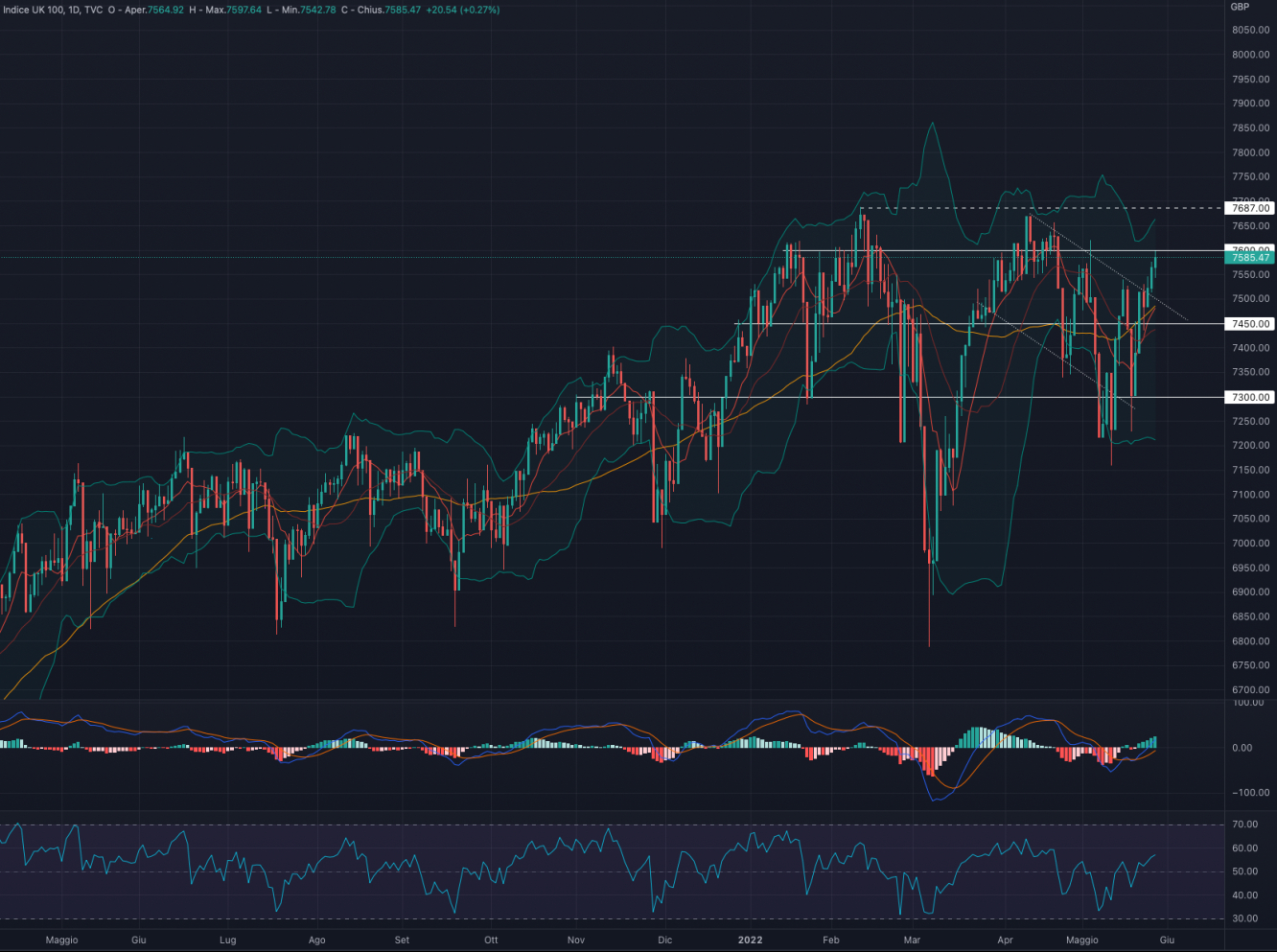

FTSE 100 Indexes

The FTSE FT100 TR (UKX) ended the week up by + 2.65%. For the coming week, we could see a consolidation around 7.500 followed by a move to the upside.

