Last month, one of the most storied airline brands faded away.

An overnight flight from San Francisco to Philadelphia marked the last-ever departure under the U.S. Airways name. Soon, the carrier’s merger with American Airlines will be complete, leaving us with just four major airlines in the U.S.

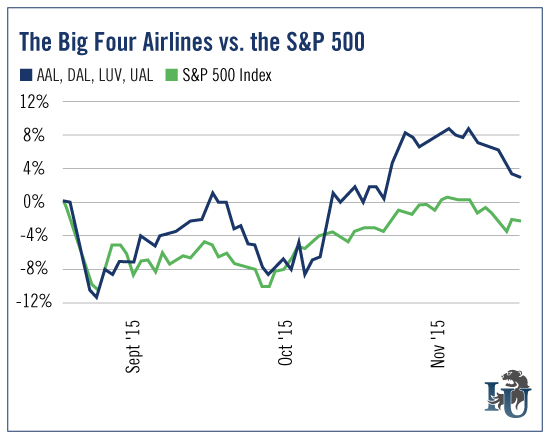

So what does it mean for the airline industry? Are they in trouble, or is this a turning point? This week’s chart holds the answer...

It looks at how the major airlines in the U.S., as a whole, have performed against the S&P 500 over the last three months. As you can see, 2015 is turning out to be a positive year for the industry.

There are four reasons for this...

- Airlines are finally enjoying the benefits of years of cost-cutting.

- The industry is benefiting from improved aircraft efficiency and falling oil prices.

- Passenger numbers are on the rise as improving unemployment rates have given many families more spending power.

- Airlines are pocketing more revenue than ever from passenger fees.

That last point may irk you as a passenger, but it’s great news for airline investors. By the end of 2015, the world’s airlines are expected to collect $59.2 billion in passenger fees, an 18% increase over last year.

Global airlines project net profits of $29.3 billion in 2015 - nearly double that of 2014.

Of course, many still face an uphill battle and slim profit margins. But one region that is performing very well is North America. Over half of the global profits are expected to be generated by airlines based here ($15.7 billion).

Clearly the industry is gaining strength. However, it may still be a little too early to hang your hat on just one company. Instead, consider riding the trend with the US Global Jets (N:JETS). It holds 33 total securities with double-digit allocations going to the four major airlines in the U.S.

That’s Southwest Airlines Company (N:LUV))... American Airlines Group (O:AAL)... Delta Air Lines Inc (N:DAL)... and United Continental Holdings Inc (N:UAL)

As a result, this specialty ETF shot up 10.5% in October.

While it is unclear what could happen next with the industry, this ETF covers you across the board. Its concentration on airlines based in North America makes Global Jets a relatively safe way to invest in this volatile industry.