Foreign currencies – especially the Emerging Markets – are having one of their worst years on record.

And investor anxieties aren’t easing up. . .

I wrote two weeks ago about the strong dollar and the chaos it’s creating for the Emerging Markets. But many don’t realize just how bad things have gotten. And it’s all thanks to the Federal Reserve’s tightening and quantitative tightening.

For starters, let’s just take a look at some of the worse performing currencies this year. . .

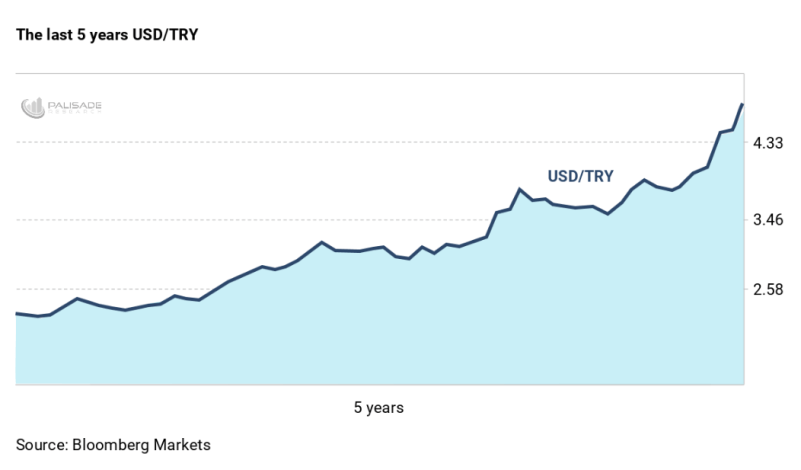

First – The Turkish Lira

I wrote a very bearish assessment of Turkey and their currency – the Lira – back in early March.

And since then, the crisis in Turkey has dominated the news stream.

A big reason for Turkey’s currency crisis stems from the fact that their external debt burden has soared over the last few years. This means that Turkey borrowed significant amounts of U.S. dollar denominated debts (and euros).

Remember: when the dollar gets stronger – and when the Federal Reserve raises rates – the external debt burden gets harder to service.

And because the country has had a plaguing inflation problem over the last couple of years – this caused the Lira to slowly depreciate on foreign exchange markets.

But due to the U.S. dollar’s shocking rally since March 2018, the Lira really started to collapse. For instance, more than a third of its value got wiped out in just the last 30 days.

Making matters worse – the Turkish Central Bank Deputy Governor is rumored to resign. And Moody’s just downgraded the credit ratings of 20 Turkish financial institutions – such as banks.

Turkey’s increasingly fragile economy and currency signals that things are still far from over. . .

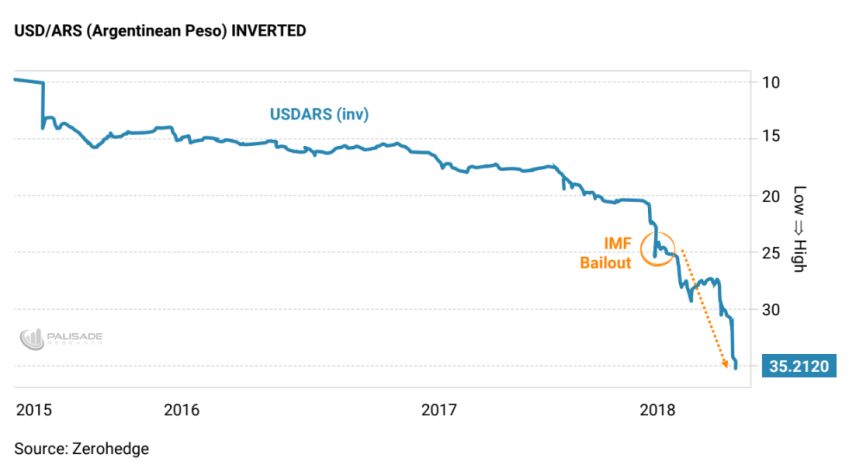

Second – The Argentine Peso

Argentina has seen their Peso really suffer this year – hitting record lows. It’s down more than 45% since 2018 began.

And throughout the last few months, investors continue dumping Pesos. They believe that Latin America’s third largest economy will probably default (making it the third time since 2000) amid a slowing economy, soaring inflation, and crushing debts.

Just like Turkey, the government’s borrowed significant amounts of debt throughout the years – most being dollar denominated. And the country’s annual inflation is well-above 25%.

