This article was written exclusively for Investing.com.

Volatility in the stock market seems to have picked up since the beginning of September, with the S&P 500 falling by nearly 6% and then racing higher.

Earnings could have a pretty significant role in where the market goes from here, with investors needing as many clues from companies and their guidance they can get their hands on.

Heading into this round of quarterly results, earnings estimates for the S&P 500 had essentially stalled, and the uncertainty around future earnings seemed to be climbing. It wasn't only earnings estimates which have struggled; sales estimates have also shown signs of weakness. One could understand that higher costs could negatively impact earnings, but sales estimates suggested perhaps something more.

The US economy appears to have taken a significant hit in the third quarter. It was forecast to grow by nearly 7% at one point. However, the latest Atlanta Fed GDPNow models suggest the third quarter may only increase by 0.5%. The slowing economic growth could undoubtedly have had a big say in why earnings and sales estimates stalled at the beginning of September.

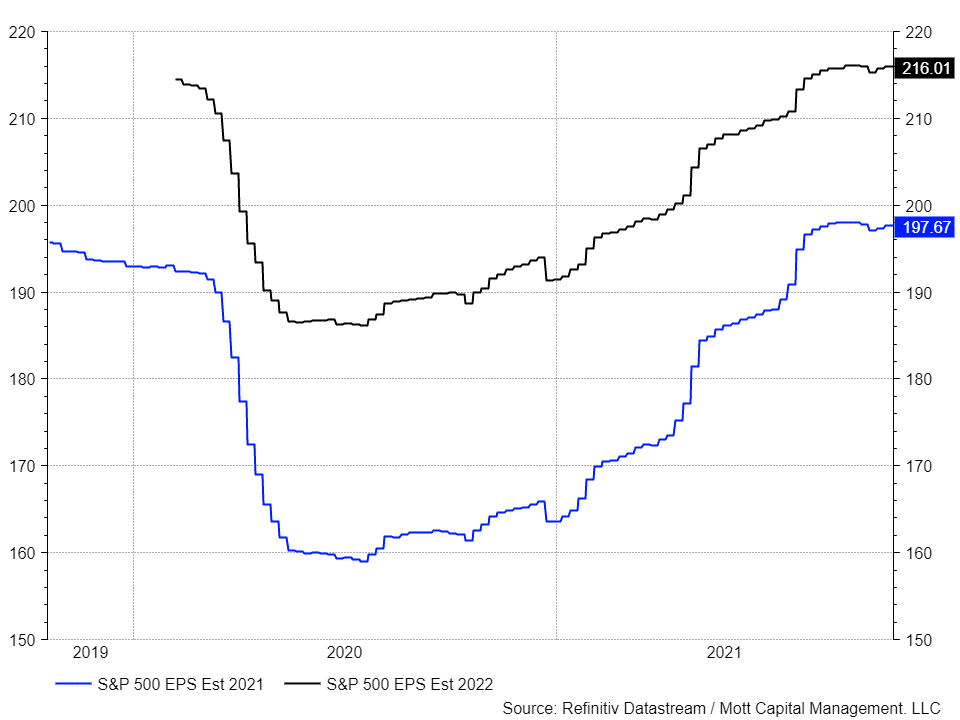

Earnings Estimates Have Been Falling

But more recently, those earnings estimates for 2021 and 2022 have taken a dip falling to $197.67 and $216.01, respectively. They have recovered some since the start of earnings season, but for them to rise back to their old highs and higher, guidance from companies will be even more critical.

