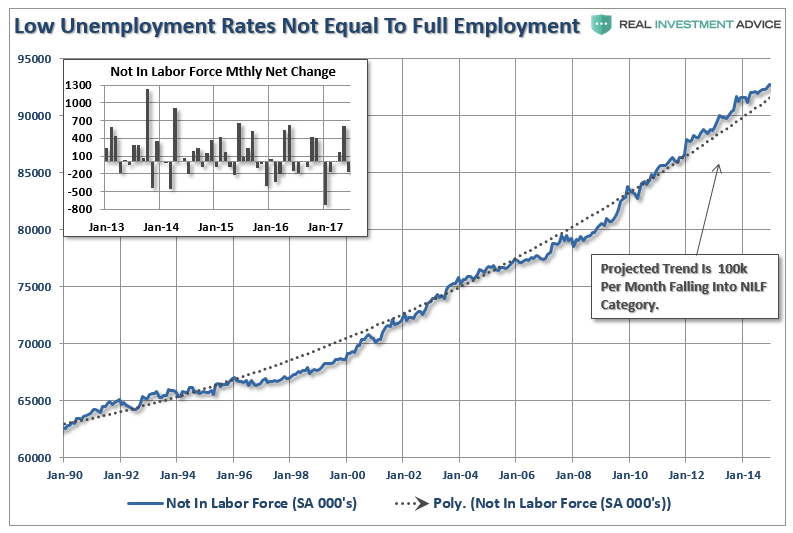

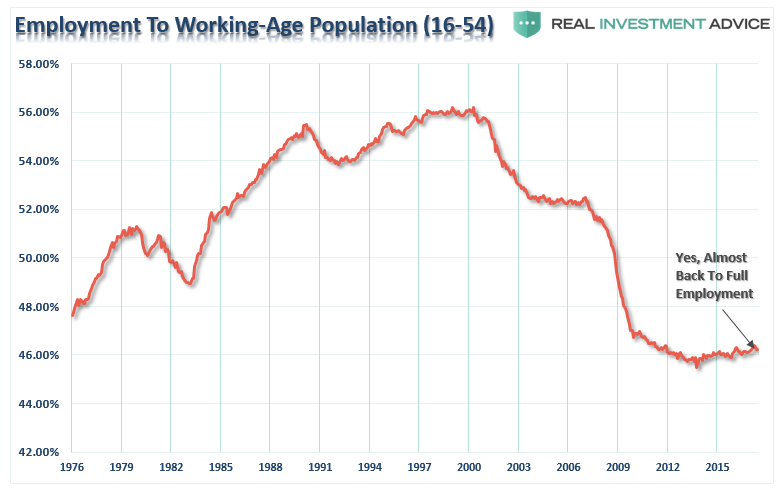

This also explains why the labor force participation rate, of those that SHOULD be working (16-54 years of age), remains at the lowest levels since the 1970’s. This chart alone should give Ms. Yellen pause in her estimations on the strength of the underlying economy.

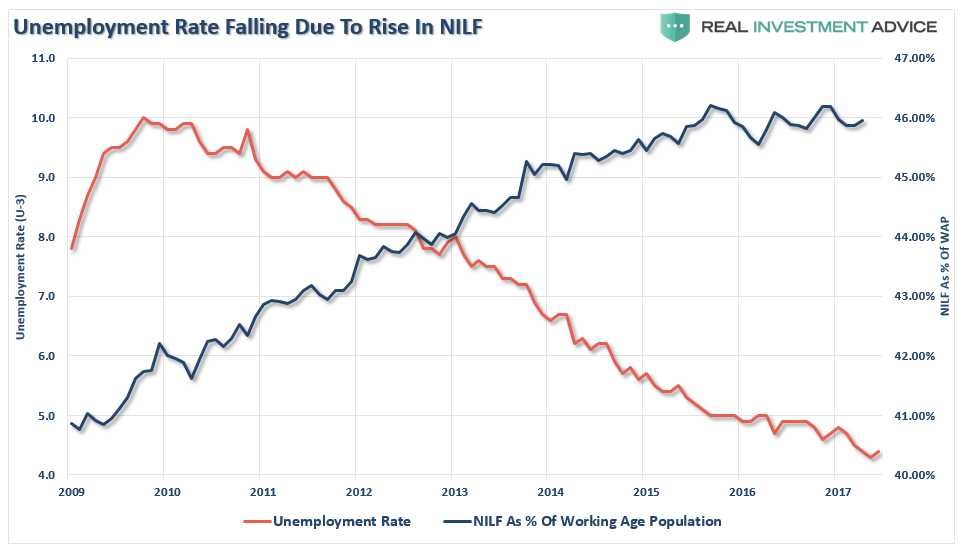

If we look those no longer counted as a percentage of prime working age (16-54) individuals, we can see the direct correlation to the fall in the unemployment rate.

