The U.S. economy continues to reflect signs of stabilizing after a months-long period of downshifting. The possibility of a firmer expansion can’t be ruled out, but there are few convincing signs at this point. What is clear: recession risk remains low, as it has been all along (unless you cherry picked an indicator or two). As outlined below, reviewing a broad-minded data set still shows that output is increasing at a moderate pace and near-term projections for the U.S. macro trend point to more of the same.

Despite recent volatility in some corners of the economy, the overall signal has been consistently biased toward growth, albeit at a softer rate in the second half of the year. As a result, arguing that a new NBER-defined recession is near hasn’t been supported by a diversified set of economic and financial metrics. Late last month, for instance, The Capital Spectator noted: “U.S. economic growth has slowed but signs that the macro trend is stabilizing suggest that the recent downshift won’t lead to a recession in the immediate future.”

The analysis remains valid today. Although output has weakened in the second half of the year, there are more signs that the slowdown of late has run its course. The bigger mystery is whether growth will strengthen in the months ahead. There are encouraging hints on that front, but it’ll take several more weeks at a minimum before an upgrade on the outlook becomes convincing from an econometric perspective.

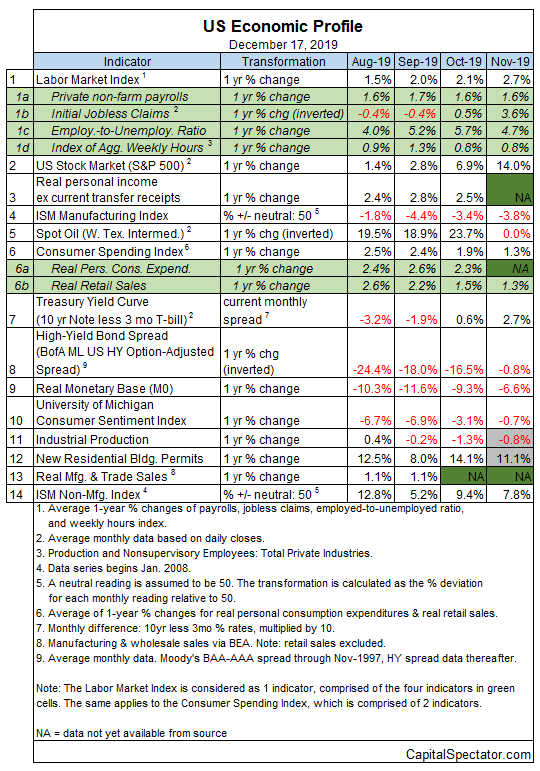

Meantime, it’s reassuring to see that the November profile of key economic and financial indicators to date shows no deterioration from October (see table below). As a result, the current expansion appears to be rolling on, based on the numbers published through Dec. 17. (For a more comprehensive review of the macro trend with weekly updates see The US Business Cycle Risk Report.)

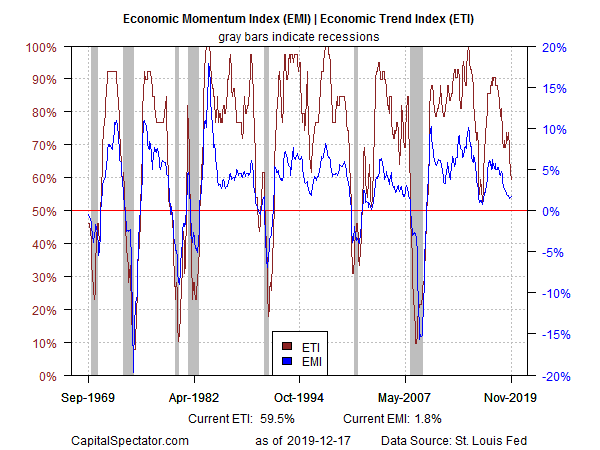

Aggregating the data in the table above provides context for interpreting the broad trend through time, as summarized in a pair of proprietary business-cycle benchmarks shown below. The Economic Momentum Index (EMI) continues to reflect a bias for stabilizing/rebounding by edging up to 1.8% in November — slightly above October’s print (blue line). That’s still close to the lowest level in three years but the recent decline appears to be steadying. By contrast, the Economic Trend Index (ETI) slipped again in November, dipping under 60% for the first time in several years (red line). Note, however, that both EMI and ETI are still above their respective tipping points that mark recession (50% for ETI and 0% for EMI). Critically, near-term projections for ETI (shown below) suggest that this indicator will join EMI and post a degree of stabilization in December and January. (For details on the design and interpretation of ETI and EMI, see my book on monitoring the business cycle.)

