Following the RBA, the BoC and the ECB decisions last week, we don’t have any central banks on the agenda for this week.

However, we do get several important data, which could shape market expectations around central bank policies. We get inflation data for August from the US, the UK, and Canada, as well as New Zealand’s GDP for Q2 and Australia’s employment report for August. On Monday, there are no major events or releases on the schedule.

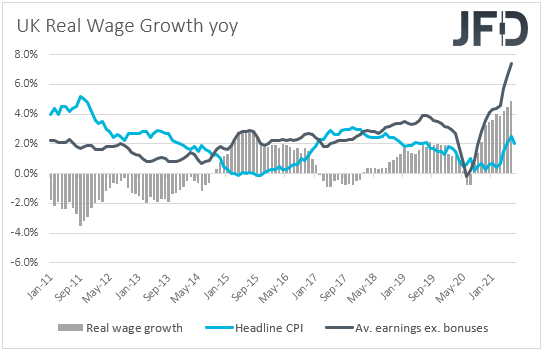

On Tuesday, during the early European morning, we get the UK employment report for July. The unemployment rate is forecast to have ticked down to 4.6% from 4.7%, while the net change in employment is anticipated to show that the economy has added 75k jobs in the three months to July, down from 95k in the three months to June. As for the average weekly earnings, both the including and excluding bonuses metrics are expected to have slowed.

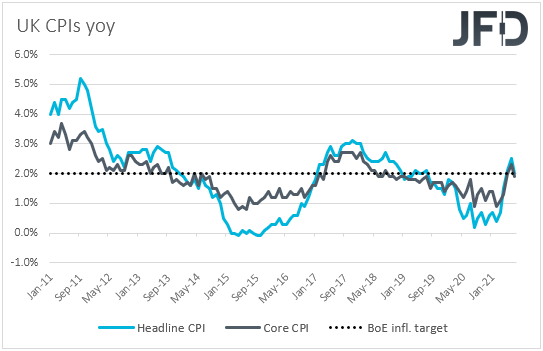

At its latest gathering, the BoE lowered the threshold of when they will start reducing their stock of bonds. Specifically, they said that they will do so when the policy rate hits +0.50%, by not reinvesting the proceeds of maturing debt. The previous guidance was for the Bank to not start unwinding its bond purchases until interest rates were near +1.5%.

In our view, this means that QE tapering may start earlier than previously anticipated. Now, the big question is when the time would be appropriate for officials to start raising interest rates. Last week, BoE Governor Andrew Bailey revealed that, even at the prior gathering, policymakers were split evenly between those who felt the minimum conditions for raising interest rates were met and those who believed that the recovery was not strong enough.

This suggests that a rate hike could take place sooner than many may have been anticipating, and a decent employment report, combined with accelerating inflation on Wednesday, and a rebound in retail sales on Friday, could allow GBP-traders to increase their hike bets and push the pound higher this week, especially against currencies the central banks of which are expected to keep interest rates at low levels for much longer, like the euro, the yen and the aussie.

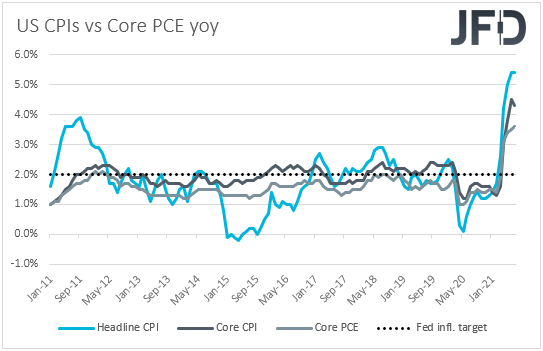

Later in the day, the spotlight is likely to fall on the US CPIs for August. Both the headline and core rates are expected to have ticked down to +5.3% yoy and +4.2% yoy, from +5.4% and +4.3%, respectively. Despite the potential slowdowns, both rates are expected to have stayed well above the Fed’s objective of 2%, which could add to questions as to whether the latest surge in inflation is transitory or not.

Following the August employment report, market participants pushed equities higher and the dollar lower, on reduced expectations that the Fed could indeed start scaling back its QE purchases this year. However, last week, several policymakers signaled that they still expect to begin the process before the end of this year, despite the slowdown in jobs growth seen in August.

This revived hopes on that front and resulted in a pullback in stocks and a strong rebound in the US dollar. So, with that in mind, inflation rates still well above the Fed’s target may allow market participants to increase bets over a first tapering step later this year and could thereby support the US dollar further and allow further correction in equities.

However, whether the Fed will indeed taper this year is not set in stone yet. Announcing such a step this month is now off the table, with the official announcement perhaps more likely to be delivered in November. That said, this could be the case if data heading into that meeting continue to come on the strong side. Upcoming employment reports could prove critical as they may indicate whether August’s miss was a one-off incident, or not.

On Wednesday, during the Asian session, we have China’s fixed asset investment, industrial production, and retail sales, all for August. All three of the yoy rates are expected to have declined notably, but yet to have stayed at historically decent levels. Therefore, we don’t expect such numbers to trigger serious concerns with regards to the performance of the world’s second largest economy.

