US Jobs growth slows down to 138,000

The US dollar is lower across the board versus major currencies. The U.S. non farm payrolls (NFP) grew by 138,000 jobs in May short of the 180,000 forecasted and there were downward revisions to the two previous months. The employment trend continues to be strong as evidence by the fall in the unemployment rate to its lowest since 2001, 4.3 percent. The market is still pricing in a 91.2 percent of a rate hike in June with U.S. Federal Reserve raising interest rates by 25 basis points to the 100–125 basis points range. US economic data was softer than expected and if anything will put under question a third rate hike by the Fed later this year but the jobs miss is not considered to derail the June rate hike.

Political uncertainty will be higher this week as the UK elections offer an uncertain result. Opinion polls have been all over the place with some showing a resounding victory by UK PM Theresa May while other see a closer battle that could make calling the snap election the worst mistake under her watch. UK pollsters have not endeared themselves to markets by missing the victory of David Cameron in 2015 and the results of Brexit in 2016. Maybe they would have refined their methods in 2017? The UK election will take place all day on Thursday, June 8.

June will be a pivotal month for central banks and the first out of the gate will be the Reserve Bank of Australia (RBA) that will publish its rate statement on Tuesday, June 6 at 9:30 pm EDT. Analysts expect the central bank to keep rates unchanged at 1.50 percent. The European Central Bank (ECB) will feature in a busy trading day on Thursday, June 8 and while not expected to change rates, there is anticipation of a change in the economic assessment with a long shot being a clear signal of QE tapering. Inflation dropped in May, but the economy should have enough momentum leaving some room for the ECB to change its guidance as Germany continues to pressure the central bank to reduce its monetary stimulus program.

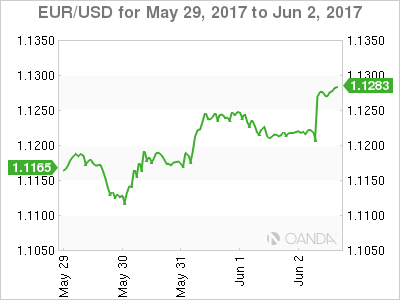

The EUR/USD gained 0.971 percent in the last five days. The single pair is trading at 1.1275 after the US employment report disappointed investors. The USD has not found its mojo after political turmoil in the White House has beat a constant drum that is going nowhere. The testimony of former FBI director James Comey on Thursday will add to an already chaotic day as investors will still be following the UK elections results.

The ECB could offer some words of encouragement to the euro by upgrading its assessment of the economy. The visit by Donald Trump might have had unintended consequences as Europe seems more united than usual with Emmanuel Macron and Angela Merkel building close ties. Macron still has to wait for the results of the June 11 parliamentary elections to know if he will get to govern on his terms, or cohabitate with one or more political parties.

There is more political events than economic releases no at the week of June 5 to 9 so investors should keep themselves informed of all the developments of the week and change their strategies accordingly.

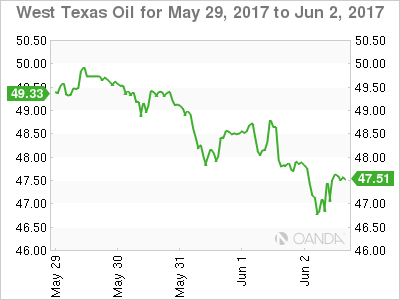

The price of oil fell 3.06 percent in the last five days. West Texas Intermediate is trading at $47.46 despite a huge drawdown in weekly oil inventories last week. Crude hit a three week on the back of the US abandoning the Paris Climate Accord. The increase in US production has kept the Organization of the Petroleum Exporting Countries (OPEC) production cut agreement from boosting oil prices, and the move by the Trump administration will support more shale drilling putting more supplies in an already saturated market.

Market events to watch this week:

Monday, Jun 5

4:30am GBP Services PMI

10:00am USD ISM Non-Manufacturing PMI

Tuesday, Jun 6

12:30am AUD Cash Rate

9:30pm AUD GDP q/q

Wednesday, Jun 7

10:30am USD Crude Oil Inventories

9:30pm AUD Trade Balance

Tentative CNY Trade Balance

Thursday, Jun 8

All Day GBP Parliamentary Elections

7:45am EUR Minimum Bid Rate

8:30am EUR ECB Press Conference

8:30am USD Unemployment Claims

Friday, Jun 9

4:30am GBP Manufacturing Production m/m

8:30am CAD Employment Change

8:30am CAD Unemployment Rate