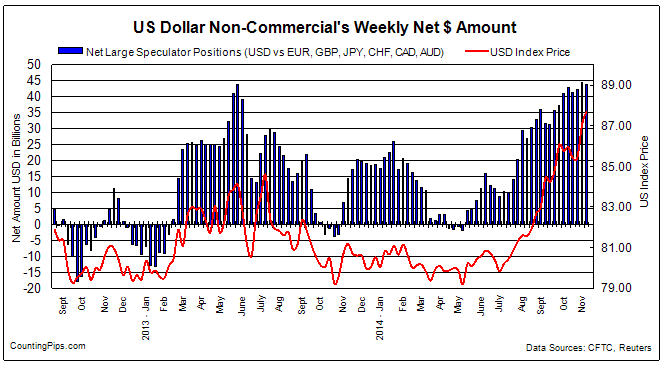

The latest data for the weekly Commitment of Traders (COT) report, released by the Commodity Futures Trading Commission (CFTC) on Friday, showed that large traders and currency speculators slightly decreased their overall US dollar bullish bets last week after two straight weeks of rising positions.

Non-commercial large futures traders, including hedge funds and large speculators, had an overall US Dollar long position totaling $43.99 billion as of Tuesday November 11th, according to the latest data from the CFTC and dollar amount calculations by Reuters. This was a weekly change of -$0.39 billion from the $44.38 billion total long position that was registered on November 4th, according to the Reuters calculation that totals the US dollar contracts against the combined contracts of the euro, British pound, Japanese yen, Australian dollar, Canadian dollar and the Swiss franc.

The US dollar’s aggregate bullish level continues to be in a very strong position and above the +$40 billion level for a sixth straight week. Each of the individually tracked currencies have now had a net bearish position versus the dollar for a sixth week (see data below).

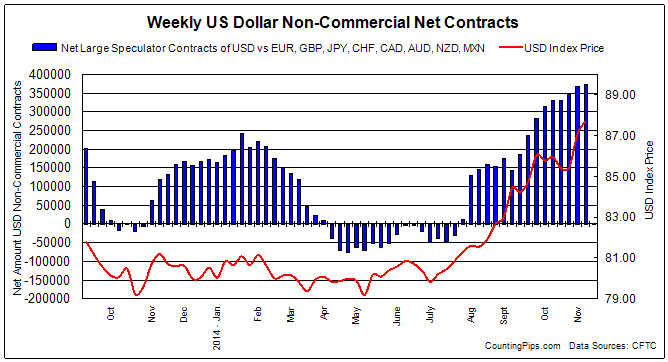

Overall Speculative Net US Dollar Contracts

In terms of total speculative contracts, overall US dollar contracts rose slightly higher last week to +372,558 contracts as of Tuesday November 11th. This was a change by +5,821 contracts from the total of +366,737 contracts as of Tuesday November 4th and represents three straight weeks of increase in net contract positions. This total US dollar contracts calculation takes into account more currencies than the Reuters dollar amount total and is derived by adding the sum of each individual currencies net position versus the dollar. Currency contracts used in the calculation are the euro, British pound, JPY, CHF, CAD, AUD, NZD and the MXN.

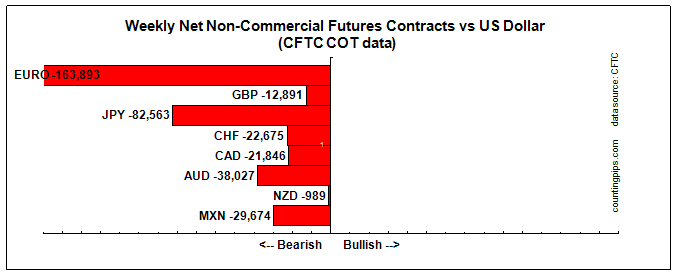

Major Currency Weekly Levels & Changes: One Sided – All currencies have net bearish position versus the USD for 6th week

Overall changes on the week for the major currencies showed that large speculators increased their bets last week in favor of the euro, Australian dollar and the New Zealand dollar while decreasing weekly bets for the British pound sterling, Japanese yen, Swiss franc, Canadian dollar and the Mexican Peso.