Those individuals not counted as part of the labor force has swelled to 94,813,000 as of June, 2016. Given that the total population in the U.S. is estimated to be 325 million currently, this would mean that roughly 1/3rd of the entire population is sitting on the sidelines. This is why the labor force participation rate remains stuck at the lowest levels in 40-years. The important difference is that in the 80’s the participation rate was rising – not falling.

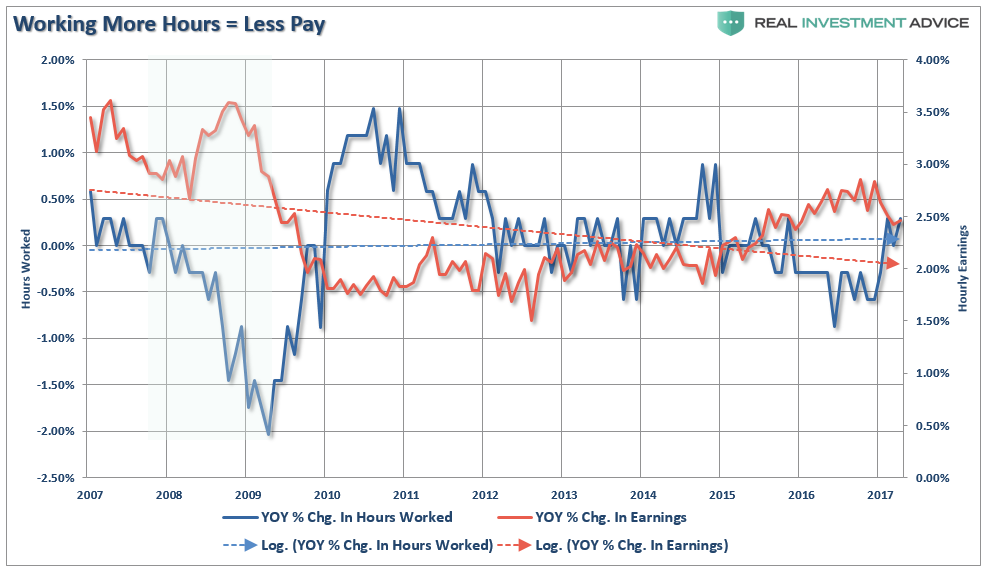

There are two very negative ramifications of this large and “available” labor pool. The first is that the longer an individual remains unemployed the degradation in job skills weighs on future employment potential and income. The second, and most importantly, is that with a high level of competition for existing jobs; wages remain under significant downward pressure.

Business owners are highly aware of the employment and business climate, and regardless of the ranting and raving about the “cash on the sidelines”, businesses are not in the business of charity. Business owners are milking the current employment climate for all it is worth in order to maintain profitability. With high competition levels for existing jobs, and the impending threat of job loss for those working, employers can work employees longer hours with only a modest increases in wages. This is great for profit margins, and workers won’t complain because there are plenty of individuals that will be happy to take their job and do it for less pay.

