After another bad week in U.S. equities and a worse week in emerging markets, some are starting to question the strength of the global economy.

Can the slow and prolonged recovery be derailed by some ill-chosen policies in a few small countries? Are we hostage to some bad hedge fund trading decisions, the way we were in 1998?

The week ahead features plenty of important economic data and earnings results. I expect this real news to displace the emerging market meme.

Last Week Recap

Last week I suggested that we would have another week of pundits on parade. Everyone would be interpreting each 1% move in the market as evidence that their analysis was correct. This was a pretty accurate summary of the news flow from financial media, especially the characterization of "triple-digit" moves in the DJIA as a meltdown. These sources have no shame when it comes to sensationalizing the news.

I also accurately suggested that the Fed would ignore emerging markets and that weather would be an important topic. Readers are invited to play along with the "theme forecast." I spend a lot of time on it each week. It helps to prepare your game plan for the week ahead, and it is not as easy as you might think. There are some Mondays when I think the CNBC producers have been reading my postJ

This Week's Theme

Economic data have turned a bit softer over the last month. What does this imply?

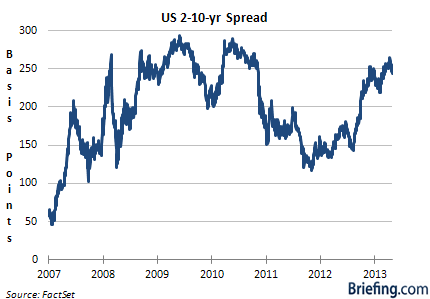

- For some, it takes only a few reports to signal the worst. The yield curve has flattened, with the 10-year note well off of the recent highs. Even if this is "flight to quality" buying, it suggests a deflationary threat. When the Fed announced the continuation of tapering at the prior pace, some expected the long end of the curve to increase in yield. Remember the recent questions about who would buy bonds if the Fed cut back? Instead, we are seeing lower long-term rates. Does this mean a weaker economic forecast? Is the Fed wrong? BondDeskGroup has a good analysis of the factors as well as this chart:

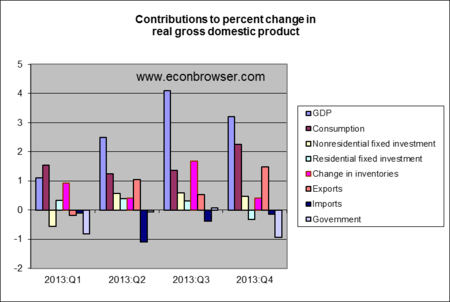

- For others, the recent GDP report shows some important trends. Prof. James Hamilton looks at the underlying components, noting that allowing for the government "drag" shows that the U.S. economy is gaining momentum.

This week we will see plenty of real data and more corporate earnings reports. It will be a big week for data, helping us to evaluate the threat to the economic recovery.

As always, I have some thoughts that I will share in the conclusion. First, let us do our regular update of the last week's news and data. Readers, especially those new to this series, will benefit from reading the background information.

Last Week's Data

Each week I break down events into good and bad. Often there is "ugly" and on rare occasion something really good. My working definition of "good" has two components:

- The news is market-friendly. Our personal policy preferences are not relevant for this test. And especially -- no politics.

- It is better than expectations.

The Good

Some of the recent news was good.

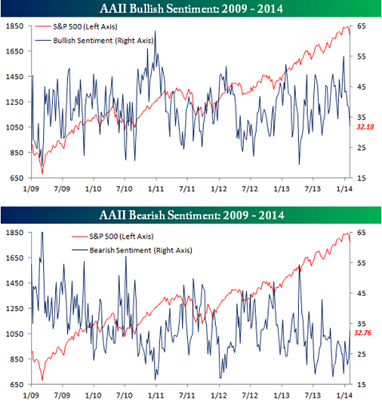

- Bullish sentiment declined yet again – a contrarian indicator. According to Bespoke Investment Group this is the fourth consecutive decline in bullish sentiment, with bears now leading bulls for the first time since August.

- The Keystone pipeline cleared a key enrionmental hurdle. This would help the economy in many ways, so the environmental tradeoff is the key. (The Hill).

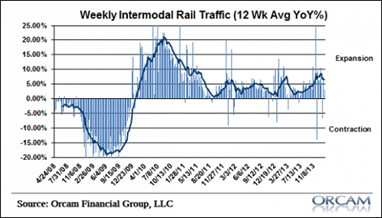

- Rail traffic remains strong. Those who are skeptical about government reports should pay special attention. (Cullen Roche).