Indicators

Positive performance for the British index which is now close to the strong resistance area at 7.600. While remaining convinced that in the short-medium term the latter will be broken upwards, we believe that the UKX may first retrace slightly.

The break of the short-term trendline from April 2022 is a promising indicator and it is for this reason that we could expect a back-test in the area of 7.500 (breaking point to the upside and in conjunction with the 50MA - yellow line).

MACD and RSI both support the bullish push with the former having in fact crossed the 0 line upwards (positive momentum) and the latter the 50 line (bullish)

We are positive about the FTSE 100 from a short to medium term perspective

Support at 7.450

Resistance at 7.600

The FTSE MIB Net Lux Index had a week up by + 2.25%. For the week ahead, we could see a consolidation between 24.200 - 24.400 followed by a move upwards.

Indicators

Positive week for the Italian index which for the first time since January 2022 managed to break up the long bearish trendline in place since the beginning of the year.

Given the length of this trendline, we believe that the index can now carry out a back-test to then continue to the upside. The area between 24.200 and 24.400 represents both the breaking point on the upside and the area in which the 50 MA is located (yellow line), making it an interesting consolidation area.

MACD and RSI support the bullish push, finding the first close to an upward crossing of the 0 line (positive momentum) and the second already above the 50 line (bullish).

We are positive on the FTSEMIB from a short to medium term perspective

Support at 23.850

Resistance at 25.000

DAX 40

The DAX ended the week up by + 3.44%. This coming week, we are in favor of a slight back-test on the area of 14.300 followed by a move to the upside.

Indicators

From a short-medium term perspective, we believe the break of the long bearish trendline in place since January 2022 is very positive. The strong long green candles of the last two days seem to almost eliminate the possibility of a scenario like that of Mar. 29, Apr. 21, and May 5 (yellow circles).

MACD and RSI appear to support the bullish push as the former is close to breaking the 0 line (positive momentum) and the latter well above the 50 line (bullish).

We are positive on the DAX in the short to medium term.

Support at 14.050

Resistance at 14.460

S&P 500

The S&P 500 had a week up by + 6.58%. For the coming week, we are in favor of a consolidation in the area of 4.100 to then possibly proceed higher.

Indicators

The week just ended has led to the breaking of the strong bearish trend in existence since March 2022 confirmed also by the break of the 9MA to the upside.

The strong level of resistance on which the SPX is now makes us lean towards a consolidation before proceeding upwards. This consolidation could also avoid possible divergences caused by too strong price action.

MACD and RSI support the recovery of the index with the first recovering after a long downward extension and the second has just crossed the 50 line (bullish signal).

We are positive on the S&P 500 in the short to medium term.

Support at 3.850

Resistance at 4.160

NASDAQ 100

The NASDAQ 100 ended the week up by + 7.15%. For the coming week, we are in favor of a consolidation in the area of 12.400 to then proceed to the upside.

Indicators

The week just ended allowed the NDX to break to the upside, the second phase of the bearish trend started January 2022. A slight consolidation before continuing to move higher could allow the Tech index to avoid divergences between price and indicators.

MACD and RSI support the price rebound by being the first one in a recovery mode after a long bearish momentum and the second near the 50 line (bullish signal).

We are positive on the NASDAQ in the short to medium term.