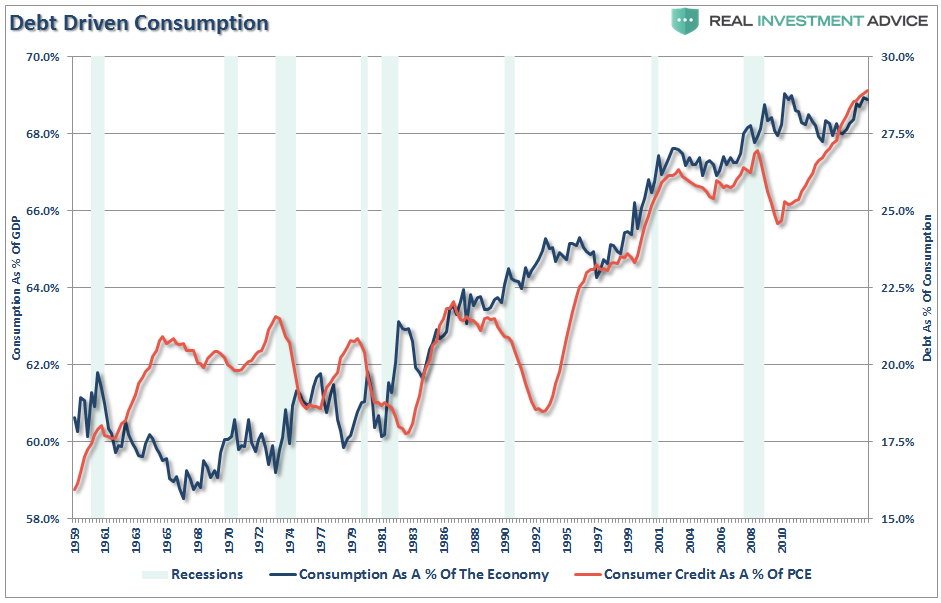

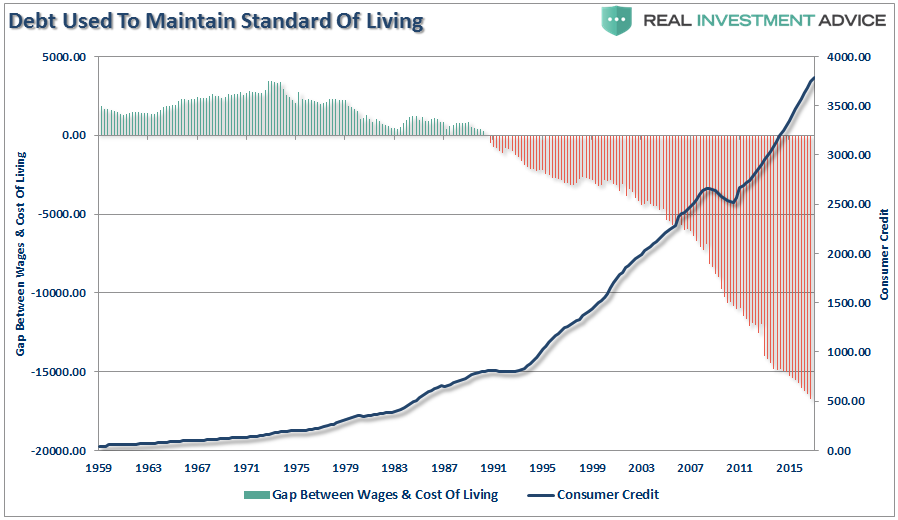

This impact on wages, as other inflationary pressures rise such as surging health care costs, rental rates, and college tuition, hits the consumer where it hurts the most. This bleed on incomes has led to significant slides in the real savings rates and the ability for the consumer to continue to spend outside of the main necessities to meet their basic standard of living. As I discussed previously in “The Illusion Of Declining Debt To Income Ratios:”

“Given this information, it should not be surprising that personal consumption expenditures, which make up roughly 70% of the economic equation, have had to be supported by surging debt levels to offset the lack wage growth in the bottom 90% of the economy.

Furthermore, this explains why the gap between wages and the cost of supporting the required ‘standard of living’ continues to expand.

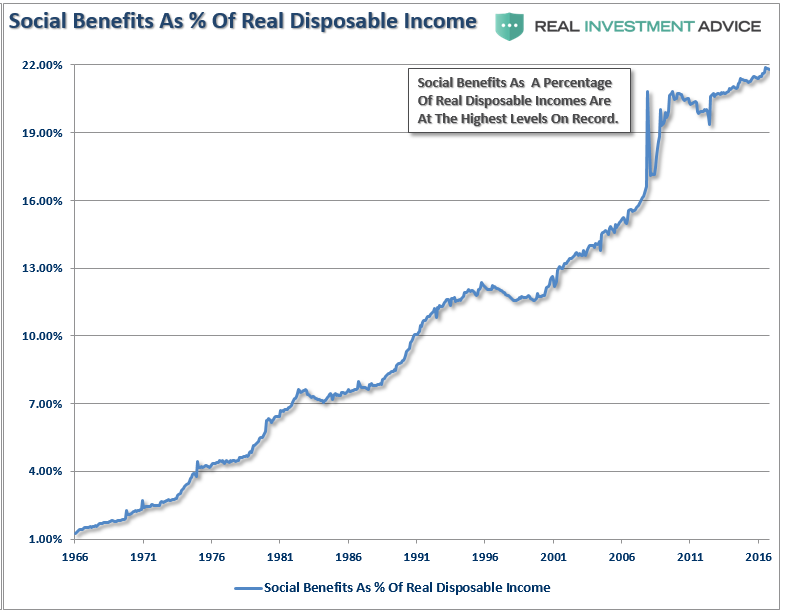

“More importantly, despite economic reports of rising employment, low jobless claims, surging corporate profitability and continuing economic expansion, the percentage of government transfer payments (social benefits) as compared to disposable incomes have surged to the highest level on record.”