Notable changes on the week for the Major Currencies:

- Euro positions rebounded a bit last week (+15,128 contracts) after five weeks of decline. It was the best weekly gain for eurofx positions since September. The EUR/USD exchange rate gravitated around the 1.2500 level last week and managed to end the week slightly above there

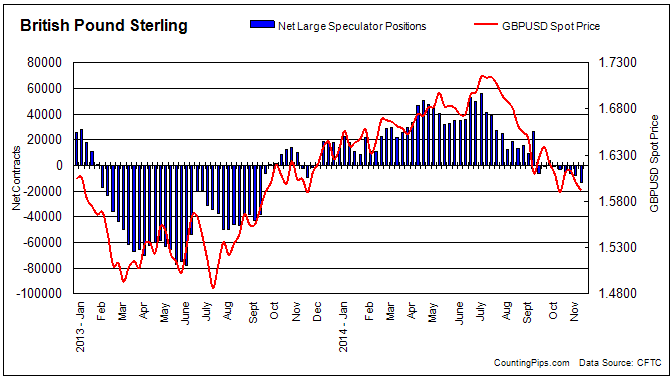

- British pound sterling positions fell for a 6th week and to the most bearish level since September of 2013. The GBP/USD spot exchange rate ended the week sharply lower with a lower weekly close for a 4th week and below the 1.5700 level

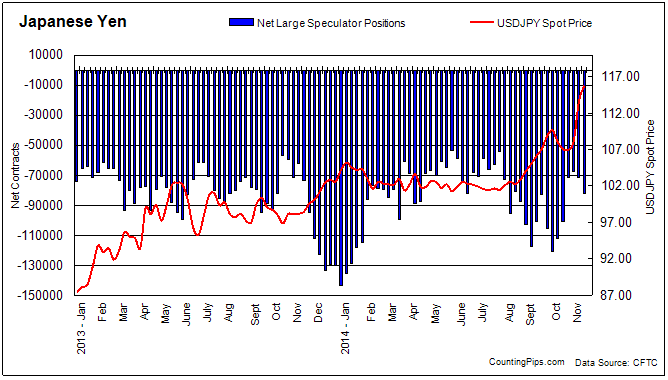

- Japanese yen bets declined last week for a second week and to the lowest level in five weeks. The USDJPY exchange rate continued to gain for a 4th week and ended the week over the 116 level

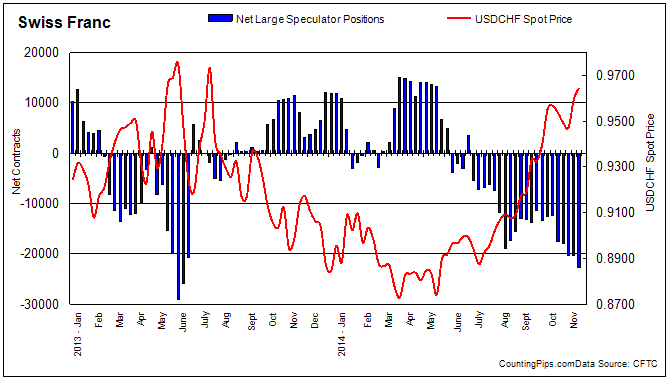

- Swiss franc bearish bets increased last week by -2,454 contracts and the franc positions (-22,675) are at their lowest level since June 2013. The USD/CHF pair closed the week slightly lower by -0.71% after 3 weeks of gains

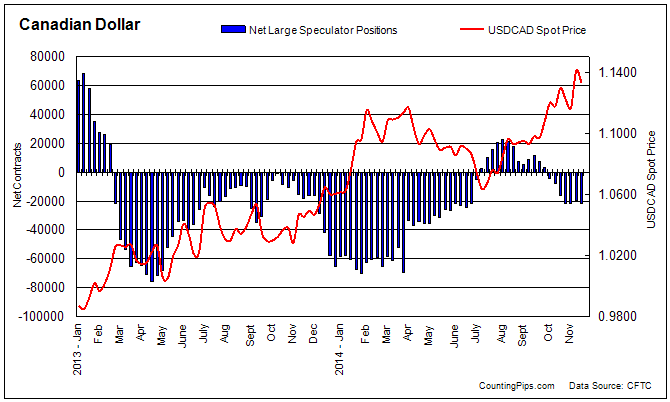

- Canadian dollar positions edged lower last week after 2 weeks of rises with positions remaining around the -20,000 level. The USD/CAD exchange rate ended the week slightly lower (-0.34%) with the rate just below the 1.1300 major level

