A rebound in manufacturing and industrial output, coupled with a decent performance from the consumer sector and net trade and inventories being less of a drag support our view of 3%+ GDP growth in 3Q. However, the housing market, a weaker external environment, higher rates and deteriorating business surveys suggest tougher times ahead

Industrial output bounces back on strong manufacturing

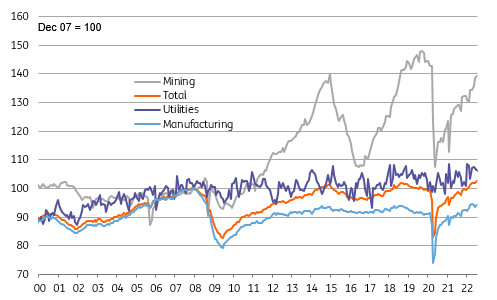

The US July industrial production report has posted a very respectable 0.6% month-on-month gain versus the 0.3% consensus. Manufacturing led the way with a 0.7% increase as auto output jumped 6.6%, but even excluding this key component output was up 0.3%. Mining also rose 0.7% with oil and gas output jumping 3.3% MoM as high prices spurred drilling activity. Meanwhile utilities were a surprise drag, falling 0.8% MoM.

US industrial output levels

Strong 3Q, but outlook for 4Q looks tougher

This report provides more evidence that 3Q GDP should be good. We strongly suspect that consumer spending will be lifted by the cash flow boost caused by the plunge in gasoline prices and decent employment gains, trade will be supportive too, inventories less of a drag and now we know that manufacturing is rebounding. Putting this altogether we think 3% annualised growth is firmly on the cards.

The worry is what happens in 4Q. Yesterday’s NY Empire manufacturing survey was awful and points to much weaker orders and activity later in the year. We will be closely looking to see if this is replicated in the Philly Fed (Thursday), Richmond Fed (August 23) and others later in the month. Even if it is seen as an aberration there are plenty of reasons to expect weaker activity towards year end. A China slowdown and recession in Europe will weigh heavily while ongoing increases in interest rates and a deteriorating outlook for the housing market will also act as a major headwind.

Residential construction worries mount...

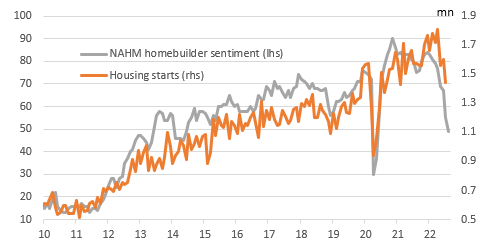

In that regard, US housing starts, fell 9.6% MoM in July to 1,446k annualised versus the 1,527k consensus. This is the weakest reading since February 2021 with the plunge in NAHB home builder confidence suggesting further falls in construction activity is likely.

Housing starts and home builder sentiment

We will get existing and new home sales numbers over the next seven days with further weakness expected in both due to high prices and a doubling of mortgage rates hurting affordability and crushing demand. We also expect supply to continue increasing, which will put downward pressure on prices at a time when home builders continue to struggle to find workers and the legacy of high material costs.

Direct residential construction will provide a major headwind for economic growth over the next 6-12 months, but it will also have knock-on effects for key retail sectors such as furniture, furnishings and building supplies given the strong correlation with housing transactions.

Disclaimer: This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more