While Ms. Yellen continues to assess that employment growth remains encouraging, giving her the “cover” to hike interest rates further, the reality is employment, as an economic measure, has not been beneficial for identifying changes to the underlying economic cycles.

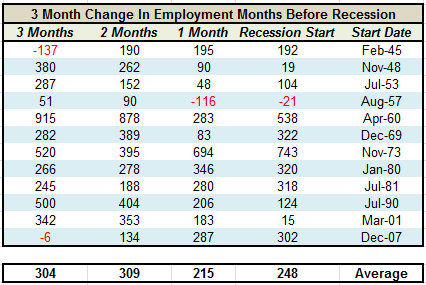

The table details every recession going back to 1948 as identified by the “Start Date” which is the first month of the recession as identified by the National Bureau of Economic Research. The table shows the month-over-month increases in payrolls beginning 3, 2 and 1 months before the actual first month of an economic recession.

The first thing to notice is that there are only 4 months in the entire table that actually show job losses. Employers are generally very slow to hire, and fire, employees which is why employment is a lagging indicator. However, if we look at the net change of employment over a 3 month period what we notice is that job gains were actually quite strong just prior to the onset of an economic recession. That should not be surprising as employers are generally overly optimistic about the future at the peak of an economic cycle.

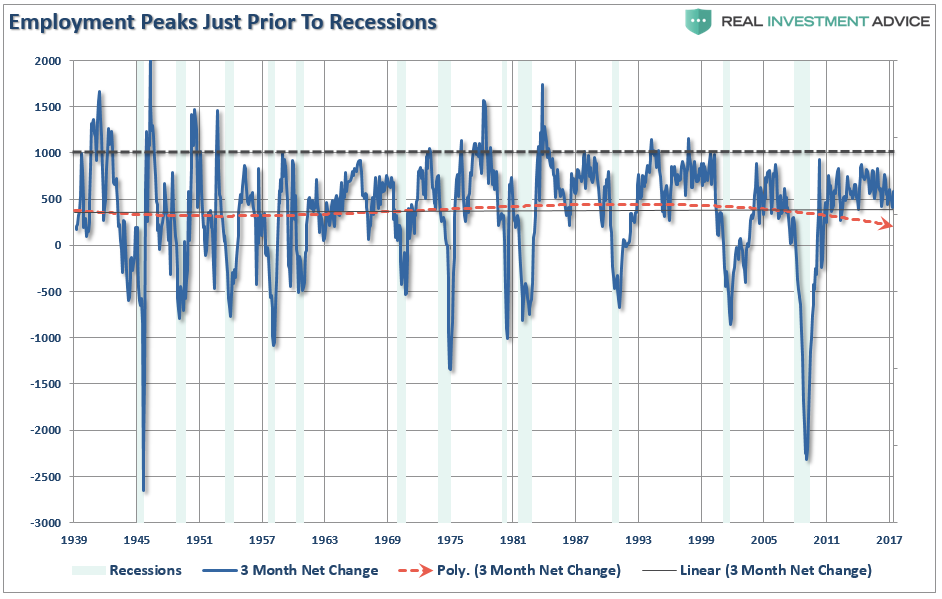

One of the key questions to be answered is whether or not the recent increases in employment are sustainable going forward considering the current length of this ongoing economic expansion. Furthermore, the weakness seen in consumption, credit expansion, and oil prices, could lead to further hiring pressures as corporations adjust to protect their bottom line.

But this is why I often discuss the importance of looking at the TREND of the data rather than just a specific data point. The chart above of the 3-month net change in jobs shows this a little more clearly. The net change in jobs tends to peak just prior to the onset of a recession historically. Importantly, the 3-month net change in jobs has already peaked at normal historical levels and has begun to TREND lower.

With respect to Ms. Yellen, without employment growing fast enough to offset labor pool overhang we are unlikely to reduce the real unemployment problem that persists in the U.S. This bodes poorly for the consumer, the economy and ultimately the markets as this weakness leaves all three very susceptible to unexpected system shocks.

If the economy, and employment, are as strong as Ms. Yellen portends, then she is certainly making the right decision. However, the data suggests this is likely not the case, and the economy, and the markets, are littered with corpses of “monetary policy errors” of the past.