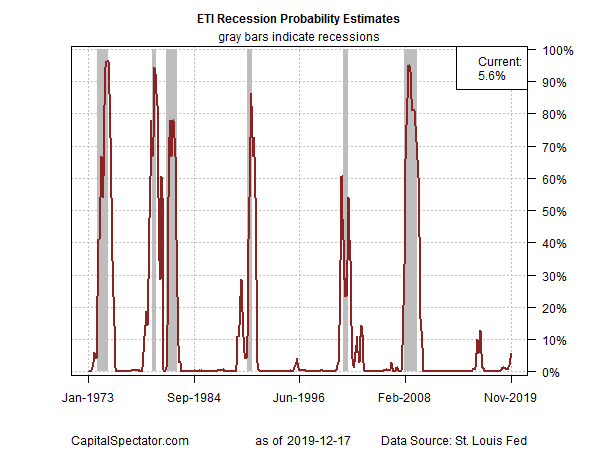

Despite recent hints of stabilization, recession risk has increased modestly in this year’s fourth quarter, although the rise remains marginal following a virtually nil reading. The methodology is based on translating ETI’s historical values into recession-risk probabilities with a probit model. Analysis through this lens indicates that the odds remain low that NBER will declare November as the start of a new recession.

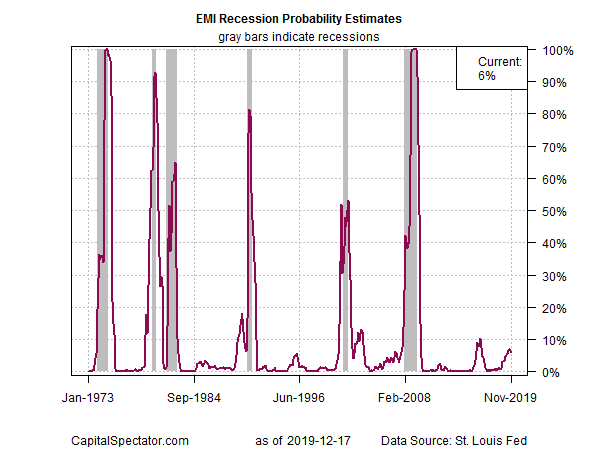

Note, too, that a probit-model reading of EMI also shows a relatively low probability (6%) that the economy was contracting last month. In fact, the latest estimate reflects a slight reduction in recession risk, which may anticipate a similar decline in the probit-modeling equivalent for ETI in next month’s update.

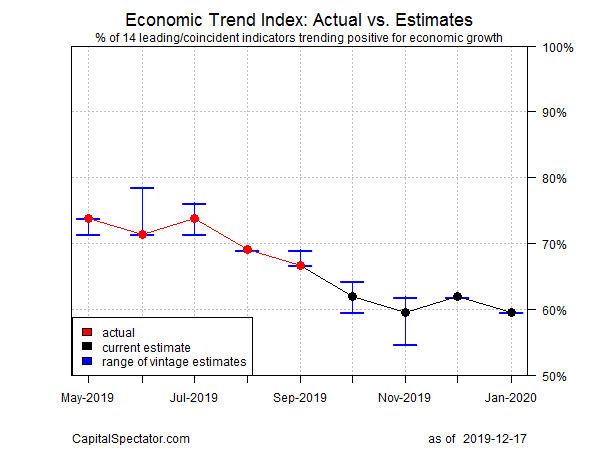

Now let’s consider how ETI may evolve as new data is published. One way to project values for this index is with an econometric technique known as an autoregressive integrated moving average (ARIMA) model, based on default calculations via the “forecast” package in R. The ARIMA model calculates the missing data points for each indicator for each month — in this case through January 2020. (Note that September 2019 is currently the latest month with a complete set of published data for ETI.) Based on today’s projections, ETI is expected to rise slightly in December and then pull back fractionally in January. Considering the November-through-January estimates overall suggests that the economic trend is stabilizing and will remain modestly above the critical 50% mark. A reading below 50% would indicate that NBER is likely to declare a month as the start of a recession.

Forecasts are always suspect, but recent projections of ETI for the near-term future have proven to be reliable guesstimates vs. the full set of published numbers that followed. That’s not surprising, given ETI’s design to capture the broad trend based across multiple indicators. Predicting individual components in isolation, by contrast, is subject to greater uncertainty. The assumption here is that while any one forecast for a given indicator will likely be wrong, the errors may cancel out to some degree by aggregating a broad set of predictions. That’s a reasonable view, based on the generally accurate historical record for the ETI forecasts in recent years.

The current projections (the four black dots in the chart immediately above) suggest that the economy will continue to expand through next month, albeit at a relatively slow pace. The chart also shows the range of vintage ETI projections published on these pages in previous months (blue bars), which you can compare with the actual data (red dots) that followed, based on the current list of published numbers.

For more perspective on the track record of the ETI forecasts, here are the vintage projections for the past three months:

Note: ETI is a diffusion index (i.e., an index that tracks the proportion of components with positive values) for the 14 leading/coincident indicators listed in the table above. ETI values reflect the 3-month average of the transformation rules defined in the table. EMI measures the same set of indicators/transformation rules based on the 3-month average of the median monthly percentage change for the 14 indicators. For purposes of filling in the missing data points in recent history and projecting ETI and EMI values, the missing data points are estimated with an ARIMA model.