- Truck tonnage, too. (Scott Grannis).

- China's official PMI came in as expected, at 50.5. This report came Friday night, after the US markets closed. After the "flash PMI" that showed slight contraction, some were worried about a surprise in this measure. It is obviously still a near-neutral growth reading, but the whisper seemed to be worse. (See Lucy Hornby's FT.com report from Beijing).

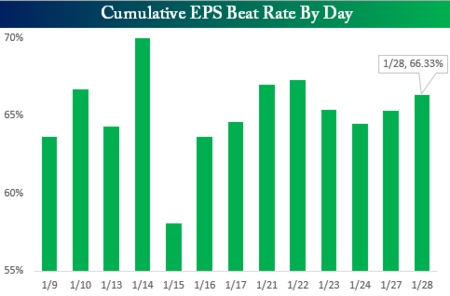

- Earnings season is going well, which must be a surprise to the casual observer. Earnings expert Brian Gilmartin is sticking with his prediction of a YoY increase of 10% in Q4 earnings. He also sees a similar increase for calendar 2014, but he is more cautious about the market reaction. Bespoke charts the progress in the "beat rate" for this earnings season.

- The money supply is growing – needed for the economy – although other frequent indicators are mixed. (New Deal Democrat).

The Bad

There was plenty of bad news.

- GOP split on immigration reform making action during this year unlikely. (The Hill).

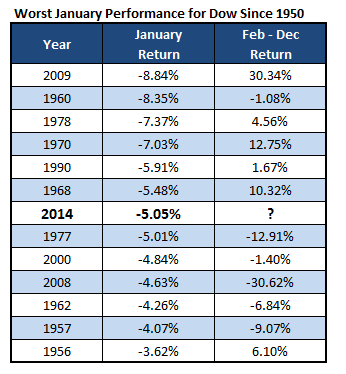

- The January Barometer. As goes January, so goes the year, says the theory. Ryan Detrick at Schaeffer's takes a deeper look, so you can decide for yourself if this is worth using.

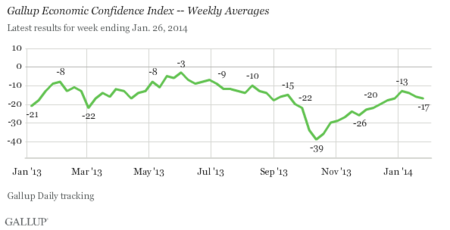

- Economic confidence declined. Gallup links it to the stock market, but I doubt that. Most people do not watch stocks that closely.

- Real Personal Income is contracting even though spending is higher. Steven Hansen has an in-depth analysis, considering the NSA data as well. Doug Short has updated his "Big Four" chart to reflect this weak report.

- Pending home sales showed a surprising, large decline of 8.7%. Calculated Risk explores the reasons – not just the weather excuse, but inventory and demand as well. Bill also notes that new construction is more important to the economy.

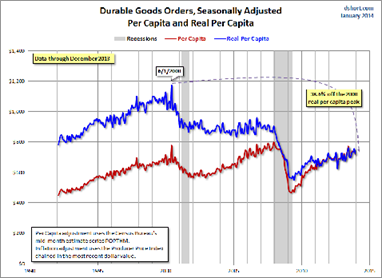

- Durable Goods orders declined sharply, down a surprising 4.3% and now up only slightly on a YoY basis. Steven Hansen looks at the NSA numbers as well. Doug Short illustrates many adjustments to this complex series, illustrating the effects of population, inflation, and the most volatile sectors. Here is a good example of the helpful charts:

The Ugly

Emerging markets. Currencies are failing and their stocks are declining. Izabella Kaminska at FTAlphaville asks whether the outflows have "only just begun?" The post includes some great analysis and charts. She notes that the Fed does not seem to be considering this in policy decisions. This will be no surprise to my regular readers.Scott Grannis explains why this is not about Fed tapering. Good charts.

Noteworthy

Barry Ritholtz and Peter Schiff both accepted the challenge to appear on The Daily Show to discuss the minimum wage. Putting aside your personal opinion about the issue, you will enjoy watching the segment. Let us just say there is quite a disparity in the impression made, although the participants did not directly confront each other.

