Technical Outlook:

- SPX had its first 3-day pullback since September and the first of this rally.

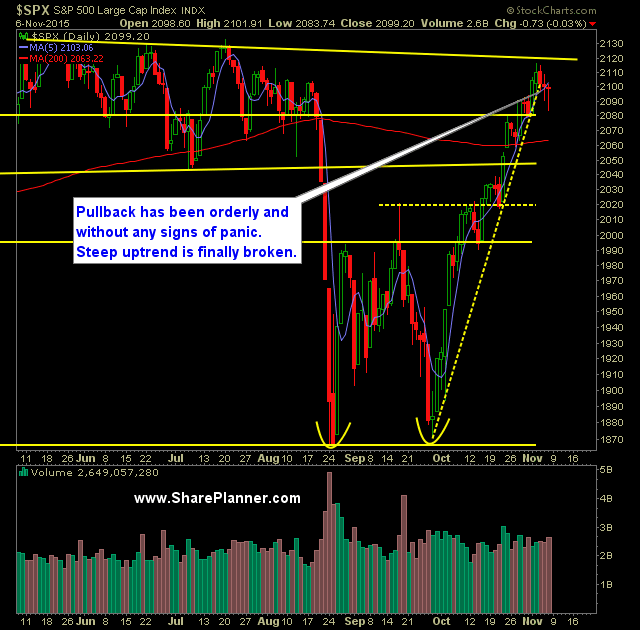

- Unlike previous sell-offs, the 10-day moving average did break intraday. But like the October rally has done, it managed to close above it by the end of day.

- Volume saw a noticeable uptick on Friday, due mainly to the jobs report influence on the huge beat of expectations.

- As a result of the jobs report, the market is acting fairly certain that there will be a rate hike in December.

- 30 minute chart continues to show that the existing uptrend in the market is still in place with a recent pullback to support in the 2080's.

- Declining resistance off of the May highs at 2119-2120 continues to play as a force in this market. So far, price has been unable to break through this.

- RUT continues to lag the overall market rally, but is showing a very strong breakout pattern that is unfolding right now.

- Despite the sell-off of three straight days on SPX, the VIX has continued to drop for the second straight day - this time down 4.8% to 14.33.

- T2108 (% of stocks trading above their 40-day moving average) is still trading range bound and is resting at 62%.

- I still maintain, that it will be difficult to see any sizable pullback in SPX until VIX gets back down into the 11-12 area - this has been the area, where historically, the indicator has bounced hard off of.

- While it would make sense to see the market pullback here, it doesn't have to, and don't think that you can force the market to do so either. Loading up on short positions is like trying to stand in front of a locomotive, and expecting it to stop in time.

- SPX has been overbought for almost a month now, which goes on to justify that the market can remain overbought longer than you can remain solvent.

- Look for the 200-day moving average to offer a strong level of support going forward.

- Seasonally, this is the strongest time for the stock market, so a major rally like what we are seeing is no big surprise and not at all uncommon.

My Trades:

- Did not add any new positions on Friday.

- Did not close out any positions Friday.

- 70% Long / 30% Cash

- Remain long: O:AAPL at $116.98, O:AAL at $46.02, N:CRM at $79.25, N:FDX at $157.91, N:PAY at $30.77, N:IWM at $118.08, N:XLF at $24.44.

- May add one additional position, but could also curb long exposure today depending on market action.

Chart for SPX: