- USD/JPY heads north with first resistance at 20-day SMA

- RSI and Stochastics confirm upside movement

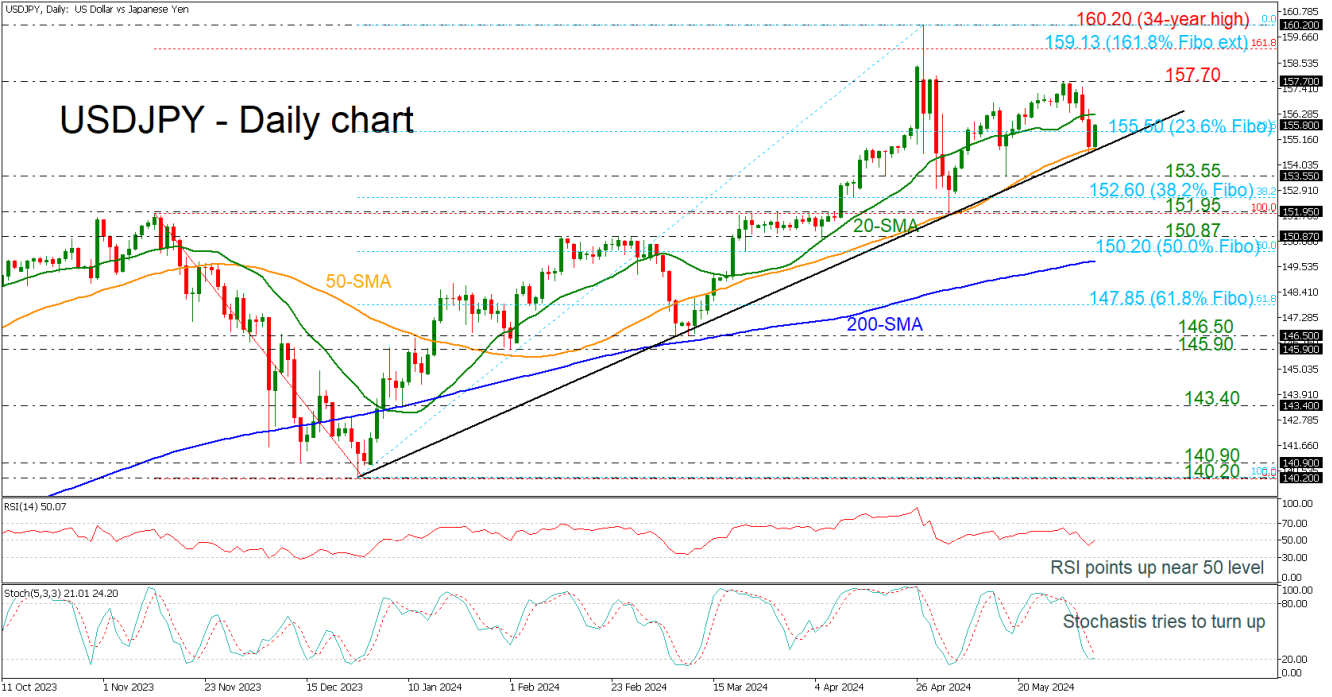

USD/JPY has reversed back up again after the strong rebound off the medium-term uptrend line and the 50-day simple moving average (SMA), meeting the 23.6% Fibonacci retracement level of the up leg from 140.20 to 160.20 at 155.50.

Momentum indicators are pointing to a positive bias in the short term with the RSI crossing above the neutral threshold of 50, while the stochastic oscillator is trying to turn higher as it bounced off the oversold region.

In the event of more upside pressure, the 20-day SMA at 156.30 could act as immediate resistance ahead of the previous peak of 157.70. Even higher, the 161.8% Fibonacci extension level of the down leg from 151.95 to 140.20 at 159.13 could be a key level for traders before flirting with the 34-year top of 160.20.

In the negative scenario, a dive beneath the valid ascending trend line could send the pair towards the 153.55 support and the 38.2% Fibonacci of 152.60. A drop lower could erase the latest upward wave, touching the 151.95 and 150.87 levels.

All in all, USD/JPY is confirming the upside tendency after the recent upside pullback and only a plunge below the 200-day SMA could switch the outlook to negative.