Oil remains under pressure for the second day in a row on the return of demand recovery fears. Brent, for example, lost more than 3% in a couple of hours after the release of a weak US ISM manufacturing index for July. The data exacerbated investor fears of a much more significant economic slowdown than had previously been priced in.

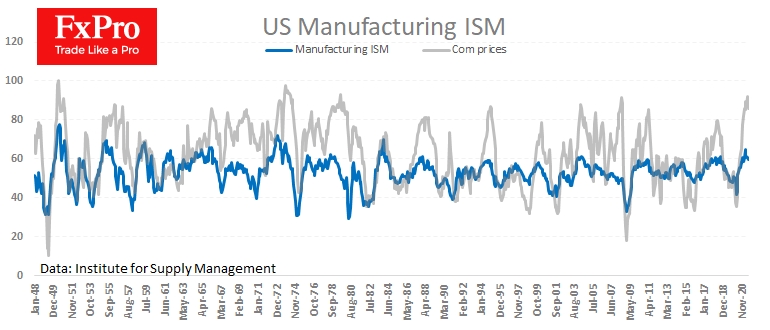

The ISM manufacturing index fell to 59.5 in July, compared with an expected rise to 60.8 and a level of 60.6 a month earlier. The price component of the index likely passed its peak in June at 92.1 and fell to 85.7 in July. The manufacturing activity index is at very high levels by historical standards, rising in March this year to the highest level since 1983.

But traders are keeping a close eye on its turning points. And it seems that yesterday, with the change in the price component, they got confirmation of that reversal. For economists, the States are enjoying a very high growth rate. The current levels of business activity are a return to a steady pace of growth, not on the back of a reopening of the economy.

However, traders in the financial markets might take the latest data as a signal to start taking profits, as the most active growth phase has already passed.

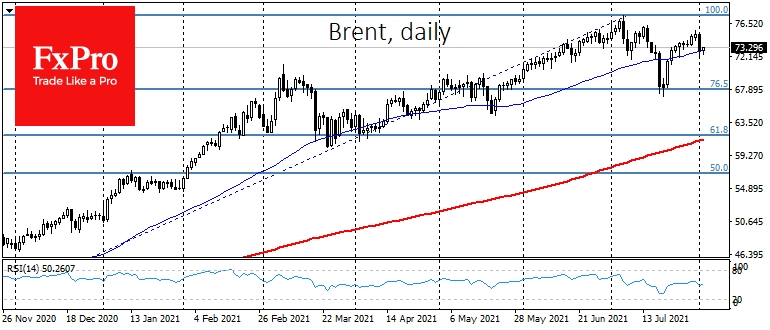

In particular, the oil chart clearly shows how the substantial drawdowns have become more frequent in recent weeks. Brent is no longer pulling away so firmly and for so long from its 50-day moving average, although it is still finding support on the declines.

Falling yields in debt markets are serving oil poorly. The fall in yields of the 10-years in recent weeks indicates that the debt market is voting for the temporary nature of inflation. This is fertile ground for a correction in metals and energy.

Suppose it fails to rally meaningfully from $73 in the next few days. In that case, traders should look for long term sideways or even correction in oil, with a remote target at $61, where the 200 SMA and the 61.8% Fibonacci rally from last November's peak in early July pass above $77.5.

However, plenty of arguments favor an alternative scenario of further growth due to solid fundamentals and continued monetary policy easing. Separately for oil, the suspension of production growth and drilling activity are all factors for a further upside with targets at $80-85 by the end of the year, where oil has not been since late 2018.

The FxPro Analyst Team

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Weakening Economic Momentum Leaves Oil Vulnerable

Published 08/03/2021, 07:55 AM

Updated 03/21/2024, 07:45 AM

Weakening Economic Momentum Leaves Oil Vulnerable

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or

remove ads

.

Latest comments

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.