- AUD/USD gains 0.4% to close US$0.7650

- ASX SPI Futures +15 points to 5498, IG’s Australia Cash +0.2% to 5548

- China CPI and PPI to be released today at 11:30 am

- Australia NAB Business Conditions and Business Confidence released at 11:30 am

- WTI oil rallied 2.6% overnight on news of a September OPEC meeting

- Spain 10-Year bond yields drop below 1% for the first time ever as ECB bond buying steps up

- Bloomberg Commodity index +0.6%, Qingdao Iron Ore +1.4%, Copper +0.3%

- Cochlear Ltd (AX:COH), Transurban Group (AX:TCL), Carsales.Com Ltd (AX:CAR), Ioof Holdings Ltd (AX:IFL), and REA Group (REA) are all set to report earnings today. With ANZ providing a 3Q trading update.

US markets pulled back from all-time highs overnight despite European markets continuing to push higher. US healthcare stocks had the biggest fall with the sector losing 1.1% overnight. But the main global macro story at the moment is the ongoing resurgence in the commodity complex. Despite another 0.2% gain in the DXY US dollar index overnight, commodities as a whole continued to gain with the Bloomberg commodity index closing up 0.6%.

News that OPEC would be having a September meeting with certain members keen to push for supply cuts again served as the impetus for oil prices to rally. While a deal is highly unlikely to eventuate, the fact that it is even being mentioned shows how much difficulty the past month’s renewed selloff was causing many struggling OPEC members.

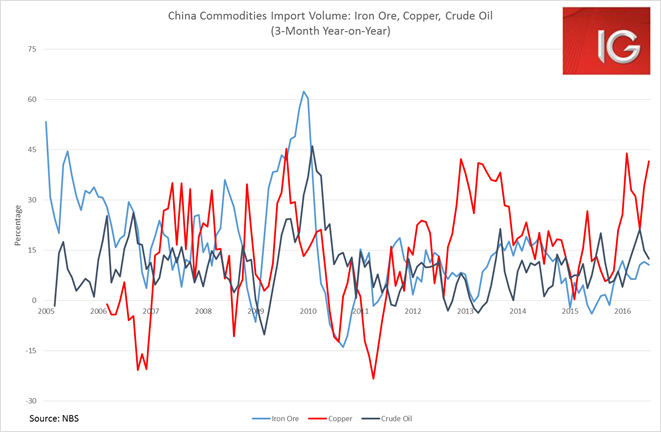

China’s July trade data released yesterday further underscored the improved global demand for commodities. The volume of copper and iron ore imports continued to grow at strong levels in July, with China importing the largest monthly volume of iron ore so far in 2016.

Chinese commodity futures also saw dramatic gains yesterday as the local Shanxi branch of the China Banking Regulatory Committee (CBRC) decided to extend the maturity of US$60 billion worth of loans to the province’s seven largest coal miners. While China continues to talk up supply-side reforms and cutting over-capacity industries, these goals often run into problems at the local level when certain provinces are almost wholly dependent on over-capacity industries for their survival. 2016 has so far seen a dramatic influx of capital back into the very industries that the Chinese economic wonks in central government and a number central-oriented think tanks would like to see curtailed.

Commodities have been a major beneficiary of this leniency to China’s over-capacity secondary sector so far this year. And the moves being seen in a range of Chinese commodity futures as well as notable pickups in the Caixin Manufacturing PMI and MNI Consumer Confidence Index look to be giving an early lead on another round of 3Q fiscal support by China. And no doubt, today’s CPI and PPI numbers will be carefully analysed today for further evidence of this as well.

With Japan committing to aggressive fiscal stimulus, the UK likely to announce a major fiscal package at the “Autumn Statement” and the potential for the EU to look into fiscal measures as well, now does not seem like a good time to be betting against commodity prices or commodity-related firms.

And this is the main reason why the Aussie dollar may continue to push back towards US$0.78, despite the prospect of further rate cuts and relative strength in the US dollar.

The negative close in US equities has not provided a strong lead for the Asian session. But the materials and energy sector look set for a strong day. Some further weakness in the yen may help Japanese equities today. While the ASX looks like it will open higher, primarily buoyed by commodities-related firms and the banks.