For comparison, take a look at last summer's "debate" between Schiff and economist Scott Sumner on Kudlow's show.

Sumner is a highly-regarded academic, whose work has clearly influenced recent Fed policy, but he does not have the same experience in this type of media setting. He did quite well, but had academic explanations rather than sound bites.

This is great fun to watch, and also instructive about what we can learn from different media approaches. How do you get your news?

Quant Corner

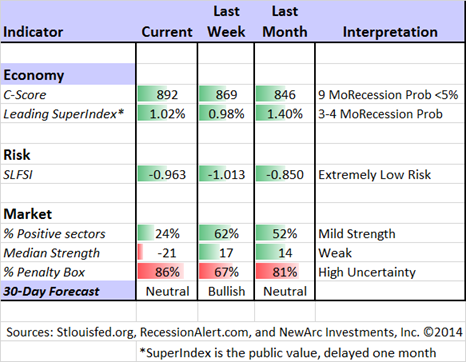

Whether a trader or an investor, you need to understand risk. I monitor many quantitative reports and highlight the best methods in this weekly update. For more information on each source, check here.

Recent Expert Commentary on Recession Odds and Market Trends

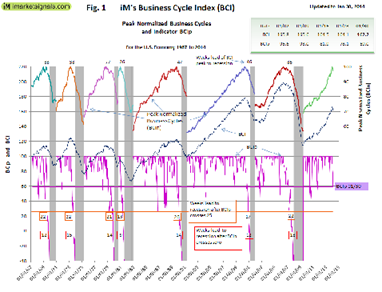

Georg Vrba: Takes a look at potential stock returns through 2020, using the 5-year Shiller CAPE. He has also updated his market timing method, which still calls for a leveraged investment in stocks. This week he reveals a new indicator, showing that a recession is not part of the near-term outlook.

RecessionAlert: Sees improvement in leading indicators for US growth, while highlighting danger areas worth monitoring. See the article for detailed charts on each indicator.

Doug Short: An update of the regular ECRI analysis with a good history and commentary – well worth reading.

Econbrowser's recession index has declined to a 3.3% probability.

I made a friendly suggestion to the ECRI: Time to ask for a fresh shot clock! They are not alone in needing to reconsider failing models.

The Week Ahead

This is another big week for news and data.

The "A List" includes the following:

- Employment report (F). Despite the volatility and issues of interpretation, this remains the most important release.

- ISM index (M). Good contemporaneous data on economic strength and employment, with some leading quality.

- Initial jobless claims (Th). Best fresh data on employment, more important than ever after last month's employment report. (Not part of the survey for the Friday report).

The "B List" includes:

- ADP private employment (W). Often alters expectations about the Friday data. Good independent read.

- ISM services (W). A shorter series than manufacturing, but still quite valuable.

- Trade balance (Th). Relevant for GDP.

- Auto Sales (M). Good evidence from a non-government source.

- Construction spending (M). December data, but still interesting.

- Factory orders (T). Also December data.

It is still the heart of earnings season, with many important reports. With the Fed decision made, the participants are free to give speeches. While the decision was unanimous, we can expect some additional color from several presentations this week.

How to Use the Weekly Data Updates

In the WTWA series I try to share what I am thinking as I prepare for the coming week. I write each post as if I were speaking directly to one of my clients. Each client is different, so I have five different programs ranging from very conservative bond ladders to very aggressive trading programs. It is not a "one size fits all" approach.

To get the maximum benefit from my updates you need to have a self-assessment of your objectives. Are you most interested in preserving wealth? Or like most of us, do you still need to create wealth? How much risk is right for your temperament and circumstances?

My weekly insights often suggest a different course of action depending upon your objectives and time frames. They also accurately describe what I am doing in the programs I manage.

Insight for Traders

Felix has switched from bullish to neutral – close to a bearish forecast. We reduced trading positions during the week, closing out a brief but profitable trade in biotech (IBB). Our one remaining position is a European ETF. While we have no short positions (via the inverse ETFs) that could change during the coming week. The ratings have shifted to slightly negative, but many sectors are still in the penalty box.

Insight for Investors

I review the themes here each week and refresh when needed. For investors, as we would expect, the key ideas may stay on the list longer than the updates for traders. This is the "actionable investment advice" summarized here.

