The new era formally begins next week, January 20, when Donald Trump is sworn in as President of the United States at 12 noon eastern. It’s clear that change is coming, on multiple fronts, including a refocusing of economic policy that’s widely expected to boost growth. The question is whether the generally upbeat expectations about the macro outlook are driven by sound economic logic vs. politically driven hype? Perhaps the answer lies somewhere between the two.

Regardless of what you’re anticipating, a transition period awaits that will roll on for months. Whatever the Trump administration can accomplish with its policy mix of tax cuts, lighter regulation, and infrastructure spending, the results won’t be obvious any time soon. In the interim, speculation and debate about what’s coming, with little if any hard data, will prevail.

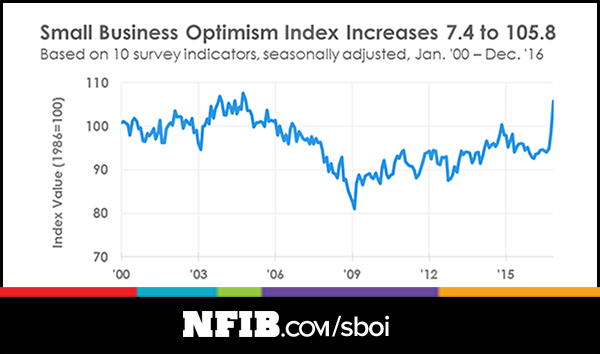

In some corners, it seems, the debate is over—Trump’s economic policies will succeed in no uncertain terms. On the front line of this optimism is the dramatic resurgence of expectations in the small business sector, based on a sentiment benchmark published by the National Federation of Independent Business (NFIB). The group yesterday released its monthly update of the Small Business Optimism Index, which soared for a second month in December, rising to the highest level since 2004.

“We haven’t seen numbers like this in a long time,” said NFIB President and CEO Juanita Duggan. “Small business is ready for a breakout, and that can only mean very good things for the US economy.” NFIB’s chief economist, Bill Dunkelberg, added that “the December results confirm the sharp increase that we reported immediately after the election.”

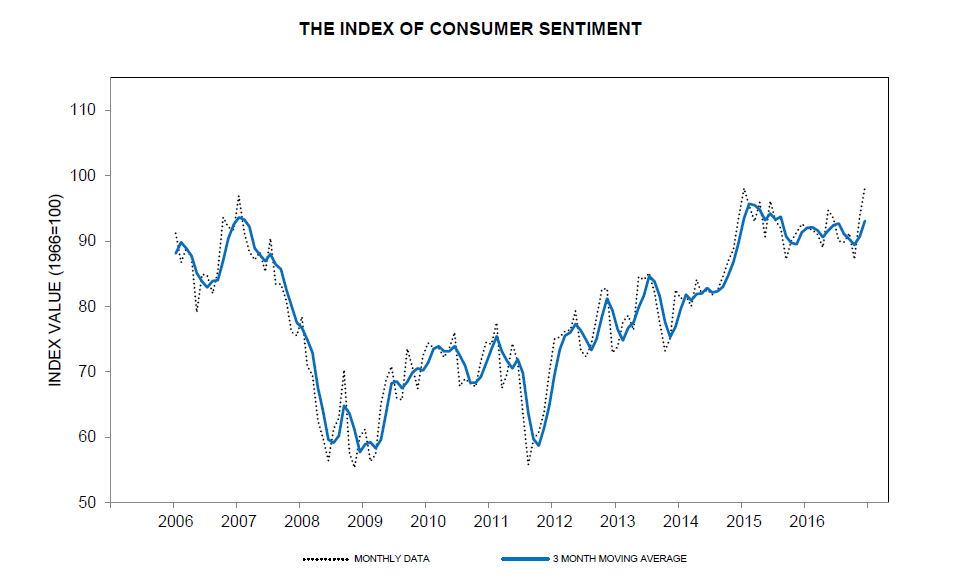

The mood in the consumer sector has brightened, too, based on the University of Michigan’s Index of Consumer Sentiment, which rose to a 12-year high last month. “An all-time record number of consumers (18%) spontaneously mentioned the expected favorable impact of Trump’s policies on the economy,” said Richard Curtin, the chief economist for surveys. “This was twice as high as the prior peak (9%) recorded in 1981 when Reagan took office.”

