Actionable ideas for the busy trader delivered daily right up front

- Wednesday uncertain.

- ES pivot 1632.83 . Holding below is bearish.

- Rest of week bias uncertain technically.

- Monthly outlook: bias lower.

- ES Fantasy Trader standing aside.

Well we were on track for some modest gains early Monday until yet another Fed Head opened their mouth and torpedoed the Dow which ended the day with a 76 point loss. Sometimes you just can't win for losing. Oh well - on we go to Wednesday.

The technicals (daily)

The Dow: After retracing last Friday's dump on Monday, the Dow proceeded to retrace the retracement on Tuesday, giving back 50% of those gains if you know what I mean and I'm not even sure I do. The net effect was to keep us in a descending RTC that has a surprisingly high Pearson's of 0.905 despite looking more like a staircase than a slope. But it drove us closer to the bullish breakout side and drove the stochastic further oversold. Still, the candle was a spinning top and that's about what this action is leaving my head - spinning. This one's too tough to call.

The VIX: The VIX OTOH sent a clearer message on Tuesday, putting in a second tall bearish inverted hammer that peaked above the upper BB intraday but finally closed below it. With the indicators remaining quite overbought, I still think the VIX is due to move lower on Wednesday.

Market index futures: Tonight all three futures are lower at 1:31 AM EDT with ES down by 0.11%. Like the Dow, ES gave us a spinning top on Tuesday spanning the range of Monday's candle. It also brought the indicators closed, but not quite to oversold. Given this indecision, I moved to the weekly chart and surprisingly, there's not much help there either. While the last two candles are rather bearish, we remain in a long-running rising weekly RTC (back to last November) so despite all the recent losses, we still can't call the current trend over.

ES daily pivot: Tonight the pivot inches up from 1632.00 to 1632.83. But with listless overnight action we remain below the new pivot so that's bearish.

Dollar index: The dollar remains in a descending RTC despite posting a small advance with a bullish inverted hammer that made the indicators bottom out and just managed a bullish stochastic crossover. So I think we could see a move higher here on Wednesday..

Euro: We didn't get the euro decline I was expecting on Tuesday, but the small spinning top does indicate some indecision here. However, the overnight continues to drift higher and we do remain in a rising RTC so I'm not going to fall for that one twice in a row - I'll say the euro goes higher on Wednesday. But that means either that's wrong or my dollar call is wrong - they won't both go up. At the moment, I'm a bit more confident in the dollar than the euro. We'll see.

Transportation: If there are any trends right now, they're in the trans which remain stuck in a descending RTC. Tuesday's 0.49% loss canceled Monday's doji and while touching the lower BB before closing just a bit higher than it. This also drove the indicators further into oversold. Still, there's no immediate sign of a reversal here now, though I think one is possible by Friday.

I have to confess I'm not getting a good read on these charts tonight. My overall bias is tending more towards the bearish and the first week in June is historically quite weak. OTOH, we've got the VIX that is clearly looking ready to move lower and that one is usually a high probability play. So bottom line, maybe I've been getting too much of that Florida sun so with all this herky-jerky action lately I'm just going to throw my hands up and call Wednesday uncertain.

ES Fantasy Trader

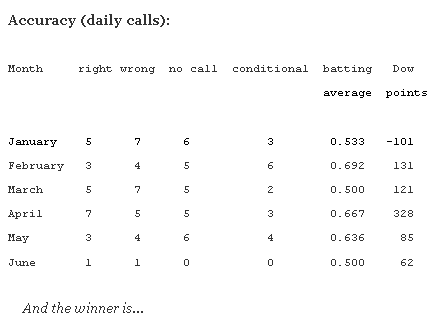

Portfolio stats: the account remains at $110,375 after 12 trades (10 for 12 total, 5 for 5 longs, 5 for 7 short) starting from $100,000 on 1/1/13. Tonight we stand aside on the "uncertain" call.