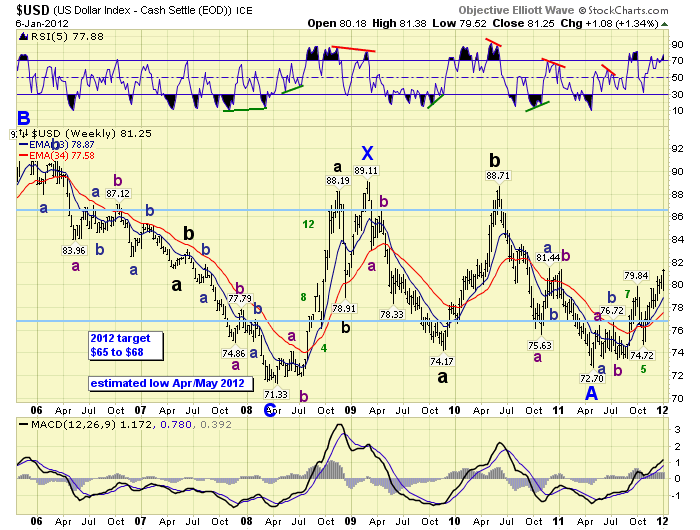

As we noted in the most recent weekend update, there have been some developments in the long term Secular/Supercycle patterns of the currencies. As you are aware, the USD Secular trend, or Supercycle if you will, has been bearish against most foreign currencies since 1985. We have reason to believe this ended at the 2011 price low of 72.70 DXY. The USD should now be in a Secular bull market. Initial estimates suggest the DXY should reach 140 by 2018.

