Worried about a recession? Two thoughts:

- I don’t blame you.

- Consider this recession-resistant REIT (real estate investment trust), poised to rally on an economic slump.

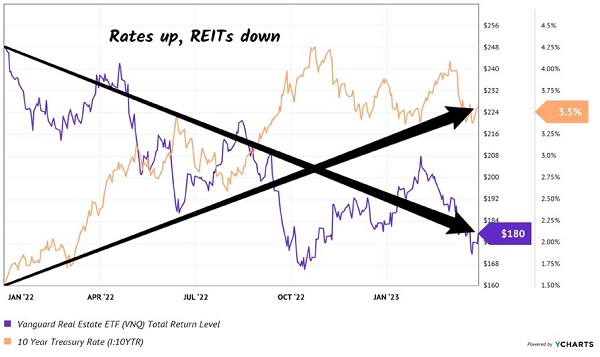

Why rally? Well, interest rates and REITs tend to seesaw. When rates rise, REITs fall. At least that’s the conventional wisdom.

In recessions, interest rates fall. Normally bullish for REITs—consider them a “second-level” bet on a bond bounce.

REITs, after all, are the bond proxies of the stock world. Investors buy them for their yields. That’s why we like them here at Contrarian Outlook.

It’s part of the REIT special sauce. As long as they dish most of their profits (90%+) as dividends, they pay no corporate taxes. Good riddance, double taxation of dividends!

It’s been a rough ride for the sector lately to say the least. Since the start of 2022, the Vanguard Real Estate Index Fund ETF Shares (NYSE:VNQ) is down 28%—even after accounting for dividends. Yikes!

REITs Down 28% as Rates Rise

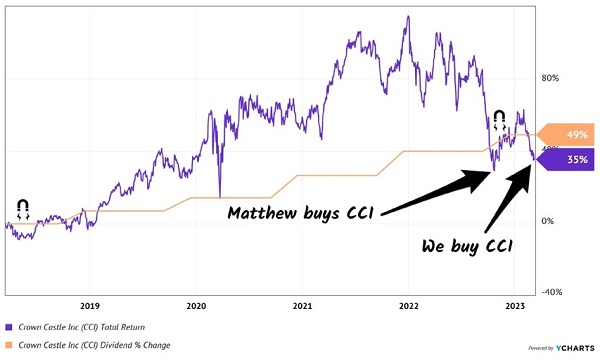

This action is perfect for us. We’re not too proud to dumpster dive for discarded dividends! Let’s buy the freaking dip—like executive Matthew, who recently plunked down a $123,874 bet.

Yup, that’s right. A few months back, Matthew Thorton III invested $123,874 into a stock he knows well—Crown Castle (NYSE:CCI). Matthew, an executive at FedEx (NYSE:FDX) by day, sits on the Board of CCI.

The cell-tower operator is a landlord for mobile phone traffic, collecting rents via its 40,000 towers (from carriers such as AT&T and Verizon (NYSE:VZ)). Think of CCI as a “toll booth” for cell phone traffic.

CCI is one of the three major cell-tower landlords in America. Its stock has certainly been knocked down alongside other REITs. Now, it appears quite cheap!

CCI yields 4.8%, as much as it ever pays. The company hiked its dividend by a fit 49% over the past five years, but the market still treated CCI like a bond, selling it off as rates rose.

But no matter what happens in the economy, Americans are not giving up their phones. Our tendency to stare at our phones all day may not be good for conversation but it’s great for CCI.

That’s our cue to join Matthew. CCI rarely trades below its dividend line. Yet here, with the stock yielding 4.8%, we find ourselves on the profitable underside of the dividend magnet:

Same Level as Previous Insider Buy

CCI is basically a “growth utility” stock that will benefit from a cooldown in rates. The company’s debt is under control, too, with 84% fixed rate and only a small percentage of it maturing in 2023 and 2024.

The stock’s dividend growth is well supported by profits. CCI is on track to increase its adjusted funds from operations (AFFO) by another 4% this year. It’s exactly the type of recession-proof bargain we want to buy now.

Stocks like CCI are the best way to win back your 2022 losses and retire rich.

Yeah, it’s the toughest market we’ve seen in generations. But my top five “dividend magnet” stocks are poised to pop no matter what happens to the market-at-large or broader economy.

Remember, the stock market is a market of stocks. We can profit while the S&P 500 pulls back. This is exactly what we’re going to do with these five dynamic dividends.

They boast stock prices that are primed for major increases in the coming months and years, thanks to massive dividend hikes and buyback plans powered by megatrends like cell phone towers.

Disclosure: Brett Owens and Michael Foster are contrarian income investors who look for undervalued stocks/funds across the U.S. markets. Click here to learn how to profit from their strategies in the latest report, "7 Great Dividend Growth Stocks for a Secure Retirement."