Cryptocurrencies are suffering and the dominant trend is to the downside. Of course, Elon Musk’s recent comment about Bitcoin have shaken many weak hands out of the market and it is likely that we may continue to see more weakness ahead.

The second biggest coin by market cap, Ethereum has also seen its prices coming off from its highs. There is no doubt that Ethereum was long due a correction especially after its price doubled from its 2017’s highs.

Investors should not feel worried about current carnage in crypto space as fundamentals have not changed substantially. For instance, institutions are in the market and they are very much going to back the current sell off. For them, this is the opportunity that they have been waiting for a long time.

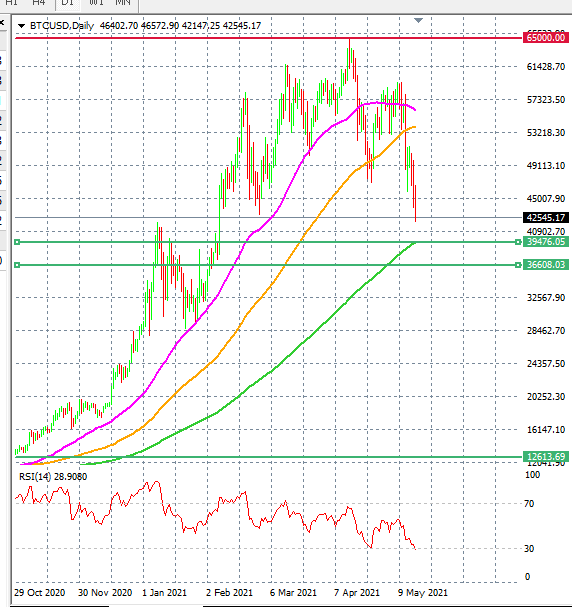

Speaking from a technical price perspective, the Bitcoin price is likely to find support near its 200-day SMA on the daily time frame. The RSI is already indicating that the current sell off is extremely oversold and buyers are very much likely to step in. The current support is at 38K while the resistance remains at an all high.