With the markets off to a hot start so far this year, it’s only natural to think things might get a little toppy. I get it—and the truth is, this market is not without the risk of a short-term pullback.

Here’s the good news: if this possibility has you worried, there are a few closed-end funds (CEFs) out there that are perfectly designed for this risk. And they’re trading at attractive valuations while paying big dividends, too.

We’ll delve into one particular ticker a little further on. It’s a “goldilocks” fund that yields a steady 7.3% and charts a steady course through any volatility we might hit in the near term.

First, though, let’s talk about the risk of a pullback and how these funds are ready to respond.

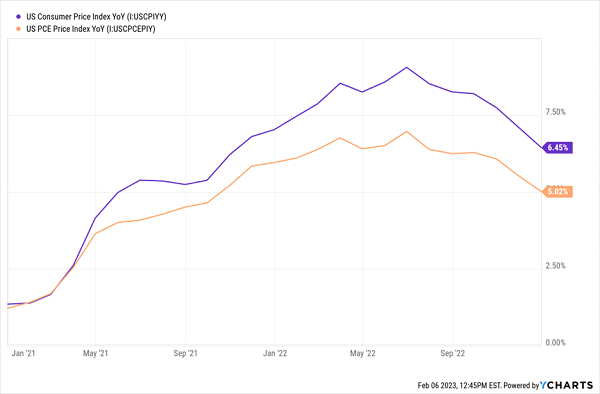

A lot of things are driving markets up now. For one, the economy is faring much better than we feared. Second, inflation, as measured by the consumer price index (CPI) and the Fed’s preferred Personal Consumption Expenditures (PCE) price index, is falling.

Further, China’s reopening may mean the pandemic disruptions are finally over. And stocks, always looking to the future, are pricing that in.

Inflation Falloff Drives Markets Higher

Since vaccines were starting to get shipped in early 2021, bringing in the beginning of the end of the pandemic’s most disruptive phase, GDP has soared as economic activity recovered, driving unemployment lower. But the cost was higher than inflation.

For a while, markets have found the waves of seemingly contradictory data we’ve seen over the last couple of years confusing. After all, modern stock markets have never had to deal with a global pandemic (stocks were too niche and economically unimportant during the Spanish flu of 1917).

More recently, more research has helped economists, hedge-fund managers, and everyday traders understand what this data means. The upshot is that the economy is growing quickly because more people are working and spending, and this demand caused price growth to skyrocket.

Determined Fed Could Cap Stock Gains

This brings us to today. Consumer demand is still high, but companies are finally adapting, helping ease inflation pressures. But we aren’t entirely out of the woods because we still have the Federal Reserve to worry about. If inflation doesn’t keep falling fast enough to ease the Fed’s worries, January’s gains could reverse. Powell’s tough talk at his last presser, emphasizing that the Fed will have to keep rates higher for a significant period, underscores that point.

Covered-Call CEFs Work Well for Markets Like This One

When markets are rallying, your best bet is to be fully invested in discounted CEFs with high-quality assets that have been oversold.

However, if you’re still feeling a bit nervous holding a “pure” stock CEF, consider one that uses a covered-call strategy. (This involves the fund’s managers selling the option to buy the fund’s holdings at a future date and price. The fund keeps the fee it charges, called a “premium,” no matter what happens).

These funds are smart buys in times of short-term volatility for three reasons.

- They don’t employ underperforming long-short strategies that are expensive to maintain.

- They don’t go into cash anticipating market downturns, which often results in the fund sitting out too long when downturns suddenly reverse.

- Their covered-call strategy keeps you fully invested for long-term gains (and dividends). This approach also works best in times of volatility, generating extra cash for the fund to support the dividend.

So if the Fed overdoes it this time, a sudden burst of volatility could help these funds rise significantly while making their income streams more sustainable than ever.

There are a lot of funds out there that use this strategy, but the Nuveen S&P 500 Buy-Write Income Fund (NYSE:BXMX) is a good way to go if you want to benefit from covered calls while sticking to blue-chip stocks. SPXX yields 7.3% today, and as the name suggests, it owns the full S&P 500, so you’re getting exposure to familiar large-cap names like Microsoft (NASDAQ:MSFT), Johnson & Johnson (NYSE:JNJ), and UnitedHealth Group (NYSE:UNH).

SPXX operates kind of like an index fund (which is great for the long term), but it also sells call options on its portfolio so that it can pass over the premiums from those options to you, the shareholder. The fund does trade at a slight (2%) premium to NAV, which is more than fair because it traded at a 16% premium in late 2022 as the selloff hit its crescendo.

As an added bonus, SPXX’s sold options increase its cash holding, protecting the overall value of the portfolio during short-term dips in the market, making it an ideal hedge if Powell ruins the party.

Disclosure: Brett Owens and Michael Foster are contrarian income investors who look for undervalued stocks/funds across the U.S. markets. Click here to learn how to profit from their strategies in the latest report, "7 Great Dividend Growth Stocks for a Secure Retirement."