The stock market is also anticipating stronger growth. The S&P 500 has rallied sharply since Trump’s election victory on November 8, closing yesterday (January 10) near a record high.

Treasury yields are up as well. Amid a revival in growth expectations, the crowd has dumped bonds, on the assumption that inflation will be firmer and the appetite for safe havens will fade as economic activity picks up. The benchmark 10-year yield is currently just below 2.4%–although easing lately, the rate remains well above its pre-election level of roughly 1.8%.

The one thing missing is hard economic data. Markets, of course, are forward-looking indicators, albeit with a mixed record. Sometimes, arguably most of the time, Mr. Market’s outlook is generally accurate. But it’s worth remembering that a year ago the stock market’s dim view of the US economy turned out to be noise. Is Mr. Market’s optimism right this time? Maybe.

Meantime, a fair number of analysts are effectively telling us to cheer up, including economists at the World Bank. As Bloomberg reports, “US growth could accelerate to as much as 2.5 percent this year and 2.9 percent in 2018 if the Trump administration follows through on a pledge to cut the corporate income-tax rate from 35 percent to 15 percent, and slash individual rates, the World Bank estimates.”

One skeptic is Bill Gross, the bond guru at Janus Capital. In his new monthly missive, he laid out the case for reserving judgment about the good times that will soon flow from Trump’s arrival in the White House.

The longer term negatives of my “New Normal” and Larry Summer’s “Secular Stagnation” may have disappeared from the business front pages of the FT and the NYT, but they have never really gone away – Trump or no Trump. Demographic negatives associated with an aging population, high debt/GDP now more at risk due to rising interest rates, technology displacement of human labor, and finally the deceleration/retreat of globalization pose negative ongoing threats to productivity and therefore GDP growth. Trump’s policies may grant a temporary acceleration over the next few years, but a 2% longer term standard is likely in place that will stunt corporate profit growth and slow down risk asset appreciation.

Even if Trump’s policies juice growth, the incoming President seems destined to ramp up geopolitical risk. As one example, consider the news that China sent warships through the Taiwan Strait yesterday, provocatively close to Taiwan, which scrambled jets and navy ships to “surveil and control” the movements. The rising tensions between the two countries follows Trump’s controversial telephone conversation with Taiwan’s president last month—a symbolic chat that has infuriated China.

China policy aside, the point is that Trump will likely bring an impromptu, arguably erratic, governing style to the White House, with global implications, for better or worse. One more reason, then, to consider that 2017 could be a year of “geopolitical recession,” as the Eurasia Group advised last week.

With the shock election of Donald Trump as president of the US, the G-Zero world is now fully upon us. The triumph of “America first” as the primary driver of foreign policy in the world’s only superpower marks a break with decades of US exceptionalism and belief in the indispensability of US leadership, however flawed and uneven. With it ends a 70-year geopolitical era of Pax Americana, one in which globalization and Americanization were tightly linked, and American hegemony in security, trade, and promotion of values provided guardrails for the global economy.

Consider Trump’s trade-war rhetoric as well and there’s sufficient reason to wonder if the high hopes for stronger growth will be offset, or even overwhelmed, by other factors that the incoming President seems likely to foment.

But for the moment, hope triumphs, at least in terms of the outlook for the US economy. Banking on this as a done deal, however, may be premature. Indeed, Trump has yet to assume the reins of power and he’s already unleashed a fair amount of political turbulence. It seems that we’re knee-deep in the most volatile interregnum in recent memory.

It’s anyone’s guess what this implies for the years ahead, but it’s reasonable to wonder if success on the economic front will be accompanied by higher geopolitical risk. If so, does the latter imperil the former? For now, there are only questions until the reality check begins in earnest on January 20.