Wednesday, we began to see a separation between what Chairman of the Fed Powell said on fighting inflation and the inflation indicators themselves.

Food commodities, particularly grains, soared. Weather is the dominant factor as we head into the summer season.

Happy June equinox.

Oil rallied, and we hope you read the Daily yesterday on why oil could rise (and did).

Hoarding is next-as is Round 2 of Inflation. Plus, the dollar is holding but feels vulnerable.

Furthermore, long bonds are holding.

Once we see the risk gauges we like to use from our Big View flip to risk-off, even the Magnificent 7 will have a hard time.

Meanwhile, in the search for green today on the board, besides commodities, we noticed another type of green in the green.

AdvisorShares Pure US Cannabis ETF (NYSE:MSOS), the ETF for U.S. Cannabis, has been left for dead.

The ETF provides exposure solely to American cannabis and hemp companies, including multi-state operators.

Interestingly, 99.64% of the basket’s holdings are the U.S. Dollar.

I checked ChatGPT to find out more about that.

It means that the ETF allocates a significant portion of its assets to holdings denominated in US dollars.

We also learned that the ETF manager might hold US dollars as a defensive position during uncertain market conditions. Cash holdings can act as a buffer against market volatility or as a safe haven asset.

This could suggest that with the horrid performance of MSOS, should the ETF increase in price and value, the dollar holdings will lessen.

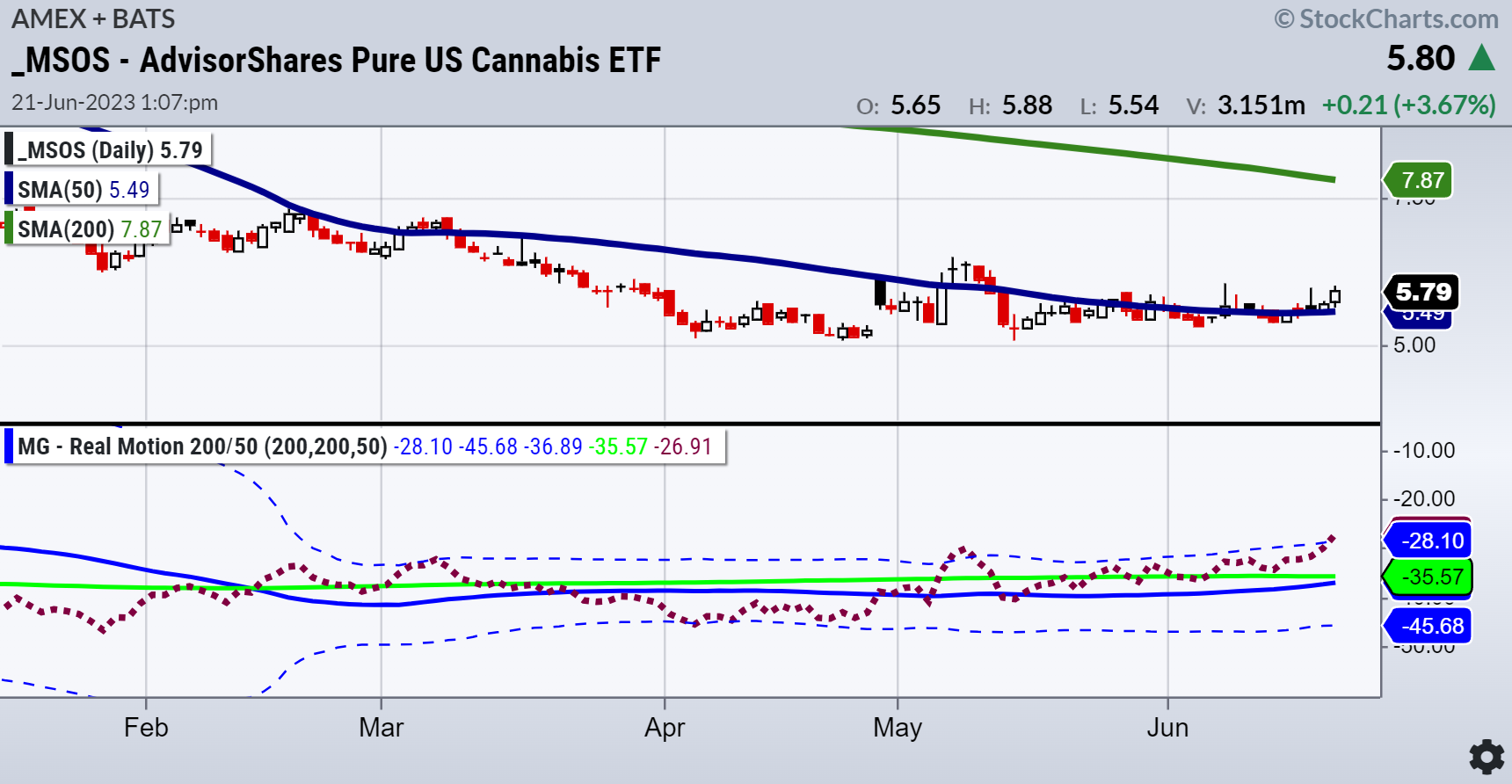

The chart shows the move above the 50-DMA (blue line.)

The Real Motion chart is more intriguing.

Note how the momentum indicator (red dots) is above the 2 moving averages (blue and green).

The 50 (blue) DMA is about to cross over the 200 (green) DMA.

The red dots are also clearing the Bollinger Band.

Talk about a short float.

We will watch the next moves carefully to see if Cannabis goes up from here or, once again, ends up moving lower.

ETF Summary

- S&P 500 (SPY) 440 pivotal with potential reversal-has to break under 434

- Russell 2000 (IWM) 180-190 stuck

- Dow (DIA) 34,000 in the Dow now pivotal

- Nasdaq (QQQ) 370 target hit proceeded by some selling-360 support

- Regional banks (KRE) 41.00 area the 50-DMA

- Semiconductors (SMH) 150 now major support.

- Transportation (IYT) 237 area the 23-month moving average

- Biotechnology (IBB) 121-135 range

- Retail (XRT) 62 support and if clears back over 63, optimism returns