Last week ended with a fresh bout of risk aversion in the market, with the safe-haven U.S. dollar benefitting from fragile global risk factors and fears over Federal Reserve tightening including rising rate hike odds.

This week brings high-profile event risks such as the Federal Reserve rate decision (Wednesday), followed by the Bank of England decision (Thursday). While the BoE is expected to leave its stimulus package in place amid a slowing economy, the Fed will probably hint that it is moving towards tapering monthly asset purchases and may make a formal announcement in November.

Most economists expect the Fed to start tapering in December. A first rate hike is expected in the second half of 2023, followed by three more in 2024 according to a survey. The much-watched “dot plot” of rate forecasts will include 2024 for the first time and will thus be the big story on Wednesday.

Elevated Fed rate hike odds have produced a more favorable trading environment for the greenback and if the Fed dots surprise to the hawkish side, dollar bulls will have room to price in a more hawkish Fed.

EUR/USD

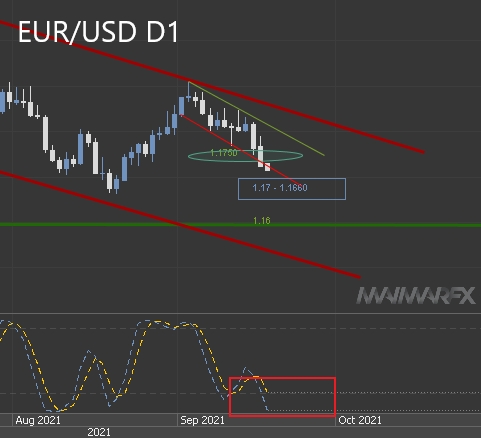

There is not much positive to report amid the euro’s clear bear trend. From a fundamental perspective, the common currency faces further downside risks in the coming days such as monetary policy decisions and their impact on the euro’s counterparts, as well as Sunday’s German Federal Election.

Technically, the risk is tilted to the downside but there is a crucial support zone ranging from 1.17 to 1.1660 which could halt the euro’s fall—at least in the short-term. Additionally, the pair approaches oversold territory, making small rebounds more likely. On the upside, we see a short-term resistance at 1.18. However, if 1.1650 breaks to the downside, lower supports come in at 1.16 and 1.1530.

DAX

The sell-off accelerates. Last Thursday we prepared traders for upcoming breakouts and we got what we have been looking for—much to the pleasure of the bears. This morning we see the index extending its slide towards 15300 while it slid in the meantime even below 15150. As long as 15000 remains unbroken, we could see some reversal towards 15700 but we bear in mind that political risk could weigh on the index.

Disclaimer: All trading ideas and expressions of opinion made in the articles are the personal opinion and assumption of MaiMarFX traders. They are not meant to be a solicitation or recommendation to buy or sell a specific financial instrument.