The Argentine Central Bank raised interest rates to 60% – the highest in the world – to try and prevent further damage. But this will no doubt send their economy spiraling into a recession.

Actually, things were so bad that the International Monetary Fund (IMF) gave Argentina a record-breaking $50 billion bailout in early June.

But it did nothing in terms of saving the Peso. . .

And as things continue worsening – the Argentine government today asked the IMF for another loan (less than three months since the last one).

I have serious doubts that another bailout from the IMF will make anything better. . .

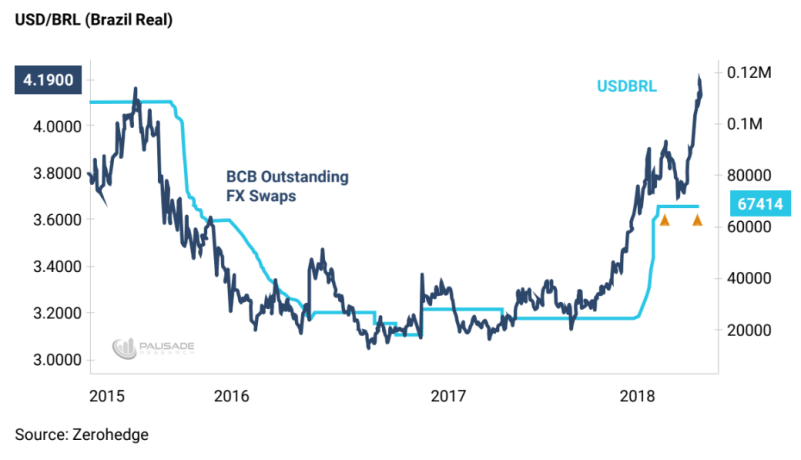

Third – The Brazil Real

The fears of Turkey and Argentina are causing a domino effect – known as ‘contagion’. . .

Meaning: as investors fear the collapsing currencies, they start to avoid similar countries in fear they could be next.

This ‘contagion’ causes investors to rotate out of other Emerging Markets and into safer options – like the U.S. Dollar.

The avoidance and heavy selling puts pressure on other Emerging Markets – even the ones without any problems – which eventually causes a currency crisis for them.

And this perception-driven-crisis (like a self-fulfilling prophecy) is known as the Theory of Reflexivity. A term created by International trader George Soros – a well known currency speculator.

That’s what is happening to Brazil and their currency – the Real.

The strong dollar, contagion fears, heavy debt burdens, and political chaos has been the perfect storm for Brazil and the Real.

Brazil’s Central Bank (BCB) just intervened again for the first time since late June. This was an attempt to try and save the currency – which is nearing record lows.

Expect things to further worsen for Brazil and their currency. . .

Other countries and their currencies – like the Thai Baht and South African Rand – are also performing very poorly.

Although the Emerging Markets have done this to themselves with their rampant dollar-denominated debt gorging over the last several years – the Federal Reserve’s to blame.

As investors have been yield starved via the Fed’s post-2008 ZIRP (zero interest rate policy), they were forced to invest elsewhere to make increased returns. This is what investors took as a “risk on” signal – i.e. look at riskier investments for higher returns, such as Emerging Markets.

This – plus the $4.3 trillion printed by the Fed via Quantitative Easing (QE) – caused huge amounts of capital to pour into the Emerging Markets – lifting their currencies in the process.

The governments of these countries were also able to take advantage of the hungry investor appetites. They borrowed significant amounts of external debt at very low rates.

But since the Federal Reserve began tightening in December 2015 with their first-rate hike (even though the first true tightening was the ‘Taper Tantrum’ in mid 2014), investors took this as a hint that the “risk on” trade was ending.

And as soon as the Fed raised rates to a meaningful level – over 2% – in 2018, investors began pulling their money out of the Emerging Markets and into safer U.S. treasuries. This capital outflow has really damaged the Emerging Markets – putting them into a ‘reflexive’ spiral downwards.

So, until the Fed reverses their tightening path – expect the dollar to stay strong, and for the Emerging Markets and their currencies to continue suffering.

I don’t expect this reversal to happen until the U.S. growth turns negative – or simply weakens. The earliest being December 2018.

Don’t get me wrong – the U.S. is very fragile with the massive amounts of debt in private sectors. Such as auto, student, and mortgages. And the Treasury is running deficits not seen since the 2008 recession years.

But as usual, the dollar is the “prettiest mare in the slaughterhouse.”

Until otherwise, beware “risk on” trades.