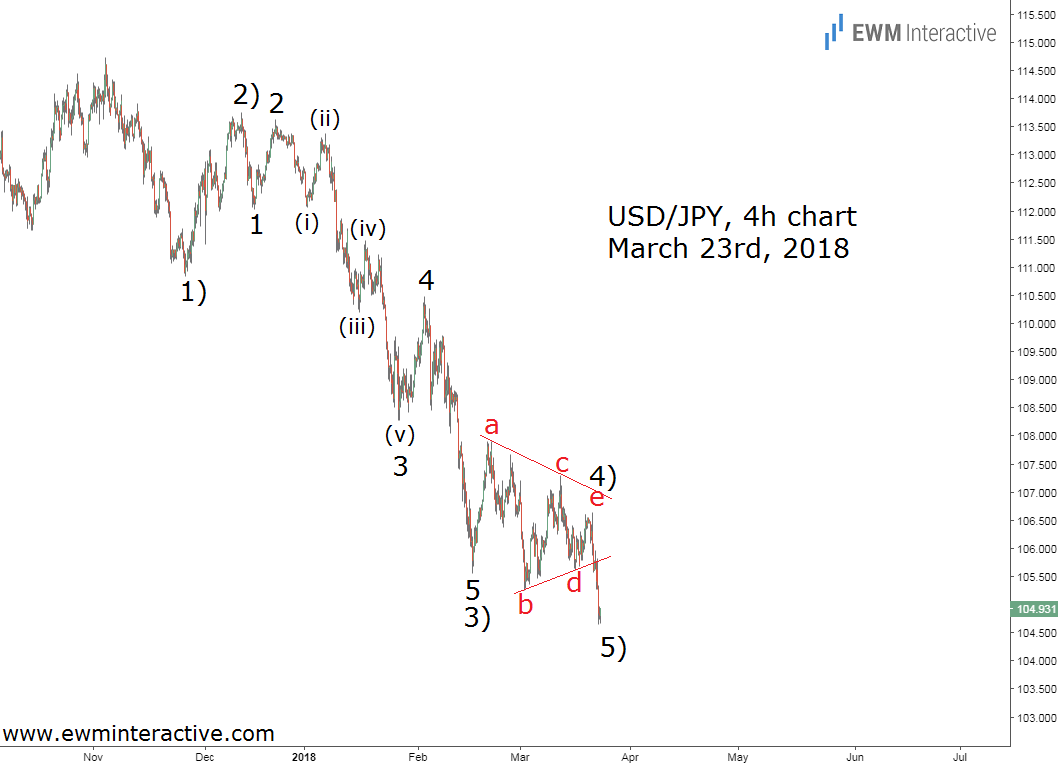

USD/JPY bulls looked like they were up to something, when the pair climbed to 106.61 on Tuesday. Three days later today, the pair is currently hovering at 104.90 after a 200-pip plunge to 104.64.

