Actionable ideas for the busy trader delivered daily right up front.

- Tuesday uncertain.

- ES pivot 1517.58. Breaking below is bearish.

- Rest of week bias uncertain technically.

- Monthly outlook: bias higher.

- ES Fantasy Trader standing aside.

Recap

Ah, this market simply continues to confound. Just when I thought my ascending triangle in the Dow had broken down, we get an 8 point up day on Friday. The "channeling" icon over there on the right has been up so long I think it's stuck. Now we have another holiday-shortened week to contemplate.

Oh, and lest I forget, let me point out that the Night Owl turned three yesterday. I can't believe it's been that long already. Many thanks to all my readers for continuing to tune in to the late-nite rantings emanating from my fevered brain. So let's see what we can do now with Tuesday.

The technicals (daily)

The Dow: Foo - we continue to be stymied by 14,013 on the top and supported around 13,970 from below. We now have two hanging-man type candles in a row, but in the absence of a preceding trend, they don't mean much. In fact, I'm not getting any sort of read off this chart, so I moved out to the weekly chart. There, we find that we have two dojis in a row, we're quite overbought and have exited a weekly rising RTC, so that's all looking rather bearish.

The VIX: The VIX continues to be stuck in the toilet, closing just under its support line of 12.5 on Friday with a star. But the lower BB continues to fall away, now down to 11.85 and we remain in a descending RTC, though it is admittedly fairly wide with a Pearson's of just 0.793. Still, I see nothing here to suggest a big pop in the VIX on Tuesday.

Market index futures:Tonight all three futures are higher at 1:33 AM EST with ES up by 0.07%. There continues to be really nothing going on here. We've got five straight sideways candles now. The only real effect is to inch use closer to the edge of the rising RTC. I 'm running two of these channels right now, one from 2.4 and the other, longer trend from 1/8. We've actually now exited the shorter one for a bearish setup there but remain inside the longer one. Overall though, I'm not seeing much on this chart.

ES daily pivot: Tonight the pivot inches up from 1516.42 to 1517.58. But the overnight action so far is enough to keep us just barely above the new number, so we'll have to watch for a break under on Tuesday - that would be bearish.

Dollar index:I called for a lower dollar on Friday. What we got was a fat little spinning top almost identical to Thursday's but sitting in a dark cloud configuration near the upper BB. So there's a suggestion of a move lower on Tuesday, but nothing really definitive.

Euro: The euro continues to find buyers at 1.3326 and has now given us three dojis in a row as it trades mostly just sideways. Even in the Monday overnight, it's up all of 0.01%. Absolutely no guidance here either.

Transportation:On Friday the trans gave us a tall spindly doji but it remained it the rising RTC. But with RSI now up to 93, there's at least a hint of a reversal here. On the other hand, momentum has been quite strong all year so far, so I'm not giving much credence to these sorts of indications at the moment. I've said it before and I say it again - show me the top.

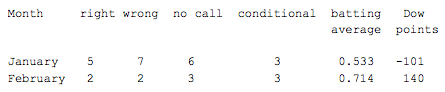

Accuracy (daily calls):

And the winner is...

These charts are literally putting me to sleep. It just looks like we continue to remain stuck in this holding pattern with very little indication of wanting to move either way. About all I can make of this is that this sideways motion will continue until it ends and therefore all I can do is call Tuesday uncertain. If we break convincingly below the ES pivot by morning, that increases the odds of a lower close.