Remember early February’s stock-market rout?

I know. Seems like a weird question. It was just a few weeks ago, after all. But many folks seem to have forgotten how stocks fell 10% from their 2018 high in a matter of days:

Amnesia Sets In

As you can see, the benchmark SPDR S&P 500 ETF (NYSE:SPY) is already recovering, and stocks are now up 3.3% for 2018. That’s still well below the 8% climb we saw in January alone, but it’s a solid return, and it means more (formerly) skittish folks will likely trickle their cash into stocks, keeping the market buoyant.

But they aren’t putting their money in all sectors equally, and that’s where our opportunity comes in, starting with the 3 closed-end funds (CEFs) I have for you below, which are boasting some of their highest dividend yields ever—up to 8.5%!

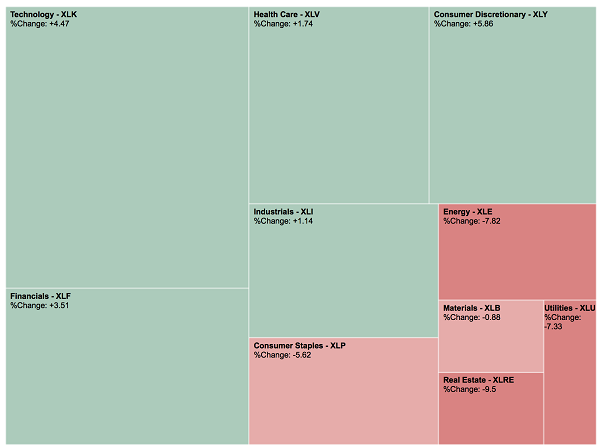

What sector am I talking about? To answer that, we only need to look at this heat map of the S&P 500.

Where the Bargains Are

A quick glance tells us that consumer discretionary, financial and technology stocks are far outperforming the rest of the market, with year-to-date returns between 3.5% and 5.9%.

But we’re mainly interested in the red sectors—one in particular. And it’s not consumer staples.

That’s because the consumer staples selloff can best be understood as a “risk-on” move—staples, of course, are things people must buy all the time, so these stocks are attractive in tighter times. And since we’re in a time of growing incomes and falling joblessness, staples aren’t where you want to be.

That means the drop in consumer staples isn’t a great contrarian opportunity—it’s a falling knife. But when we compare ETFs benchmarking two other lagging sectors—the Energy Select Sector SPDR (XLE (NYSE:XLE)) and the Utilities Select Sector SPDR (NYSE:XLU)—a terrific opportunity pops up.

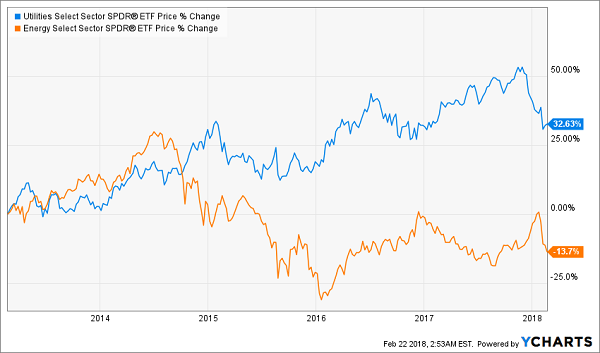

Utilities Go Up, Energy Goes Down—Until Now

As you can see, it’s rare for utilities and energy to fall at the same time; they tend to be inversely correlated.

When you stop and think about this, it makes sense. Utilities sell energy they produce using fuels from oil and gas producers; higher profits in the oil patch, therefore, mean lower profits for utilities, and vice versa.

But as you can see, both sectors are headed down today—and that’s why utilities look so attractive: because they’re buying energy cheap while selling more of it into a surging economy!

And when you add in the fact that many utilities have something near a monopoly in their market, this opportunity gets better still.

