For the 24 hours to 23:00 GMT, the EUR marginally declined against the USD and closed at 1.3389, after inflation in the Euro-zone continued its downward trend and fell to its lowest level in almost five years in July. Official data revealed that the consumer price index in the region registered a rise of 0.4% (YoY) in July, compared to an advance of 0.5% in the prior month. Market anticipations were for the consumer price index to advance 0.5%. However, other data reported that the unemployment rate in the region surprisingly declined to 11.5% in June, the lowest level in almost 22 months, compared to a rate of 11.6% recorded in the previous month. Markets were expecting the unemployment rate to remain steady at 11.6% in June.

Data from Germany revealed that the unemployment rate in the country remained unchanged at 6.7% in July, in line with the market expectations. Meanwhile, the number of people unemployed in Germany declined by 12.0K in July, compared to a revised unemployed people of 7.0K reported in the previous month. Furthermore, the retail sales in the nation rose 1.3% on a MoM basis, compared to a drop of 0.6% in the previous month. Market anticipations were for retail sales to rise 1.0%.

The US Dollar gained momentum, after the labour costs in the US recorded their biggest gain in more than 5 1/2 years in the second quarter, bolstering the nation’s economic outlook. However, the initial jobless claims increased by 23,000 to a seasonally adjusted 302,000 in the week ended July 26, after falling to lowest level since May 2000 in the previous week. Moreover, the Chicago purchasing managers index unexpectedly tumbled to a 12-month low level of 52.6 in July, from previous month’s level of 62.6.

In the Asian session, at GMT0300, the pair is trading at 1.3388, with the EUR trading tad lower from yesterday’s close.

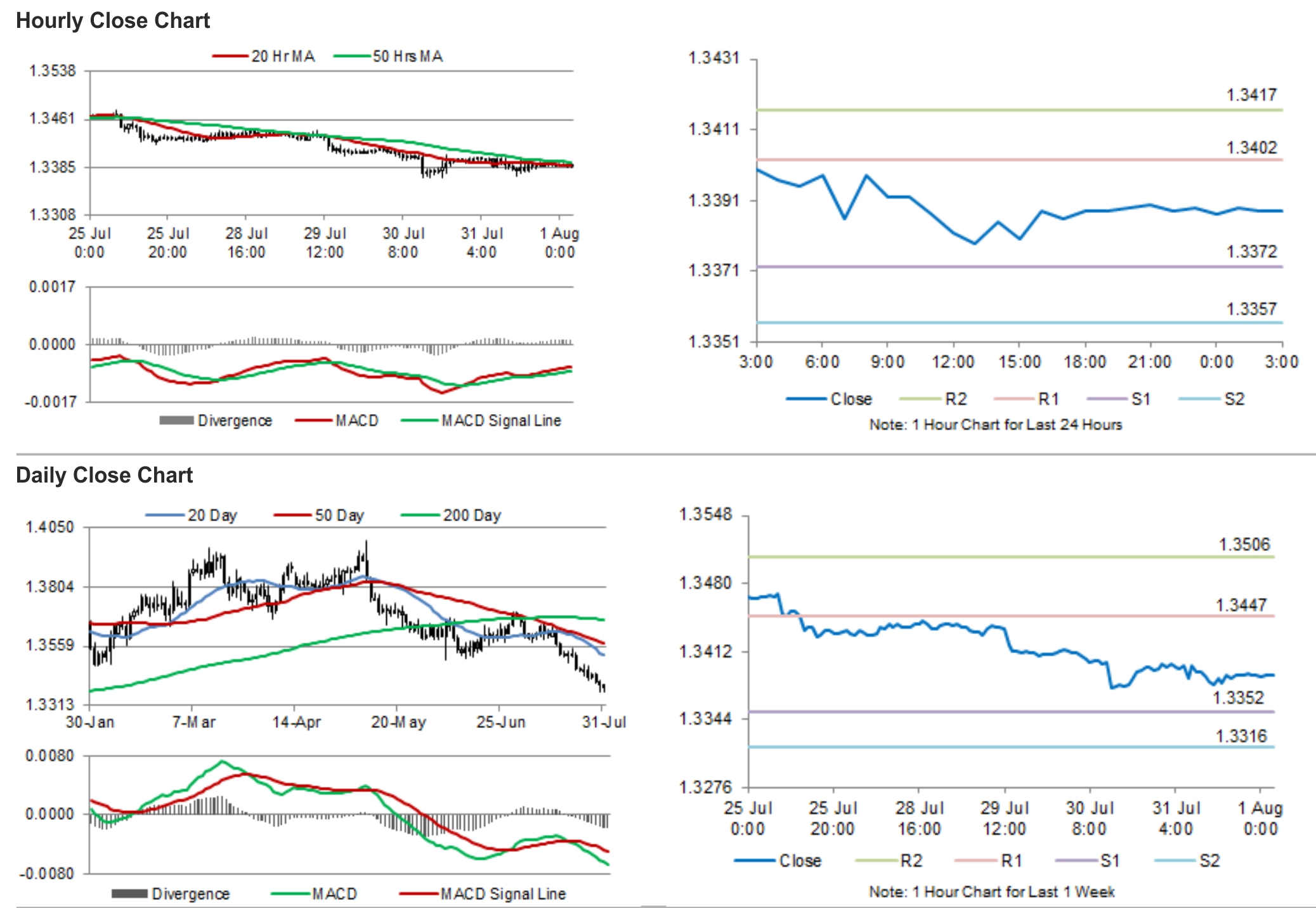

The pair is expected to find support at 1.3372, and a fall through could take it to the next support level of 1.3357. The pair is expected to find its first resistance at 1.3402, and a rise through could take it to the next resistance level of 1.3417.

Later today, investors would turn their attention to the crucial non-farm payrolls data and unemployment rate from the US. Meanwhile, the manufacturing PMI from the Euro-bloc and its member nations would also be closely watched.

The currency pair is showing convergence with its 20 Hr and 50 Hr moving averages.