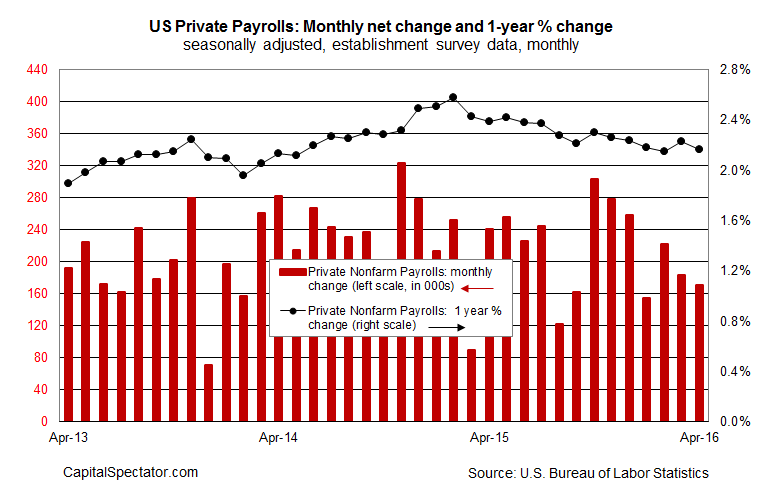

Company payrolls increased by a lower-than-expected 171,000 last month, the US Labor Department reports–the weakest gain in three months. The crowd had been looking for stronger results near +200,000. Instead, Friday morning’s nonfarm payrolls update falls in line with ADP’s April profile of weaker growth.

The news provides more evidence that the US macro trend is off to a sluggish start in the second quarter, but it’s premature to assume the worst via Friday’s data. The labor market’s expansion has been decelerating this year, but for the moment the downshift doesn’t exceed the low points of the last several years. In short, we’ve been here before and without sinking into a new recession. Will it be different this time? No one knows, but the worst you can say at the moment is that we’re knee-deep in another soft patch that may or may not lead to a new downturn.

On the plus side, private payrolls are still growing at a healthy annual rate, rising by nearly 2.2% in April vs. the year-earlier level. That’s a robust trend… if it holds. The problem is that the annual pace has been edging lower for much of the past year.

But let’s recognize that the slowdown is unfolding in slow motion, which implies that a sharp slide is nowhere on the horizon. In other words, the bigger concern at the moment is less about the economy slipping into a new NBER-defined recession vs. weak growth that becomes even weaker over an extended period of time. That may turn out to be an irrelevant distinction, depending on your personal finances and career path. In any case, the game of looking for a clear and distinct start to a new recession may fade into the mists of a post-2008 realm of warm and fuzzy macro trends subsumed by slow growth and unsatisfying job opportunities.

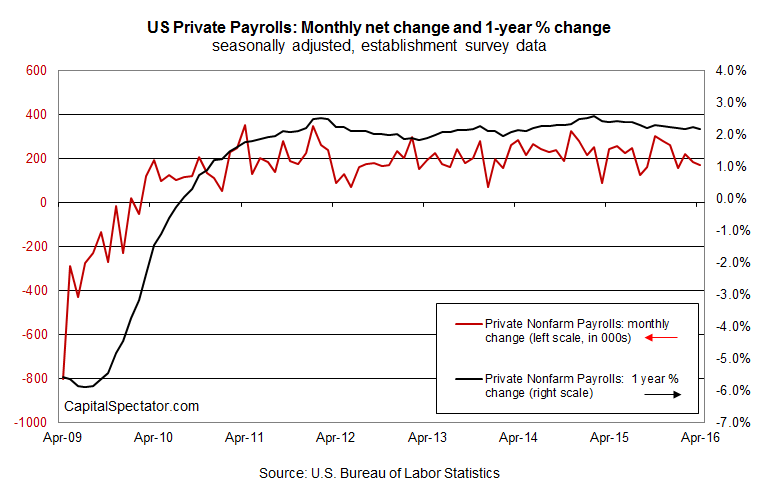

As for the latest numbers, let’s look for deeper perspective by putting the data above into a longer stretch of historical context. In the next chart below, it’s clear that the current downtrend for payrolls—in monthly and annual terms—isn’t unprecedented relative to the past six years. In fact, previous slowdowns have been worse. That said, the profile will suffer if the labor market continues to stumble in the months ahead.

