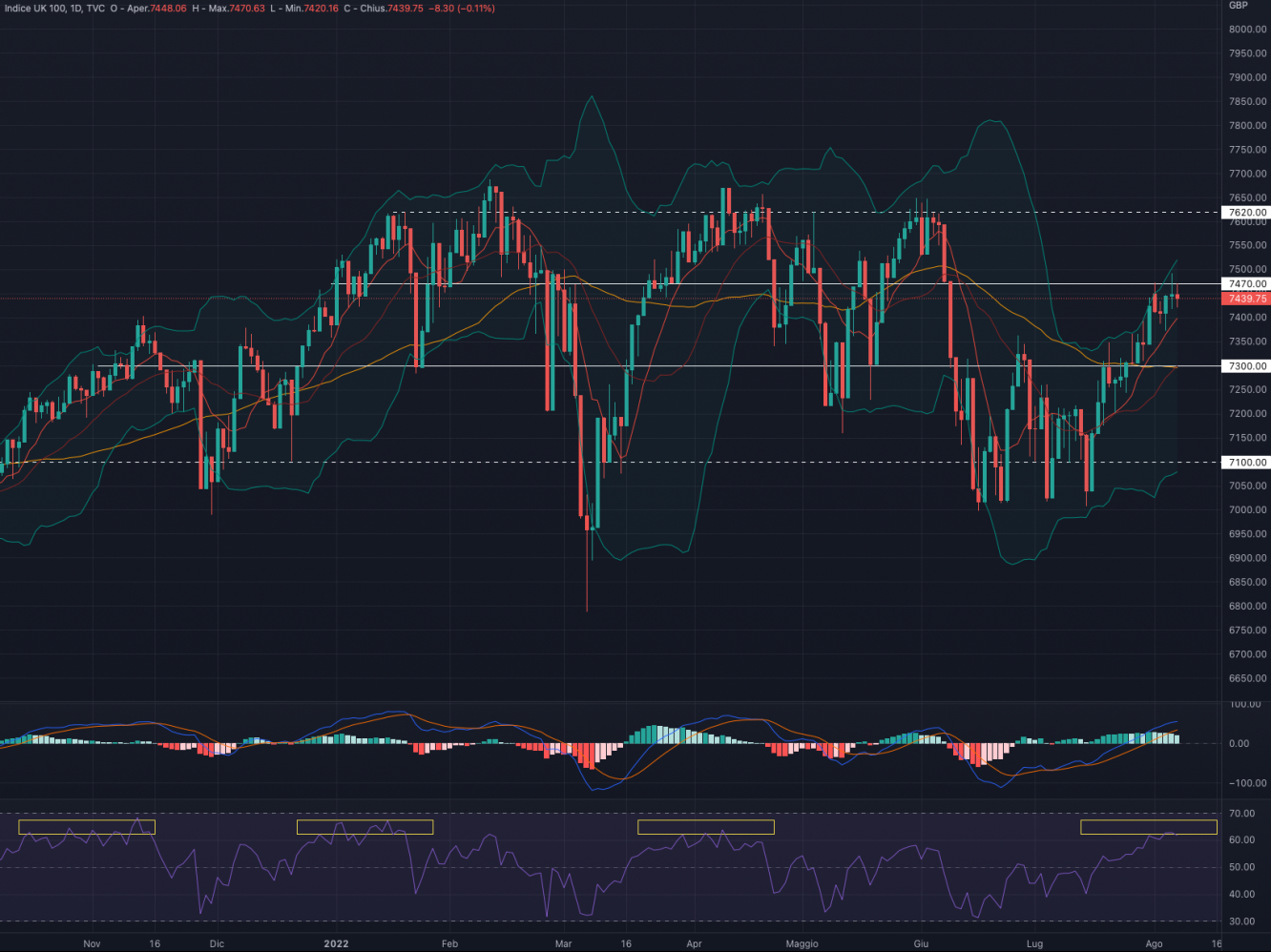

FTSE 100

The FTSE 100 ended the week up by + 0.22%. For the coming week, we could see a consolidation in the area between 7,300 - 7,400.

Indicators

Price action continues to be just below the strong resistance at 7.470 with a series of indecision candles. It seems to resemble those of April 2022, which was followed by strong declines.

MACD and RSI are, in our opinion, the first indicators to signal a slowdown: both have decreased their run, and especially the second is now in a strong resistance area.

The strong upside of these indicators also makes us exclude short-term rises. A possible retracement could lead the index to initially retest the area of 7.350.

We remain positive on the FTSE100 but prefer to wait for retracements.

- Support at 7,300

- Resistance at 7.470

DAX 40

The DAX ended the week up by + 0.67%. For the coming week, we could see a consolidation in the area of 13,200-13,400.

Indicators

A positive week for the German index as it continues to advance upwards, oscillating between the 9MA (red line) and the upper part of the Bollinger band. If this price action is positive, it could soon lead to a rapid fall in price.

MACD and RSI are supporting the push between and are also signaling a slight slowdown: the former is seeing a contraction of its histograms and the latter is now on a strong resistance area.

We remain positive on the DAX but await the occurrence of possible retracements.

- Support at 12,600

- Resistance at 14.050

S&P 500

The S&P 500 had a week up by + 0.36%. For the coming week, we favor consolidation in the area of 4,000 - 4,050.

Indicators

A week that saw the SPX moving near the strong resistance at 4,175. The strong stretches of the past few weeks make us exclude a break to the upside of this area and lean more towards a retracement to avoid situations of overbought and unsustainable growth.