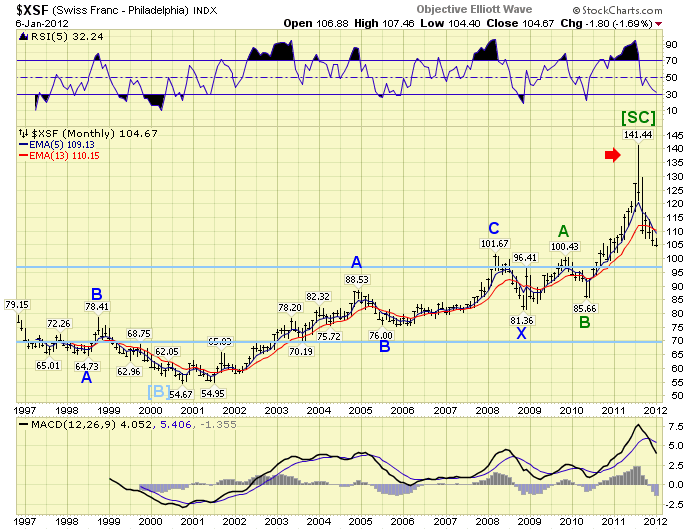

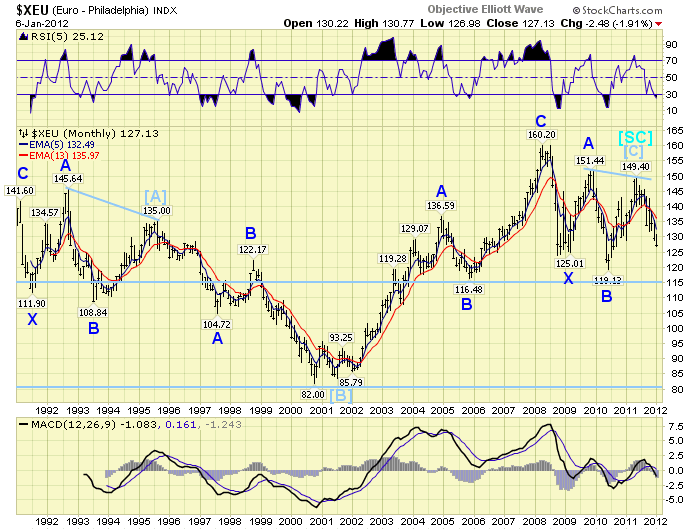

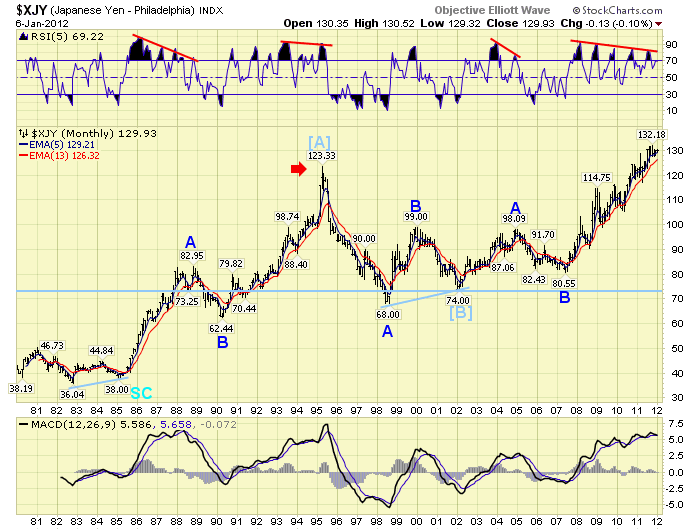

we detailed how the 17 year cycle appeared to be peaking with a blowoff top in the CHF/USD pair. The CHF/USD is our bellwether for the currency cycles. We also illustrated the CAD/USD was peaking right at our targeted zone of 1.06, and the JPYUSD pair was nearing our targeted zone of 1.33. The CHF/USD blowoff looked similar to the JPY/USD blowoff top in 1995, which also ended a Cycle wave. 1995 completed a Cycle wave [A], and 2011 completes a Cycle wave [C] and the total Supercycle wave since 1985. See EUR/USD chart below. Long term currency waves move in ABCs.

In the past few weeks the USD has confirmed an OEW long term uptrend, and the EUR/USD an OEW long term downtrend. This confirms our previous analysis and we expect most foreign currencies will be declining against the USD for the next seven years. Now to the specifics.

The CHF/USD pair peaked in 2011 at 141.44. Since then it has declined steadily and is currently around 105. With the Supercycle top completed, as noted on the chart, we expect the CHFUSD to continue to decline until it hits around 96 this year. Then we should see a bear market rally to around 118-120 during 2013. After that a decline to around 70, or lower, into 2018. These two support levels are noted on the monthly chart by blue lines.

The EUR/USD pair peaked in 2008 at 160.20. Since then it completed another set of ABC Primary waves with lower and lower highs. This is somewhat similar to the price action in the 1990′s. With a long term downtrend now confirmed in this pair, we expect the current decline to continue until it hits around 116. A bear market rally should follow at that point into the 129-133 range by 2013. After that a decline to around 82, or more, into 2018.

The USD/DXY bottomed in a Primary wave A in 2011 at 72.70. With the long term uptrend now confirmed we expect the DXY to rally to around 87 in 2012. After that it should decline, with the bear market rallies in the CHF and EUR, to around 77 in 2013. Then we expect a massive shift out of all foreign currencies and commodities into the USD. This USD bull market should continue for about five years as the DXY hits 140, or more, in 2018. During this 2013-2018 time period there could be a reorganization in the Eurozone, and/or a resetting of the world’s currencies. The USD, and then USD denominated assets should be in great demand between 2013-2018.

The JPY/USD pair appears to have topped at the recent 132.18 high. Thus far, it has not declined much while the CHF and EUR have headed lower. This appears somewhat similar to the early bull market waves after the last Supercycle low in the USD in 1978. Then the JPY and CHF were declining while the DMK and GBP held steady. The USD/DXY rose during the first year after the low, but the rally was kept in check by the DMK and GBP. This time around, it appears, the JPY, GBP and CAD are keeping the DXY in check during its first rally. In 2011 the CHFUSD appeared to be the most overvalued currency in the world. In 2012 the JPY/USD appears to have that distinction. When this pair does start to breakdown we’re expecting a price low of around 74, or lower, before 2018.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

USD and Foreign Currency Update

Published 01/09/2012, 07:27 AM

Updated 07/09/2023, 06:31 AM

USD and Foreign Currency Update

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or

remove ads

.

Latest comments

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.