This is an important time for long-term investors. They all know (in theory) that market corrections of 15% or so occur regularly without any special provocation. Recent years have been the exception. Whenever there is a decline in stocks you can expect to see plenty of doomsday forecasts.

This WTWA series is designed to maintain focus on market fundamentals. The featured advice this week comes from some great sources:

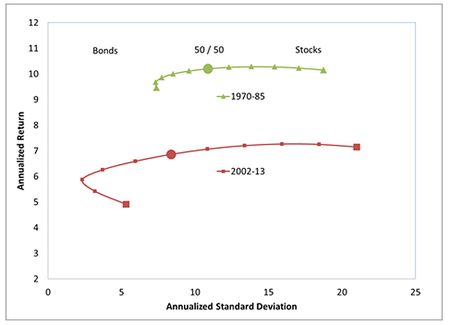

- Rick Ferri explains that bond/stock correlations are often not the best guide for portfolio rebalancing. In a thoughtful post, he points to a Treasury position as a way of reducing risk, not increasing return. While I prefer different choices for the "safe" part of the portfolio, I agree that everyone should start with risk control! Here is a key chart showing the dramatic change in the relationship between stocks and bonds:

- Eddy Elfenbein explains emerging markets. There is a real skill in taking a complex subject and explaining the crucial aspects in a clear fashion. Eddy is a master, and combines wit with wisdom. Every investor should take a minute to read the full article, but here is a taste:

The situation in Argentina is especially screwed up—although when I use the phrase "screwed up" in conjunction with our friends on the Rio Plata, it's like saying there's "trouble" in the Middle East. The president of Argentina didn't make any public appearances for six weeks. Can you imagine if President Obama had done the same?

President Kirchner promised not to devalue the currency, but reality intervened. Of course this was after the government spent a pile of cash trying to defend the indefensible peso. In the last three years, Argentina's currency reserves have been cut in half. No one really knows what the inflation rate or dollar-peso exchange rate truly is.

There are a lot of people in Argentina, in and out of government, whose job it is to see how well the economy is doing. They track all sorts of complicated econ data, but I have a simple rule I use: How loudly are the politicians yapping about the Falklands? If they're loud, you can be sure that means the economy is a wreck.

- Schwab's Liz Ann Sonders calls the equity market the "best in our lifetime."

"There is a slightly elevated risk of a 10% correction this year, but I don't think the secular bull market is over," she said. "I have some short-term concerns, but I personally think the bull market we're in now will be the best is our lifetime."

Some of the driving forces she identified include the fact that U.S. businesses "are sitting on a huge hoard of cash, which is at a level not seen since World War II," she said. "We know the capital is there, but we haven't had the animal spirits to put it back to work yet. But this is the year we'll probably see increase in [capital expenditure] spending."

- Josh Brown explains, in his characteristic colorful fashion, "Vol Happens" and the 2014 playbook is different.

I am still shopping for stocks. I have some cash in our long stock program, with a mission that I described in my regular annual preview interview with Seeking Alpha. The interview combines strategy, perspective, and some specific themes. As I often do, I start by emphasizing risk control. I see that as crucial in dealing with the temptations to engage in poor market timing. Several of the themes I mentioned are near the buy points.

While I am not trying to time a correction, I do have more than a normal cash level, raised through normal trimming. I am actively shopping in the sectors I have highlighted.

And finally, we have collected some of our recent recommendations in a new investor resource page -- a starting point for the long-term investor. (Comments and suggestions welcome. I am trying to be helpful and I love feedback).

Final Thought

For the average investor it is important to focus on fundamentals – the economy, earnings, and the risk of recession. These factors are all encouraging.

There are plenty of distractions. Turn on "ignore" mode. I have to monitor this stuff, but you do not.

- Politics is already becoming a big factor. As I predicted last week, there was little in the State of the Union speech that could help investors. There certainly was plenty of noise about it. You should not care about this, nor the problems of specific candidates.

- Keep the anecdotes from the old-timers in perspective. (I know, I know. I qualify for the old-timer club!) I always hate it when analysis proceeds from a single example – usually without any real perspective. This week it was reminiscing about the Thai baht, the Asian Contagion, and the market reaction over a year later. There are many steps between the currency problems in a small country or two and a major economic impact either for the US or the global economy. It is so easy to write a post or do a video showing a chart and a few facile comparisons.

None of this has any proven, long-term investment value. Instead, why don't we focus on the real information? We'll get plenty in the week ahead.