MACD and RSI reflect the positivity in the index. Still, they are signaling a slowdown: the first shows a slight contraction of its histograms, and the second is now overbought territory.

We remain positive on the S&P 500, but with an almost overbought RSI coupled with strong resistance at 4.175, we are cautious and in favor of a retracement.

- Support at 3,950

- Resistance at 4,175

NASDAQ 100

The NASDAQ ended the week up by + 2.01%. For the coming week, we believe there may be a retracement to the area of 12,600.

Indicators

The Tech index continues to move near the top of the Bollinger band: while the strong bullish push is undoubtedly positive, on the other, we believe that a slight drop below the 9MA (red line) we believe it can lead the NDX to sharp but fast retracements.

We believe a possible target for such retracements can be identified at 12,600. MACD and RSI, while supporting the push of the index, now shift the risk return in favor of a possible retracement. The MACD is now well above 0 but with shrinking histograms, and the RSI is now near the overbought area.

We remain positive on the NASDAQ 100 but await a possible retracement.

- Support at 12,400

- Resistance at 13,500

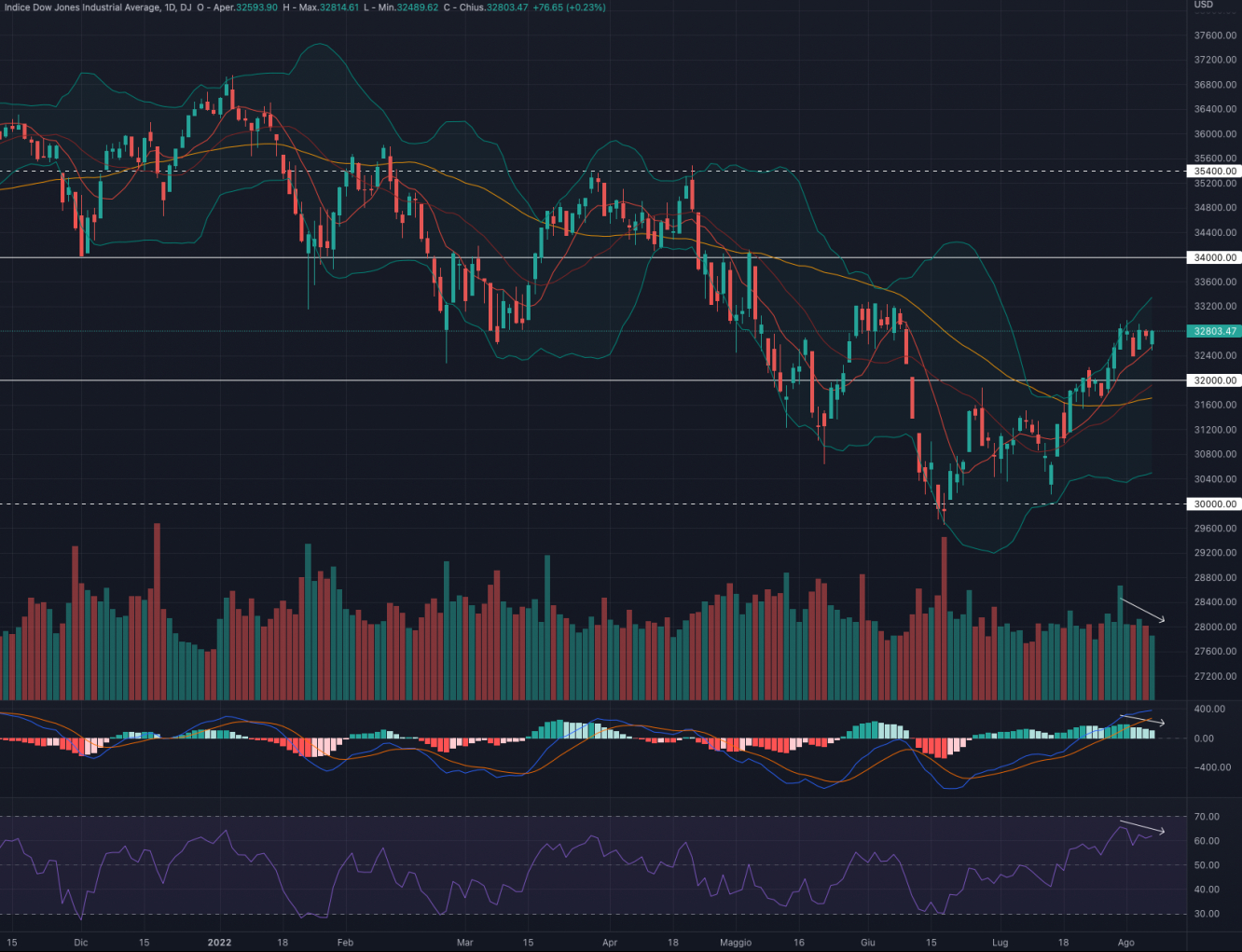

Dow Jones

The Dow Jones Industrial Average had a week up by + 0.38%. For the coming week, we could see a possible retracement to the area of 32,200.

Indicators

The index is now close to the intermediate resistance observed in May-June 2022. Given the strong stretches of the past few weeks and the latest indecision candles, we believe we can see a slight retracement.

MACD and RSI seem to want to signal a negative divergence between price and indicators, as the price has essentially remained unchanged in the face of a slight decrease. MACD is experiencing a slight contraction of its histograms, and the RSI remains in the overbought area.

We remain positive on the Dow Jones but look forward to its retracement.

- Support at 32,000

- Resistance 34,000