Yes, economic momentum has weakened recently due to the outbreak of the Delta coronavirus variant, but last week, data showed that the nation’s exports grew faster than expected during the month of August due to solid global demand, suggesting that, despite some domestic headwinds, the Chinese economy may receive fuel and support from the rest of the world.

During the early EU session, the UK CPIs for August are coming out, with expectations pointing to strong accelerations in both headline and core terms. Specifically, both the headline and core rates are forecast to have jumped to +2.9% yoy, from +2.0% and +1.9%, respectively. As we already noted, this may allow participants to add to bets over a rate hike by the BoE soon, and thereby prove supportive for the British pound.

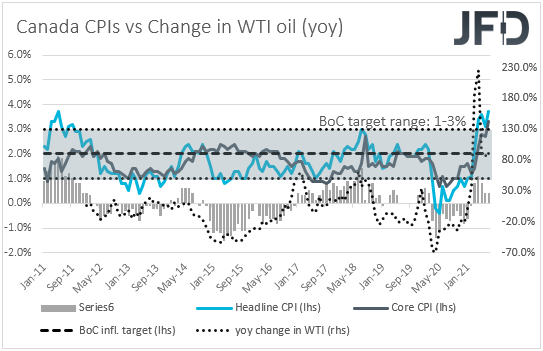

Later in the day, we have more August CPIs coming out, this time from Canada. The headline rate is forecast to have inched up to +3.9% yoy from +3.7%, while no forecast is available for the core one.

Last week, the BoC kept interest rates at a record low of +0.25% and maintained its QE program, as was widely anticipated. In the statement, it was noted that they expect growth to strengthen in the second half, though a fourth coronavirus wave and supply bottlenecks could weigh on the recovery. What’s more, they maintained the guidance that the economic slack would be absorbed sometime in H2, 2022, which means this is when they expect to start raising interest rates.

Following the latest disappointing data, especially the economic contraction in Q2, many participants may have been expecting the Bank to announce a delay in its tapering plans. However, that was not the case. Yes, there was no action at this gathering, but this could be due to the fact that the federal elections are planned in a week, and perhaps because this was a smaller meeting, with no updated economic projections and a press conference.

In our view, the door for another tapering in October remained open, and this was confirmed by BoC Governor Tiff Macklem, who on Thursday said that he and his colleagues are moving closer to a time when continuing to add stimulus through QE won’t be necessary. Therefore, following Friday’s decent employment data, further acceleration in the CPIs could add to the case of an October tapering and could support somewhat the loonie.

On Thursday, Asian time, New Zealand releases its GDP data for Q2. The qoq rate is expected to have ticked down to +1.5% from +1.6%, but this is likely to take the yoy one up to 16.4% from 2.4%.

At the previous gathering, the RBNZ delayed raising interest rates, at a time when the financial community was more than certain for such a move. Policymakers changed their minds after the nation entered a lockdown due to new coronavirus cases, however, they signaled that they still expect to push the hike button before year end. The Bank’s next gathering is scheduled for Oct. 6, and decent GDP numbers could add to the likelihood of a hike then.

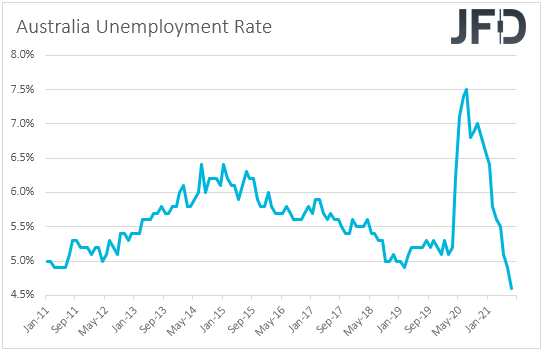

We also get Australia’s employment report for August. The unemployment rate is expected to have risen to 4.9% from 4.6%, while the net change in employment is anticipated to show that the economy has lost 70.0k jobs, after gaining just 2.2k in July.

At its latest gathering, the RBA proceeded with the planned tapering from AUD 5bn to AUD 4bn per week, but it delayed the date for a new review from November 2021 to February 2022, due to a delay in the economic recovery and increased uncertainty associated with the outbreak of the Delta coronavirus variant.

As for interest rates, officials stuck to their guns that they are likely to keep them at present levels at least until 2024. So, with that in mind, the employment report could confirm the Bank’s view and choices, but we don’t expect a major reaction from the aussie, as despite the most recent lockdown measures in Australia, now, vaccinations are gathering pace, something that raises hopes that the nation could abandon restrictions sooner than previously thought.

Later in the day, we have the US retail sales for August, with both the headline and core rates expected to have risen somewhat, but to have stayed in negative territory.

Finally, on Friday, we get the UK retail sales for August. Both headline and core sales are expected to have rebounded 0.5% mom and 0.7% mom, from -2.5% and -2.4%, respectively. Eurozone’s final CPIs for August are also coming out, but as it is always the case, they are expected to confirm their preliminary estimates.