Struck right between a rock and hard place, today the Fed will deliver its difficult policy choice. The FOMC will have to choose between supporting the financial system and fighting inflation. They can do both, but both results will be mediocre.

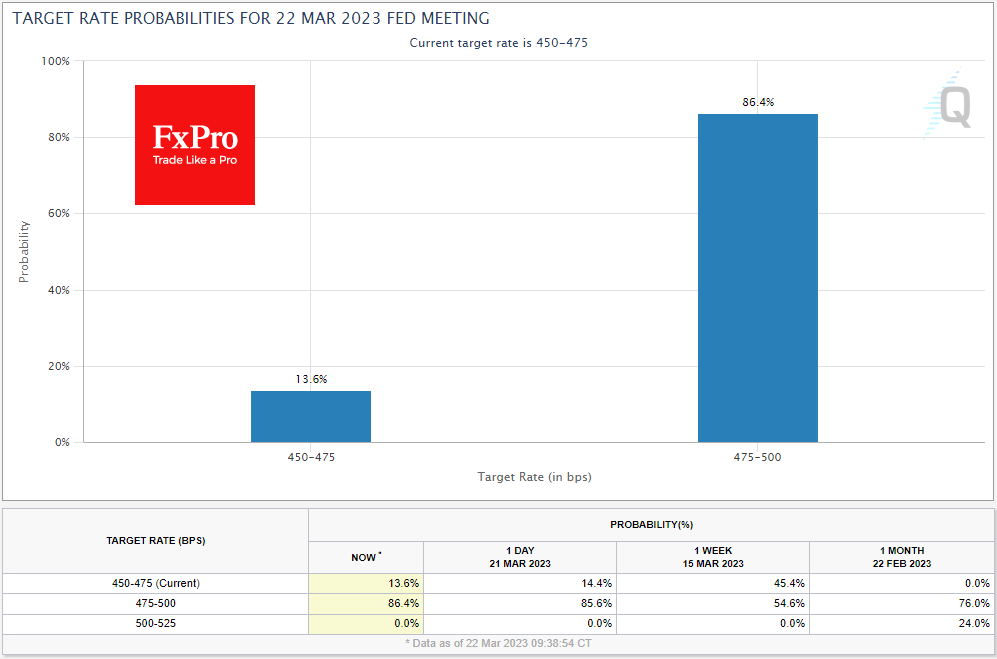

Economists' and markets' expectations are for a 25-point hike (with about 86% probability). But the big intrigue is whether this will be the last hike in this cycle and when we can expect a rate cut.

On the one hand, there is high inflation, which is already linked to soaring labour costs and sustained demand rather than higher commodity and energy prices, as was the case a year ago when the hiking cycle began. Powell's speech to Congress at the beginning of March led markets to expect a 50-point move on the back of persistently high inflation.

If the Fed is indeed responding to the data, today's decision should include hints of further policy tightening in addition to the actual rate hike. This is necessary to prevent inflation from becoming entrenched. Put simply, the US needs a "clean-up" recession that cools the labour market.

Such a straightforward approach to fulfilling the Fed's mandate could give the dollar a boost.

On the other hand of the Fed, is the resilience of the financial system, which we have heard a lot of crunch about again in recent weeks. The suffering of the regional banks is one of the consequences of the rate hike. Further policy tightening will only make things worse. There is also the risk that a recession and a shrinking labour market will increase defaults, further eroding banks' balance sheets and resilience.

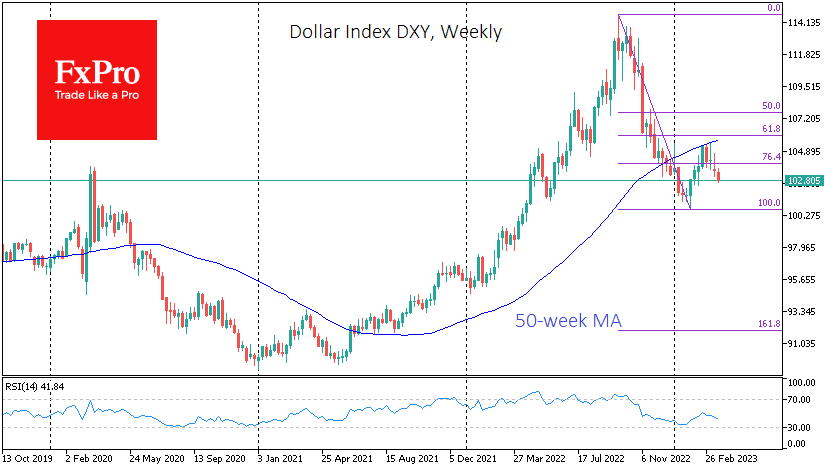

Judging by the performance of markets and the dollar index, speculators are betting on this policy reversal and paying attention to financial stability, believing that the Fed is scared enough to follow through. If this happens, equity markets will take a massive hit and the dollar will surely return to growth. A return to the March highs above 105.5 from the current 102.8 would be a matter of a few days, and the rally is unlikely to stop there.

The Dollar Index has slipped below 103, the area of the lows of the last six weeks. Its steady decline over the past few days suggests that we have seen nothing more than a corrective bounce in February. The weekly chart clearly shows that the Dollar Index is perfectly contained near its 50-week moving average, confirming the long-term downtrend.

Furthermore, the DXY is not only in danger of falling below 100.6 (February lows). The long-term target for this decline is seen at 92.0, which would almost wipe out the dollar's gains over the course of the policy tightening cycle. Looking at the charts so far, this seems the most likely scenario, although there could be surprises.

The FxPro Analyst Team

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Will Fed Boom or Bust the U.S. Dollar?

Published 03/22/2023, 11:26 AM

Updated 03/21/2024, 07:45 AM

Will Fed Boom or Bust the U.S. Dollar?

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or

remove ads

.

Latest comments

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.