- Walmart CEO is more optimistic about spending patterns than he did 3 months ago

- The US dollar’s five-day rally halted as the Yen and Yuan rebound

- Fed could remain in hiking mode if economic resilience prevents inflation from coming down

Now that we heard from Walmart Inc (NYSE:WMT), it is clear that the US consumer is still willing to spend. Expectations for robust consumer spending in Q3 have been confirmed and that should keep growth estimates trending higher. With COVID savings still expected to be used over the next couple of months and a lag with how student debt repayments go, confidence in continued business momentum should remain. The Atlanta Fed’s estimate of 5.8% looks like it might actually happen, which should keep the Fed standing by its hawkish stance that they might need to do more tightening to combat inflation.

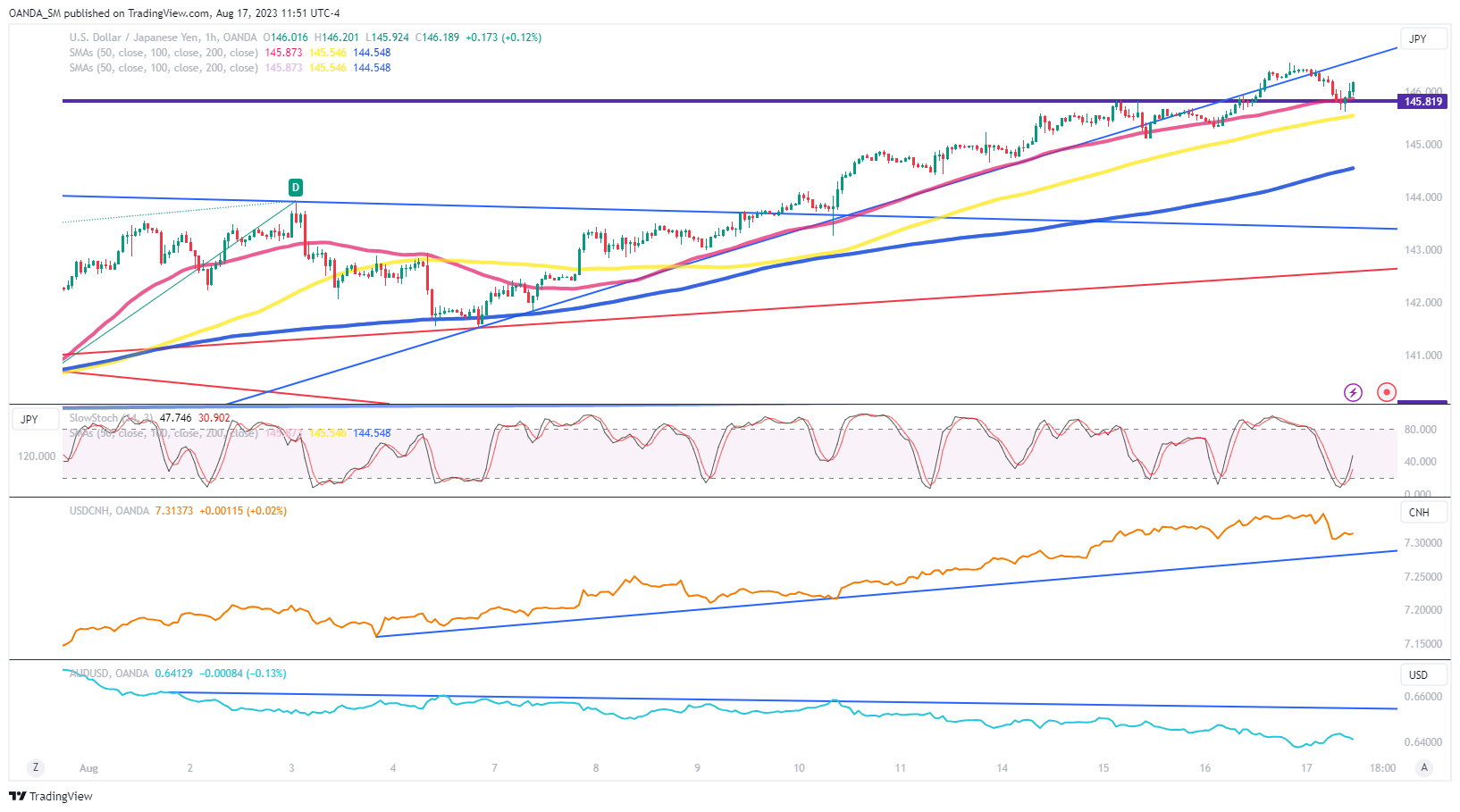

The US Dollar is seeing some profit-taking as the yen and yuan, each respectively stages a rebound. It might be hard for risk appetite to remain in place if the bond market selloff continues. With global yields at a 15-year high, that surely will feel like restrictive territory for the world. China remains in focus and the decision from authorities to tell state-owned banks to step up intervention efforts is providing some support to markets. It is clear that China is working on its response here and that more support is on its way.

Walmart

Walmart’s top and bottom earnings beats were accompanied by raised guidance, which made them have one of the top results among the retailers. It seems that Walmart is taking away business from Target too, with grocery and e-commerce sales leading the way. When the economy starts to cool in Q4, Walmart looks well-positioned to be one of the top retailers.

FX Snapshot

The AUD/USD declined after the unemployment rate rose more than expected. Labor market weakness should make the next RBA meeting easy as the economy is feeling the impacts of the RBA rate hiking cycle. The RBA will hold rates steady for a third straight time at the September policy meeting.

The Chinese Yuan rallied against the dollar after the PBOC asked state banks to intervene. The yuan was depreciating too quickly and authorities needed to boost sentiment.

Some traders are not expecting BOJ intervention until we see an excessive weakness that takes the dollar-yen possibly beyond the 150 level. We also need to hear Japanese officials state they are watching exchange rates with great interest. Japan will likely need to step into markets, but until we see further yen downside, traders might eye further dollar short-term strength.

Oil

After falling nearly six dollars, it was only a matter of time before crude prices found support. WTI Crude is rebounding on expectations that Chinese officials will deliver meaningful stimulus and that the oil market will remain tight. Earnings are also providing optimism that the US consumer is still strong and willing to spend and travel at the end of the year.

The dollar rally has stalled but if the bond market selloff falls to a new level, that could prevent commodities from rebounding further. Oil looks like it will find a home around the $80 level as too many risks to the outlook still remain on the table; fears that the Fed will overtighten are back and uncertainty persists on how will the US consumer behave once all their COVID savings disappear and as student loan debt bills come due.

Gold

Gold prices are trying to recover after some hawkish Fed Minutes kickstarted a global bond market selloff. Bond yields are too high as more people become convinced inflation is not going away anytime soon. After making a 5-month low, spot gold has fallen below the $1900 level. For the spot market, the $1870 level remains major support, as the $1900 level with the gold’s future contract appears to have solid support.

Bitcoin

It looks like some leveraged funds are ramping up bearish bets that Bitcoin will drift lower. The US Commodity and Futures Trading Commission’s (CFTC) report on commitment of traders (COT) showed that as of August 8th, two-thirds are bearish, most likely a result of disappointment with the delays in seeing a Bitcoin US ETF approved. When you throw in what is happening in the bond market, it becomes easy for Bitcoin prices to soften. If risk aversion becomes the dominant theme on Wall Street, Bitcoin’s bearish momentum could target the $27,200 level.