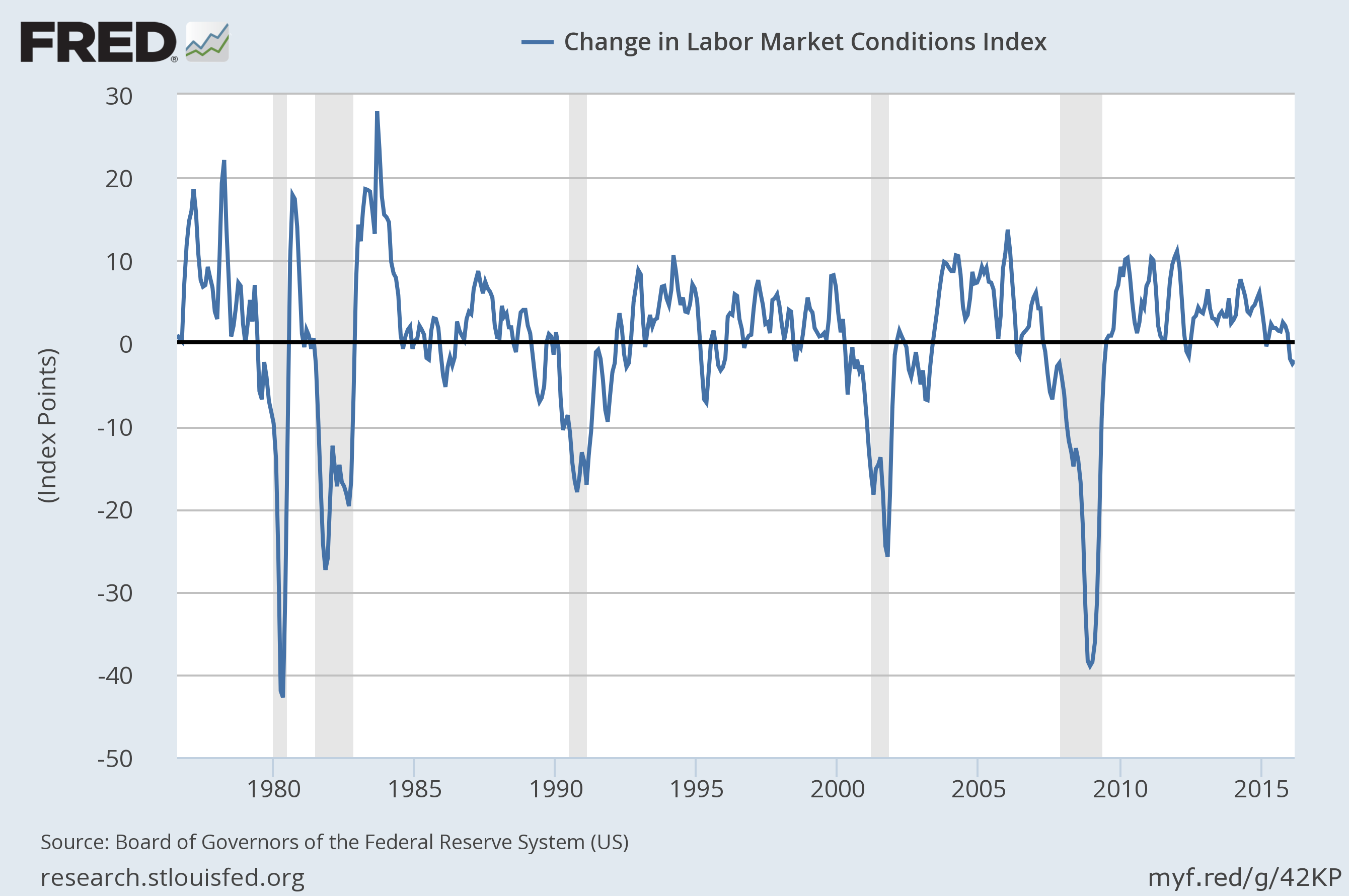

The next clue for reading the tea leaves for payrolls arrives in Monday’s update of the Federal Reserve’s Labor Market Conditions Index (LMCI) for April. This multi-factor benchmark offers a deeper read on the labor market’s trend and so the numbers for last month by this lens will be helpful for deciding what may be lurking in May and beyond.

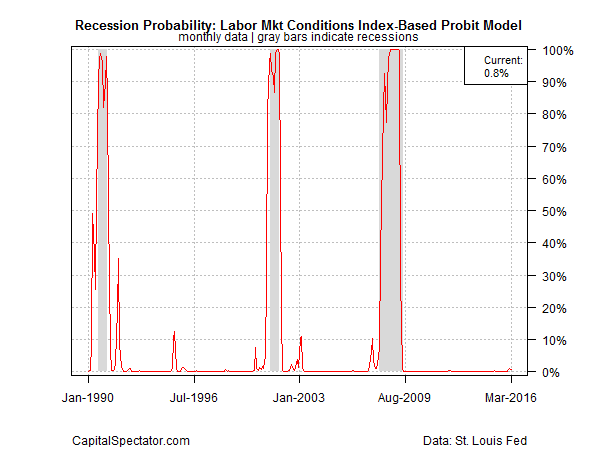

Here too it’s clear that a softer trend has been unfolding, as the chart above shows. Recent history isn’t encouraging, but it’s not a smoking gun, at least not yet. In other words, the March profile for LMCI doesn’t signal the start of a new recession. But that could change, depending on what’s revealed in the April update. For now, LMCI’s implied estimate of recession risk as of March is virtually nil. The main event for Monday is monitoring how or if that probability changes for April.