Here are the Rest of the Top 10:

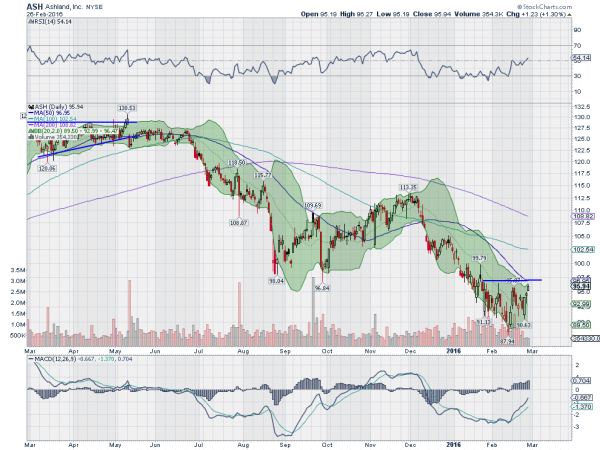

Ashland Inc (N:ASH)

Ashland, ASH, has been in a downtrend since the beginning of December. That morphed into consolidation at the end of January as it bounced along under resistance. With the bottom in mid February it is back at resistance coming into the week. Momentum is building as the RSI is rising and near the bullish zone while the MACD is rising. Watch for a push through resistance to participate in a new leg higher.

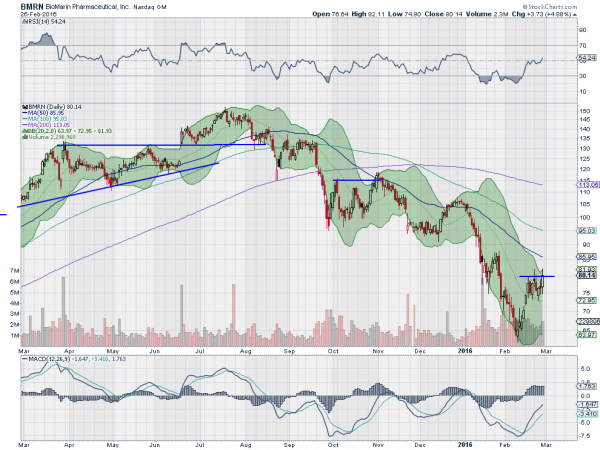

Biomarin Pharmaceutical Inc (O:BMRN)

BioMarin Pharmaceuticals, BMRN, has been trending lower since July in a series of steps. The recent bounce though is making it attractive to look at for a short term (at least) reversal higher. Consolidating the move with a rising RSI and MACD it has momentum on its side to continue through the consolidation higher. Look to participate if it does.

Capital One Financial Corporation (N:COF)

Capital One, COF, fell on volume in July but then consolidated for several months. In December it started lower again though, reaching a bottom in late January. It retested that bottom, for a double bottom, and is now finding resistance at the gap from the start of the year. The RSI is rising and near a turn into the bullish zone, with the MACD rising as well. These support more upside. Look for a push through resistance to participate higher.

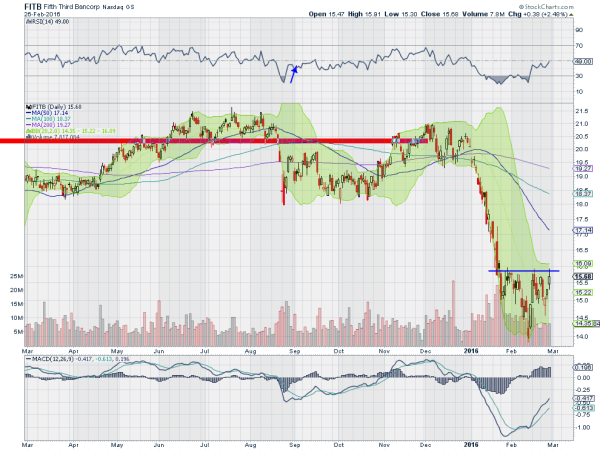

Fifth Third Bancorp (O:FITB)

Fifth Third, FITB, fell from consolidation to start the year, eventually losing over a third of its market cap in 6 weeks. It has bounced along since finding that bottom with resistance sitting just below 16. The RSI is rising and moving toward the bullish zone, while the MACD is bullish and rising. Look for a break of resistance to the upside to participate in the move.

Tyco International PLC (N:TYC)

Tyco, TYC, started higher in July 2011. But that ended June 2014 when it started the recent down move. That found a bottom in late January and a strong bounce in a gap move higher. The price action since has been consolidation, until the price broke higher Friday. The RSI is in the bullish zone and the MACD is turning back up for a cross, both supporting more upside. Consider adding this stock as long as it holds that break out level.

After reviewing over 1,000 charts, I have found some good setups for the week. These were selected and should be viewed in the context of the broad Market Macro picture reviewed Friday which with just a Leap Day left in February sees the Equity markets looking ready to spring higher.

Elsewhere look for Gold to continue to consolidate in its uptrend while Crude Oil consolidates the recent move higher. The US Dollar Index also looks to continue to move sideways but with an upward bias short term while US Treasuries are showing signs of topping in their uptrend. The Shanghai Composite seems ready for more downside, at least in the short term, while Emerging Markets are biased to the upside next week.

Volatility looks to continue the move lower towards normal levels easing the pressure for the equity index ETF’s SPY (N:SPY), IWM and QQQ. Their charts all look better to the upside in the short term, with very constructive movement higher out of the 2016 range for the SPY and IWM. The QQ lags behind but only just slightly. Use this information as you prepare for the coming week and trad’em well.

DISCLAIMER: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.