The economic calendar has plenty of news, including most of the big reports except employment. Despite this, I expect many to be asking:

What are the chances for tax cuts?

Last Week Recap

In the last edition of WTWA I suggested that Black Friday news would be the most important story, with plenty of speculation from people you have never before seen on TV. There would be a lack of analysis of the Fed minutes as people headed for an early vacation. That was all pretty accurate. CNBC had a Fed debriefing without a single economist on the panel.

The Story in One Chart

I always start my personal review of the week by looking at a great chart. Investing.com has a nice interactive version of futures trading with news. Check out the site to have some fun.

The regular story – new records and low volatility – continues.

Personal Note

I am enjoying some time away from work. As promised I am updating the indicators. Many readers have asked for these posts as a focal point for discussion, so I am trying to cooperate. I am competing with the best bridge players in the world, mostly full-time professionals. Here is the view from my window. Any readers in the area might want to check in and say hello.

The News

The economic news last week was solid on all fronts. Earnings expectations remain positive.

Most of the negative arguments rest on the idea that we are “due” for some bad news. Many people have gone broke betting on the “due theory.” I recommend sticking with our fundamental analysis, which is improving along with stock prices.

Perspective

Those who worry about “geopolitical risks” and argue that there should be some undefined impact on stock should look for some historical perspective. Does anyone remember this?

The Inspirational

For those who missed the post, please look at my Thanksgiving message. It is a challenge to find something that combines motivation, wisdom, humor, and investment advice. I found it. You should read it.

The Week Ahead

We would all like to know the direction of the market in advance. Good luck with that! Second best is planning what to look for and how to react.

The Calendar

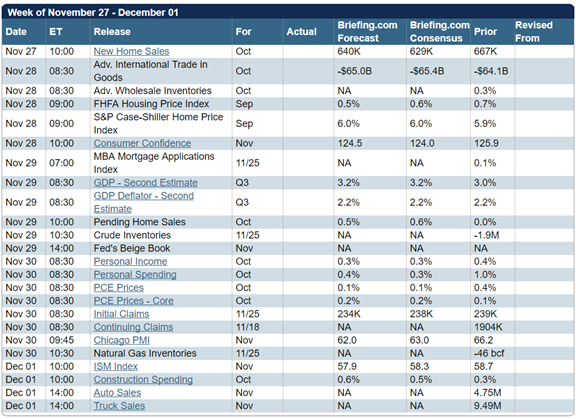

We have a big calendar. The big reports at week’s end, including the ISM survey, will set the table for the employment report.

Briefing.com has a good U.S. economic calendar for the week (and many other good features which I monitor each day). Here are the main U.S. releases.

Next Week’s Theme

Despite the increased flow of economic news, I am expecting a lot of buzz on tax cut potential.

As usual, I’ll have more in the Final Thought, where I always emphasize my own conclusions.

Quant Corner

We follow some regular featured sources and the best other quant news from the week.

Risk Analysis

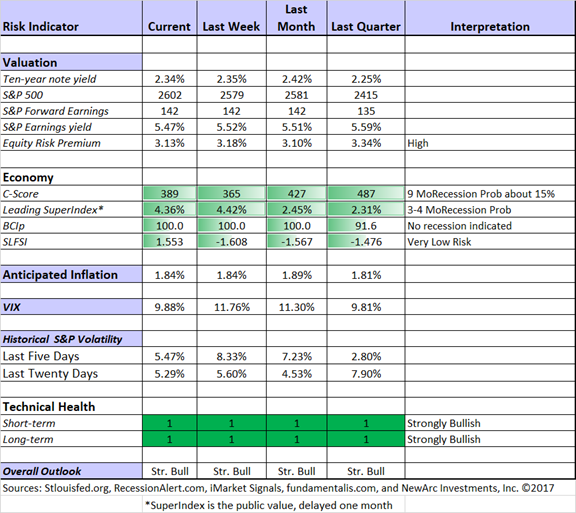

I have a rule for my investment clients. Think first about your risk. Only then should you consider possible rewards. I monitor many quantitative reports and highlight the best methods in this weekly update.

The Indicator Snapshot

Recession odds remain low and many economic indicators are improving.

The Featured Sources:

Bob Dieli: Business cycle analysis via the “C Score.

RecessionAlert: Strong quantitative indicators for both economic and market analysis.

Brian Gilmartin: All things earnings, for the overall market as well as many individual companies.

Georg Vrba: Business cycle indicator and market timing tools.

Doug Short: Regular updating of an array of indicators. Great charts and analysis. Let’s take another look at the regular update (via Jill Mislinski) of the Big Four indicators most influential in recession dating. The recent strength in these indicators is clear from the chart.

Insight for Traders

Our discussion of trading ideas has moved to the weekly Stock Exchange post. The coverage is bigger and better than ever. We combine links to trading articles, topical themes, and ideas from our trading models. This week’s post covers some opportunities in energy trading, and also updates the “very hot” records of two of the models. And of course, there are updated ratings lists for Felix and Oscar, this week featuring small caps. Blue Harbinger has taken the lead role on this post, using information from me and from the models. He is doing a great job.

Insight for Investors

Sorry that I cannot update links this week. I hope we’ll get some suggestions in the comments!

Final Thoughts

My expectation is that stocks will continue to track the improvement in earnings expectations.

I do not expect tax cuts before the end of they year. My personal count of likely objections is high, and the possible conversions are low. Anything that is done to induce another vote also alienates some deficit hawks.

Meanwhile, we are seeing opposition form old people, cities, high-tax states, people dependent on health care, homeowners, and others.

I don’t see a coalition forming around either the House or the Senate plan.

I remain hopeful for something early next year, and expect some bipartisan support.

And finally, little if any of the current market valuation is anticipating tax reform.