- Australian dollar net positions edged very slightly higher after nine weeks of decline with net positions just below -40,000 contracts. The AUDUSD finished the week stronger (+1.30%) with the exchange rate near the 0.8750 level

- New Zealand dollar net positions rose higher last week (+3,120 contracts) although the net position remains bearish overall for a 6th week. The NZD/USD exchange rate ended the week sharply higher (+1.99%) and just above the 0.7900 level

- Mexican peso bearish positions rose last week (-3,084 contracts) as the peso speculator positions have been on the bearish side now for seven straight weeks just below the -30,000 level. The USD/MXN exchange rate ended the week close to unchanged and near the 13.5000 level

This latest COT data is through Tuesday November 11th and shows a quick view of how large speculators and for-profit traders (non-commercials) were positioned in the futures markets. All currency positions are in direct relation to the US dollar where, for example, a bet for the euro is a bet that the euro will rise versus the dollar while a bet against the euro will be a bet that the dollar will gain versus the euro.

Please see the individual currency charts and their respective data points below.

Weekly Charts: Large Speculators Weekly Positions vs Currency Spot Price

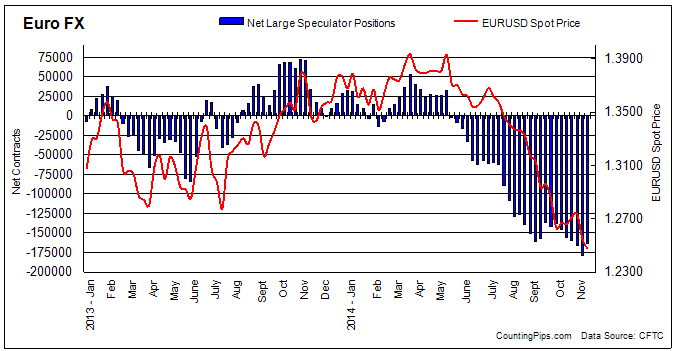

EuroFX:

Last Six Weeks data for EuroFX futures

| Date | Open Interest | Long Specs | Short Specs | Large Specs Net | Weekly Change |

| 10/07/2014 | 425656 | 61467 | 207679 | -146212 | -8687 |

| 10/14/2014 | 434873 | 60158 | 215500 | -155342 | -9130 |

| 10/21/2014 | 439863 | 60188 | 219559 | -159371 | -4029 |

| 10/28/2014 | 441369 | 59054 | 224761 | -165707 | -6336 |

| 11/04/2014 | 465332 | 59566 | 238587 | -179021 | -13314 |

| 11/11/2014 | 463976 | 60454 | 224347 | -163893 | 15128 |

British Pound Sterling:

Last Six Weeks data for Pound Sterling futures

| Date | Open Interest | Long Specs | Short Specs | Large Specs Net | Weekly Change |

| 10/07/2014 | 129666 | 46503 | 47578 | -1075 | -4664 |

| 10/14/2014 | 138471 | 43116 | 45953 | -2837 | -1762 |

| 10/21/2014 | 135766 | 36567 | 41052 | -4485 | -1648 |

| 10/28/2014 | 138661 | 40718 | 46965 | -6247 | -1762 |

| 11/04/2014 | 144215 | 43289 | 50751 | -7462 | -1215 |

| 11/11/2014 | 151660 | 40661 | 53552 | -12891 | -5429 |

Japanese Yen:

Last Six Weeks data for Yen Futures

| Date | Open Interest | Long Specs | Short Specs | Large Specs Net | Weekly Change |

| 10/07/2014 | 223255 | 24837 | 137388 | -112551 | 8327 |

| 10/14/2014 | 212420 | 22839 | 123986 | -101147 | 11404 |

| 10/21/2014 | 185412 | 26634 | 98372 | -71738 | 29409 |

| 10/28/2014 | 184120 | 23883 | 91282 | -67399 | 4339 |

| 11/04/2014 | 207974 | 37917 | 109568 | -71651 | -4252 |

| 11/11/2014 | 227576 | 47271 | 129834 | -82563 | -10912 |

Swiss Franc:

