The S&P 500 started Tuesday with modest gains, putting us near the highest levels since March, but a late selloff pushed the market firmly into the red. The question is if yesterday’s bearish reversal means anything, or if this is just more meaningless noise tricking over-active traders into making poorly timed trades.

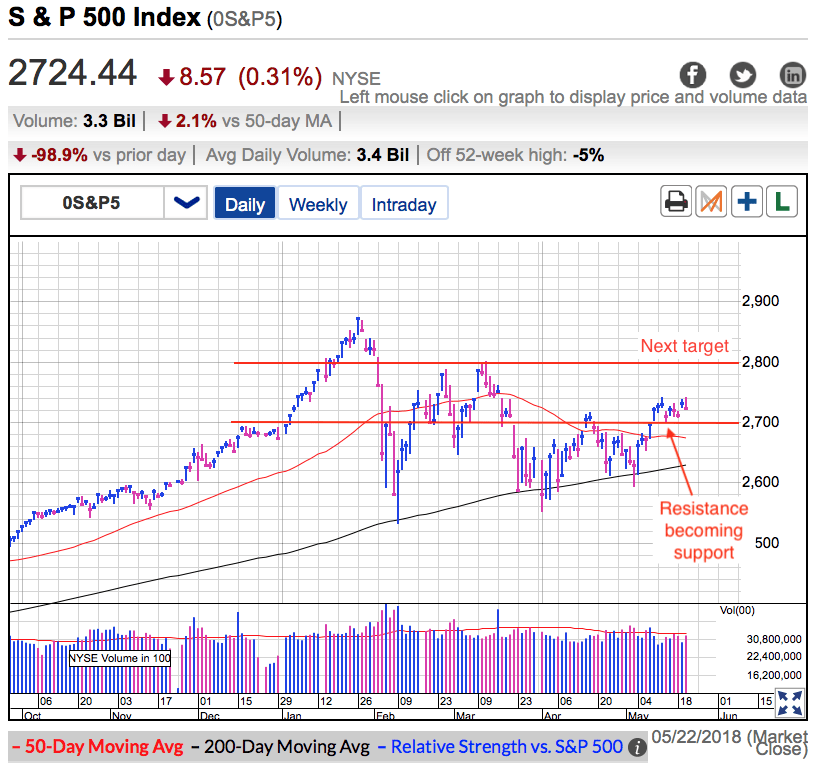

Headlines have been relatively benign, allowing stocks to remain above 2,700 for nearly two weeks. There has been some back-and-forth regarding Chinese tariffs, but to this point we seem to be avoiding a larger trade war. As expected, there have been some small bumps along the way. One day a positive development pushes us up 10-points. The next day a hiccup sends us tumbling 10-points. But so far last month’s resistance has turned into this month’s support.

Holding 2,700 this long is encouraging. Stocks tumble from unsustainable levels quickly. Maintain these levels for nearly two weeks tells us we are standing on solid ground. There have been more than enough unnerving headlines and weak price-action to send us tumbling, but confident owners refuse to sell and that is keeping supply tight.

We’ve seen several dramatic dips over the last few months, largely driven by uncertainty surrounding Fed rate hikes, rising interest rates, a looming trade war, and a potential scandal in the White House. While this uncertainty has created some near-term volatility, prices haven’t undercut February’s lows and this price action looks more like basing and consolidating last year’s gains than standing on the precipice of another plunge lower. As I’ve been saying for months, if this market was fragile and vulnerable, we would have plunged a long time ago. This resilience against a larger selloff tells us this market is strong, not weak.

I’ve been encouraging readers to buy the dips over the last few months and that led to some very profitable trades. But now that we are at the upper end of the trading range, should we be concerned about another dip? Two weeks ago I was cautious and told readers the easy gains were behind us and that was a better place to be taking profits than adding new positions.

So far that has been wise advice since we have been trading sideways ever since. The sharp gains from the May lows made us vulnerable to a dip and the risk/reward was skewed against putting new money in stocks. But two weeks later and the picture is shifting. The market resisted dipping back into the trading range and is holding up quite nicely despite the headline headwinds. That tells me the path of least resistance is still higher.

Unfortunately the easy gains are behind us. The best profit opportunities come during the scariest moments. Now that the fear and uncertainty has passed, the discounts have disappeared. Even though the market is acting well and the path of least resistance is higher, further gains are going to be harder and slower. It took little more than a week to bounce more than 100-points from May’s lows, but it could take all summer to rally the next 100-points.

The best short-term opportunities arise from emotional overreactions. Unfortunately this calm isn’t giving us much to trade. But just because we don’t have a short-term trade in front of us doesn’t mean we cannot make money. The path of least resistance is higher, the best slow-money trade is buying-and-holding these near-term gyrations. The market is acting well and don’t let the bears scare you out of good positions. If this market was fragile and vulnerable, we would have crashed a lot time ago.

The tech trade is alive and well. Most of the FAANG stocks are near all-time highs and even Alphabet (NASDAQ:GOOGL) is well off its lows. I told subscribers weeks ago that people would be kicking themselves for not buying the tech dip and no doubt that is what a lot of people are doing. It is human nature to beg for pullbacks so we can jump aboard the hottest trades, yet when the pullback happens, those same people are too afraid to jump in.

Even though the easy profits are behind us, the Tech Darlings are acting well and will lead this market higher. But just like the broad market, further gains will be hard and slow. The path of least resistance is higher and smart money is still sticking with these stocks.

Bitcoin is a completely different story. Last week’s $9k support has turned into this week’s $8k support. And thus far it is giving every indication that $7k will become next week’s support. I hope you see the trend here. Cryptocurrencies are still very much in a downtrend and we should expect lower prices. It takes most bubbles between 6 and 24 months to finish bursting. If Bitcoin is like most bubbles, that means the worst is still ahead of us and we should expect lower-lows over the next few months.