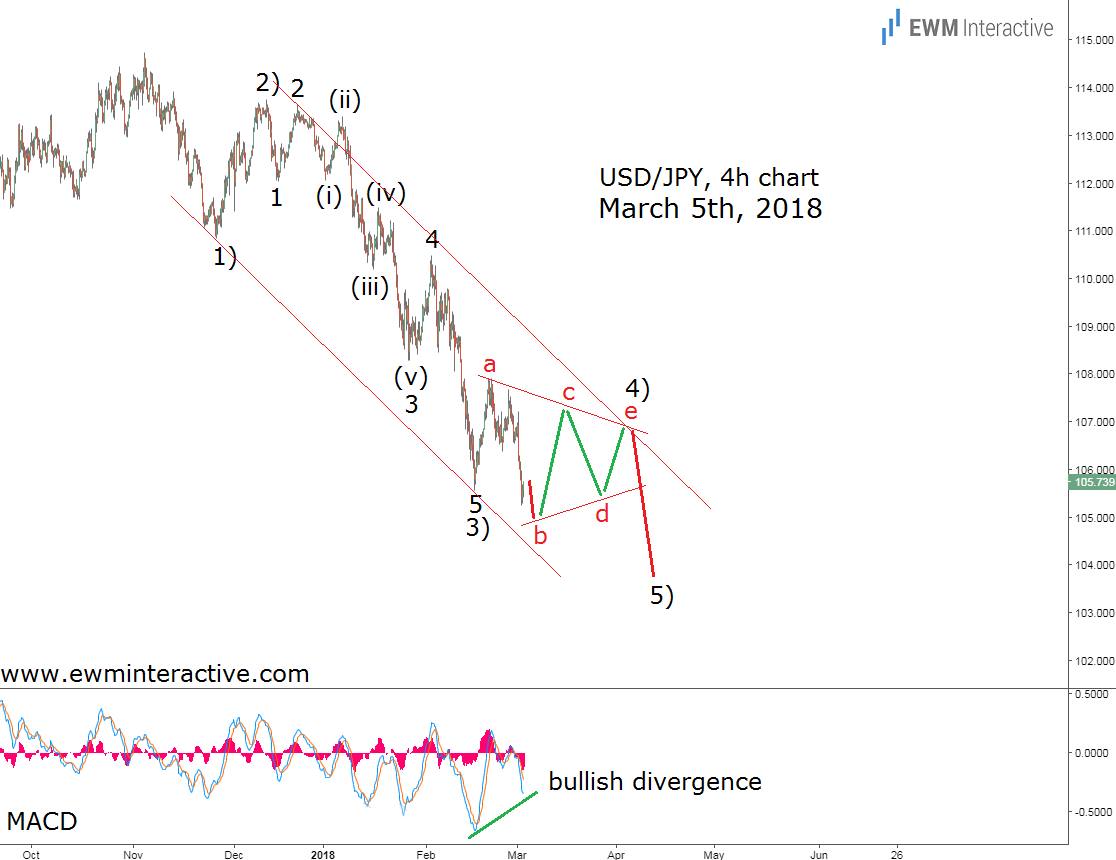

Conventional wisdom suggests traders should look no further than the looming US-China trade war to explain the Japanese yen’s strength against the greenback. The Elliott Wave Principle, on the other hand, makes us think USD/JPY was poised to decline with or without Trump’s tariffs and China’s counter measures. The chart below, sent to clients three trading weeks ago, before the open on March 5th, proves the pair was headed down anyway. Not right away, though.

The 4-hour chart of USD/JPY allowed to take a look at the structure of the entire decline from 114.73. It led us to conclude that we have seen the first three waves – 1)-2)-3) – of a larger five-wave impulse to the south. The rule of alternation suggested that a sideways correction in wave 4) was going to develop, before the bears return in wave 5) down. That is why we decided not to sell right away near 105.70 and wait for the pattern to fully develop instead. By the time we had to send Wednesday’s updates to clients on March 21st, the bears were already eager to return.

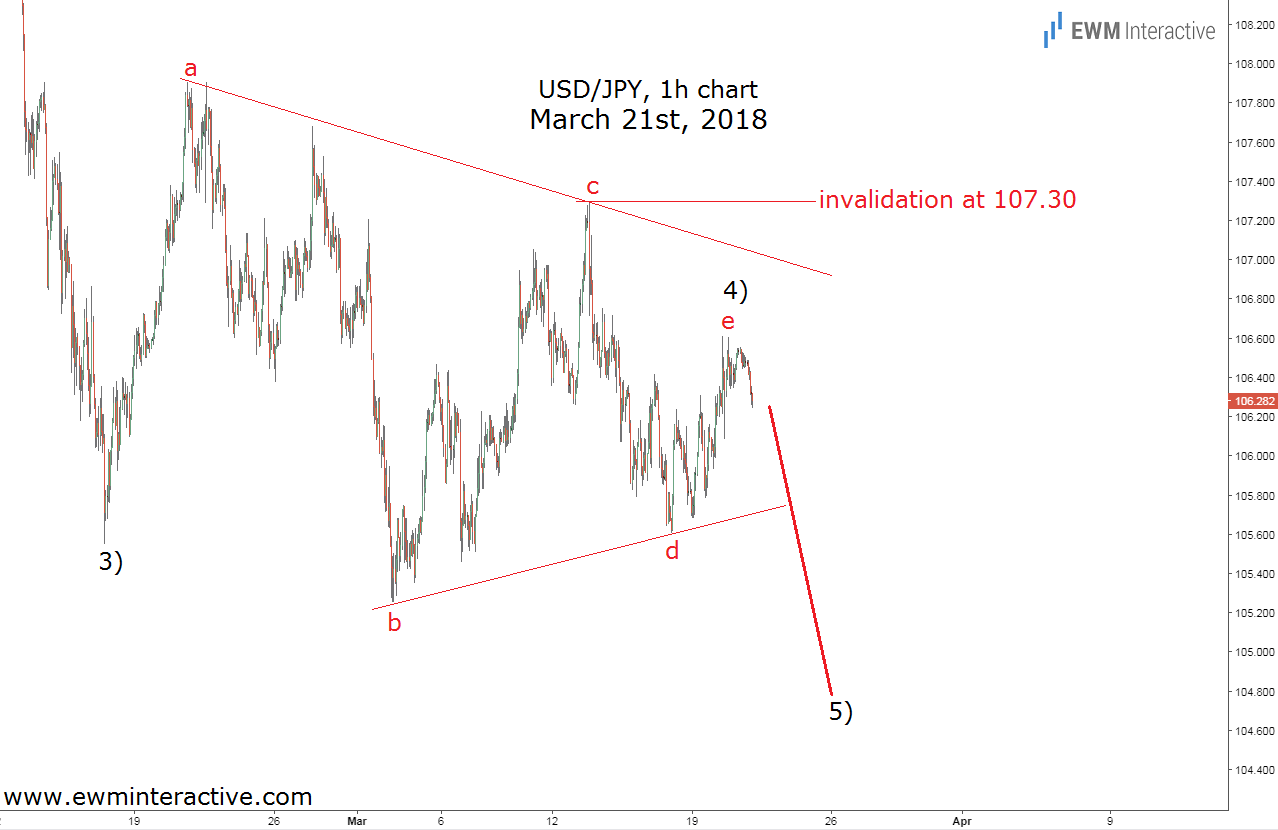

Despite USD/JPY not being able to even come close to the upper line of the pattern, this is almost a perfect triangle correction. It also provided a specific stop-loss level for the short positions, because in order for the negative outlook to survive, the top of wave “c” of 4) at 107.30 had to remain intact. Two days later, the updated chart below visualizes the U.S. dollar’s fall against the Yen.

In that case, Elliott Wave analysis not only helped traders prepare for an entire pattern and its consequences, but also saved them the trouble to anticipate and interpret geopolitical news and events – a task that is getting more difficult with every day that passes in the Trump era. But if the mainstream media uses the trade war to justify USD/JPY’s decline, one must be wondering how is it going to explain the pair’s next move?