Last Six Weeks data for Franc futures

| Date | Open Interest | Long Specs | Short Specs | Large Specs Net | Weekly Change |

| 10/07/2014 | 60516 | 15509 | 27928 | -12419 | 138 |

| 10/14/2014 | 60968 | 11113 | 28666 | -17553 | -5134 |

| 10/21/2014 | 55550 | 7643 | 25505 | -17862 | -309 |

| 10/28/2014 | 57006 | 6887 | 27170 | -20283 | -2421 |

| 11/04/2014 | 59699 | 7844 | 28065 | -20221 | 62 |

| 11/11/2014 | 61280 | 8752 | 31427 | -22675 | -2454 |

Canadian Dollar:

Last Six Weeks data for Canadian dollar futures

| Date | Open Interest | Long Specs | Short Specs | Large Specs Net | Weekly Change |

| 10/07/2014 | 100900 | 39174 | 46626 | -7452 | -2886 |

| 10/14/2014 | 104060 | 35688 | 51855 | -16167 | -8715 |

| 10/21/2014 | 102170 | 28837 | 50371 | -21534 | -5367 |

| 10/28/2014 | 99309 | 26093 | 47498 | -21405 | 129 |

| 11/04/2014 | 104720 | 29627 | 49042 | -19415 | 1990 |

| 11/11/2014 | 108445 | 32668 | 54514 | -21846 | -2431 |

Australian Dollar:

Last Six Weeks data for Australian dollar futures

| Date | Open Interest | Long Specs | Short Specs | Large Specs Net | Weekly Change |

| 10/07/2014 | 129561 | 31601 | 58087 | -26486 | -24469 |

| 10/14/2014 | 115941 | 14367 | 44638 | -30271 | -3785 |

| 10/21/2014 | 115985 | 13951 | 45460 | -31509 | -1238 |

| 10/28/2014 | 120071 | 17446 | 51297 | -33851 | -2342 |

| 11/04/2014 | 123342 | 14595 | 52863 | -38268 | -4417 |

| 11/11/2014 | 123726 | 12896 | 50923 | -38027 | 241 |

New Zealand Dollar:

Last Six Weeks data for New Zealand dollar futures

| Date | Open Interest | Long Specs | Short Specs | Large Specs Net | Weekly Change |

| 10/07/2014 | 19214 | 10052 | 10152 | -100 | -164 |

| 10/14/2014 | 21317 | 9171 | 11555 | -2384 | -2284 |

| 10/21/2014 | 21311 | 8526 | 10858 | -2332 | 52 |

| 10/28/2014 | 22023 | 8506 | 12404 | -3898 | -1566 |

| 11/04/2014 | 23716 | 9737 | 13846 | -4109 | -211 |

| 11/11/2014 | 19809 | 9244 | 10233 | -989 | 3120 |

Mexican Peso:

Last Six Weeks data for Mexican Peso futures

| Date | Open Interest | Long Specs | Short Specs | Large Specs Net | Weekly Change |

| 10/07/2014 | 147139 | 43781 | 51364 | -7583 | -269 |

| 10/14/2014 | 139036 | 39798 | 45561 | -5763 | 1820 |

| 10/21/2014 | 138193 | 30087 | 51211 | -21124 | -15361 |

| 10/28/2014 | 144016 | 26832 | 53675 | -26843 | -5719 |

| 11/04/2014 | 159857 | 30218 | 56808 | -26590 | 253 |

| 11/11/2014 | 167364 | 29393 | 59067 | -29674 | -3084 |

*COT Report: The weekly commitment of traders report summarizes the total trader positions for open contracts in the futures trading markets. The CFTC categorizes trader positions according to commercial hedgers (traders who use futures contracts for hedging as part of the business), non-commercials (large traders who speculate to realize trading profits) and nonreportable traders (usually small traders/speculators).

The Commitment of Traders report is published every Friday by the Commodity Futures Trading Commission (CFTC) and shows futures positions data that was reported as of the previous Tuesday (3 days behind).

Each currency contract is a quote for that currency directly against the U.S. dollar, a net short amount of contracts means that more speculators are betting that currency to fall against the dollar and a net long position expect that currency to rise versus the dollar.