Why bet against the market when the Fed made it clear that it was willing to step in to buoy the economy?

The disconnection between the economy and the stock markets grew starker recently. The technology-heavy Nasdaq Composite Index entered positive territory for the year, erasing much of its losses from the coronavirus-fuelled rout. Other major US indexes also notched strong gains for the week. The S&P 500 rose 3.5%, while the Dow Jones Industrial Average advanced 608 points, or 2.6%. The Nasdaq Composite added 6% for the week.

Markets are looking past the grim economic data, forecasting a speedy recovery as state economies open back up across the country. New York, which has been facing the hardest hit by the pandemic, has begun developing plans to restart its economy. Other states are farther ahead, with more than 20 allowing some businesses to reopen. Nevada’s Governor Steve Sisolak said some businesses, including dine-in areas of restaurants, would be allowed to reopen Saturday with safety measures like social distancing and occupancy limits. Those moves have encouraged investors to think that the economy is poised for a rapid rebound by early 2021.

Traders are making the bets that this is the bottom. The market is really divorced from economic reality right now. Furthermore, many investors said Friday’s unemployment numbers and other disappointing data came as no surprise after data in recent weeks showed a flood of people applying for unemployment benefits.

Earnings have been abysmal, and the coronavirus has already pushed companies from J. Crew Group (NYSE: JCG) to Neiman Marcus Group (NYSE:NMG) and Diamond Offshore Drilling (NYSE:DO) into bankruptcy. However, investors are counting on a quick rebound.

Earnings are expected to register a decline of 14% in the nearly completed first-quarter earnings season, which would mark the biggest decline since 2009, before falling further later in the year. Analysts are projecting earnings to bottom in the current quarter with a 41% drop—and rise 13% in the first quarter of next year.

While the earnings outlook will remain challenged at least through the first half of 2020, investors are increasingly discounting the Covid-19 hit to fundamentals this year and turning their gaze to a 2021 recovery. They are bullish on stocks and are forecasting a return to previous highs by the first half of 2021.

Another fear among some investors is missing out on a quicker-than-expected recovery. The Federal Reserve’s and US government’s moves to buoy the economy have been wide-ranging and elicited confidence among investors. If the stock-market bulls end up being right about a speedy recovery and the economy stages a strong rebound, that would leave other investors left behind a potential stock rally, missing out on gains.

It creates a two-sided risk to this equation for investors. On one hand, it might be that the virus continues to spread. On the other hand, treasury yields are hovering near record lows and the corporate-bond market has recovered since the Fed introduced its stimulus plan. That means returns on high-grade corporates remain thin as well. Some investors have even started betting on negative interest rates in the US.

Our Picks

EUR/USD – Slightly Bullish

This EUR/USD pair may rise towards 1.10 this week.

USD/JPY – Slightly Bullish

This USD/JPY pair may rise towards 106.90.

Gold – Slightly Bullish

We expect the XAU/USD price to rise towards 1722 this week.

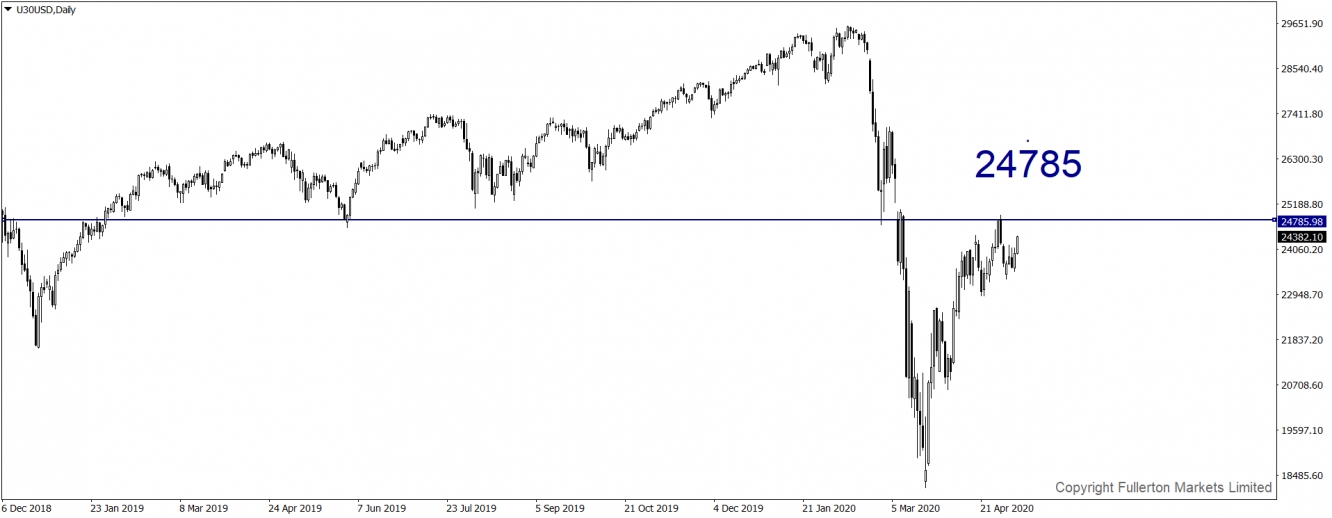

U30USD (Dow) – Slightly Bullish

Dow Jones 30 Futures may rise towards 24785 this week.