3 Ways to Buy In

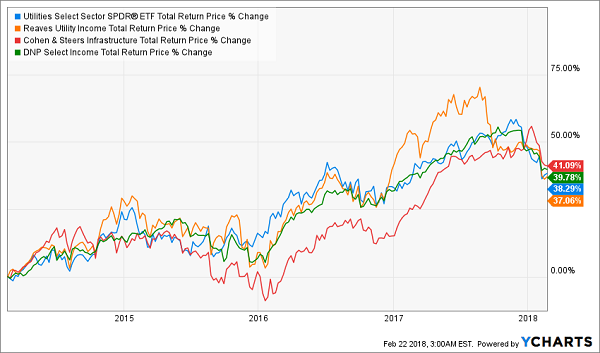

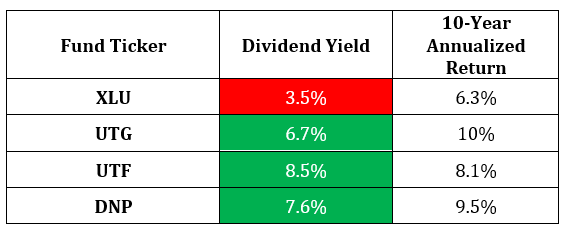

We could just buy XLU and call it a day. With a 3.5% dividend yield, we could feel satisfied that we’re getting utility exposure and a “set it and forget it” investment.

But you’d be leaving a lot of cash on the table when you stack up XLU next to those 3 high-yielding CEFs I mentioned off the top. They are the Reaves Utility IF (NYSE:UTG), the Cohen and Steers Infrastructure Closed Fund (NYSE:UTF) and the DNP Select Income Closed Fund (NYSE:DNP).

I’ve chosen these funds not only because of their strong historical returns, which I’ll get to in a minute, but also because of the quality of their management and their portfolios.

UTG, for example, has one of the best asset management teams in the utilities space, and UTF’s diversified portfolio across North American, Asian and European assets has protected investors from a major market downturn for years. Finally, DNP’s focus on high-yielding large cap US utilities and telecommunications companies provides stability and a dividend investors can count on.

Each one specializes in utilities and has beaten XLU’s dividend yield while matching—or even topping—the ETF’s performance since the 2014 commodity crash.

Topping the Benchmark—With Big Cash Payouts, Too

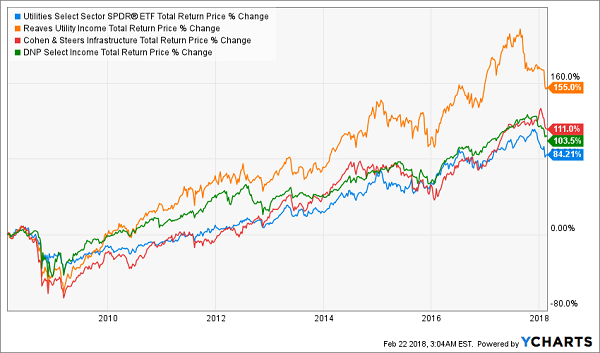

On a longer term basis, these funds have all crushed XLU.

Winning Out Over the Long Haul

But how do these funds’ dividend yields compare to that of XLU? Quite nicely.

The bottom line? Utilities have tremendous upside, and it’s only a matter of time till the market picks up on this. The 3 CEFs I just showed you are a great way to get in on the action.

4 Must-Buy CEFs for 2018 (Huge Cash Dividends and 20%+ GAINS Ahead)

Utilities aren’t the only shockingly cheap corner of the market resulting from the selloff. There are 4 more markets that are even better places for your money now. But you won’t find them by looking at the S&P 500 “heat map” above—they’re well off most investors’ radar screens.

But these 4 obscure markets boast cash payouts 4 TIMES BIGGER than what the average S&P 500 stock pays!

They’re plenty safe, and even more undervalued than utilities are now.

That means one thing: we’re looking at massive upside here, especially if you buy my 4 favorite funds—one from each of these 4 unloved markets—today: I’m talking 20%+ price gains in a year or less!).

AND you’ll collect an outsized 7.6% average dividend payout while you watch these 4 incredible funds’ share prices arc higher.

Disclosure: Brett Owens and Michael Foster are contrarian income investors who look for undervalued stocks/funds across the U.S. markets. Click here to learn how to profit from their strategies in the latest report, "7 Great Dividend Growth Stocks for a Secure Retirement."