Support at 11.500

Resistance at 13.000

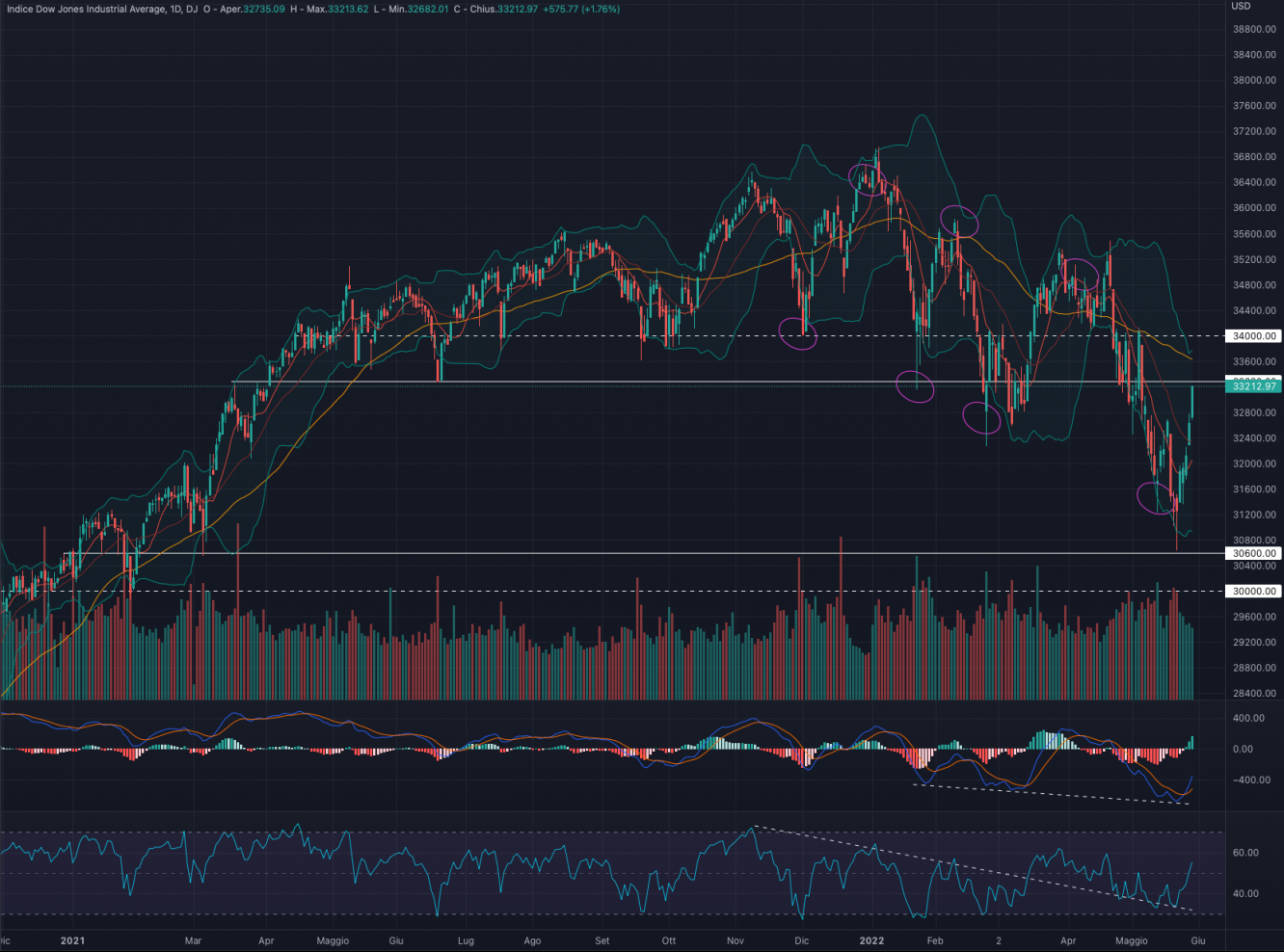

Dow Jones

Dow Jones Industrial Average had a week up by + 6.24%.This coming week, we are in favor of a slight consolidation in the area of 32.800 possibly followed by a move to the upside.

Indicators

The strong recovery of the week just ended has brought the DJI back to the breaking point of early May 2022, which has now become resistance.

Given the importance of the current price range at 33.300, we believe the index may initially consolidate before attempting to break this level.

MACD and RSI support the DJI price action with the former having crossed to the upside after a long negative phase and the latter just crossed the 50 line (bullish signal).

We are positive about DOW JONES in the short to medium term.

Support at 30.600

Resistance 33.290