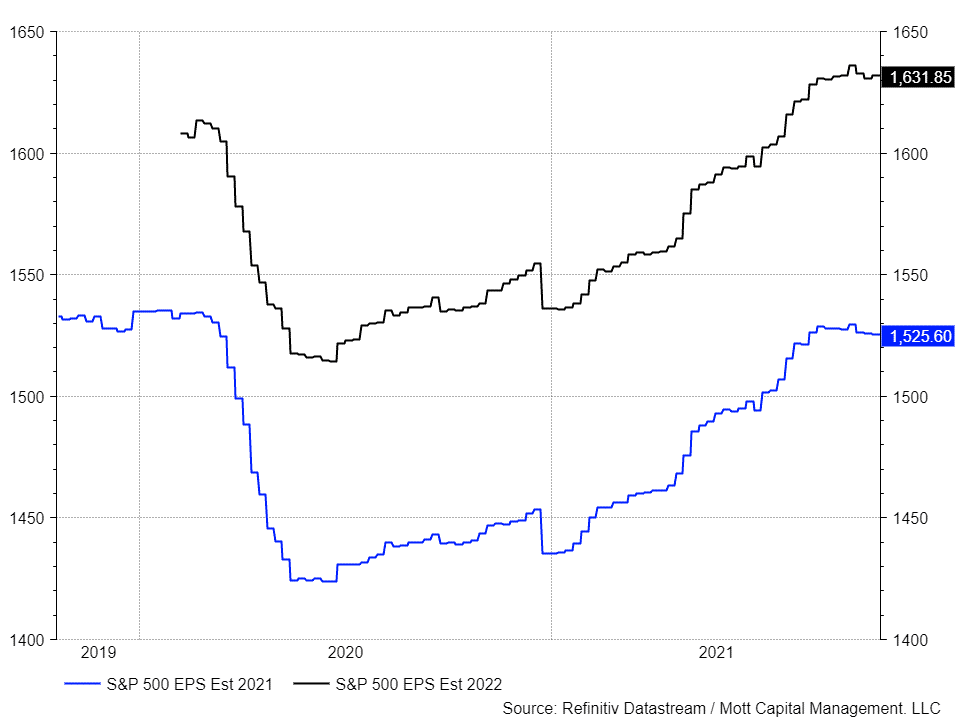

Sales Estimates Slip

More surprising is that sales estimates have been on a steady path lower for 2021 and have been flat for 2022. Therefore, for earnings estimates to begin to rise again steadily, the sales outlook will need to turn around, or there will be a need for further margin expansion. However, it seems difficult to think that margins will expand in a meaningful way when input costs are rising.

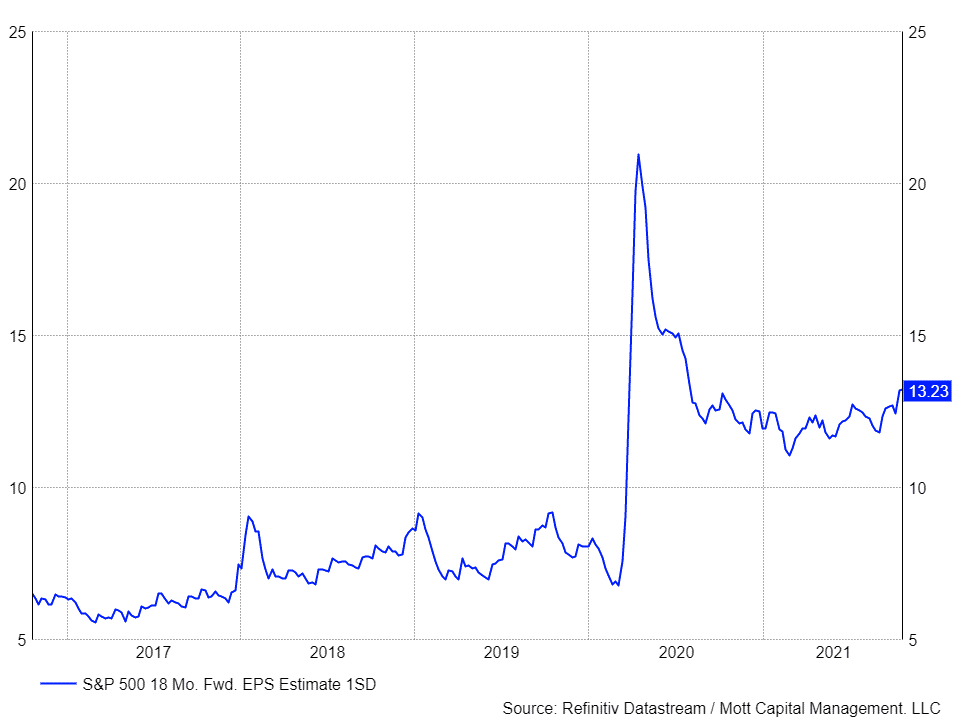

Rising Earnings Uncertainty

This mix of slower GDP growth, stalling earnings, and falling sales increase uncertainty about future earnings estimates when looking at their standard deviation. The standard deviation has risen to around 13.2% from the Feb. 24 low. A sign that analysts see several different outcomes for the direction of where earnings may be heading.

For all these factors to begin to move in a favorable way, which will help the market to keep rising, there will need to be positive guidance to lift consensus estimates. The PE ratio for the S&P 500 has increased back to 21.1 times its next-twelve-month earnings estimates, which is its highest level since early September, and an indication that investors are betting on earnings estimates rising in the future.

If sales and earnings fail to provide a narrative that supports higher stock prices, the recent rebound witnessed off the October lows may prove harder and harder to maintain. It will force the PE ratio back down to those lower levels and potentially start a process of further PE contraction. Overall the PE ratio of the S&P 500 is historically high, and given weakening earnings and growth rate, it will be hard to maintain.

This earnings season may be the stock market's first actual test.