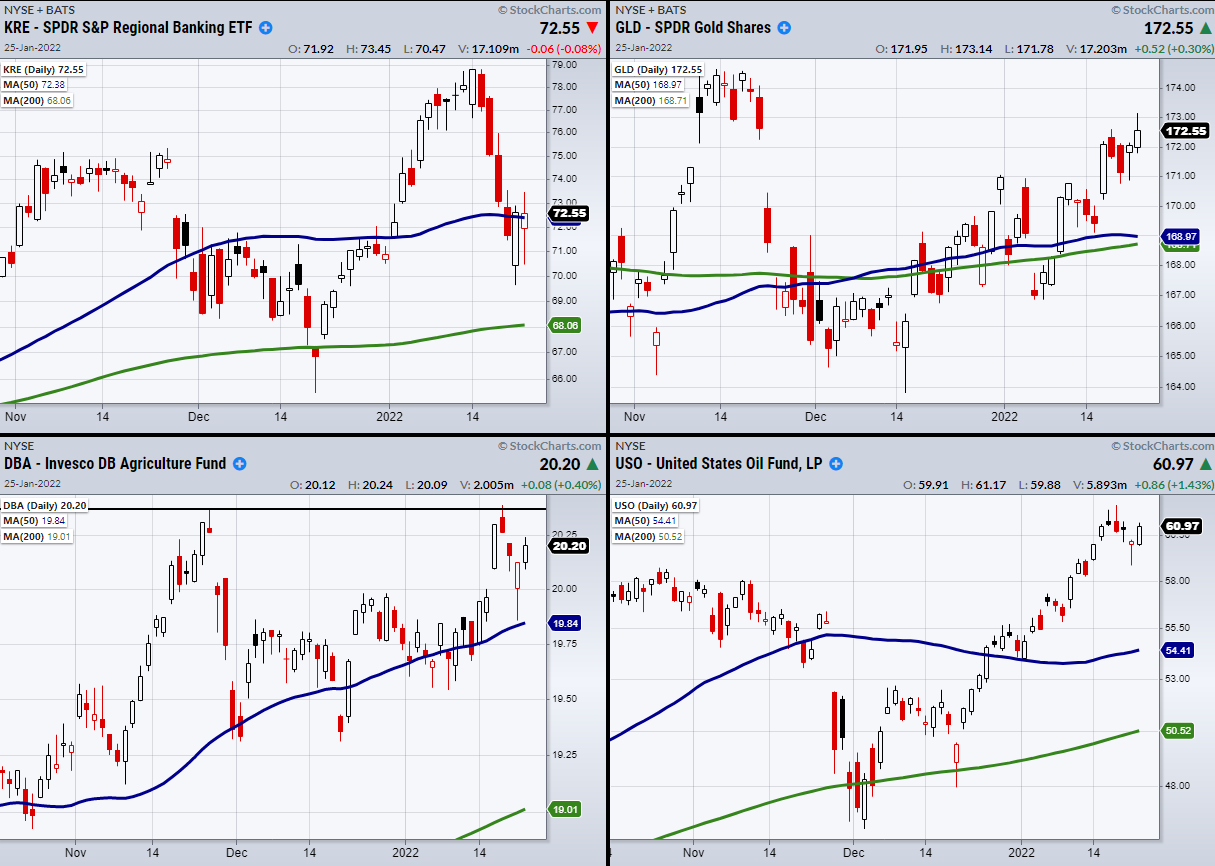

The market is looking to hold its current price area along with Monday’s low as a new key support level. Additionally, with many banks coming out of earnings season the Regional Banking ETF—SPDR® S&P Regional Banking ETF (NYSE:KRE)—is perking up.

Now it needs a close over its 50-Day moving average at $72.58. Currently, KRE is one of Mish’s strongest Economic Modern Family members and if it holds over its 50-DMA, we can watch for a move towards $76.

When it comes to the four major indices, besides the Dow Jones (DIA)—S&P 500 (SPY), NASDAQ (QQQ), and Russell 2000 (IWM)—each made an inside day chart pattern showing that while buying was a major force on Monday, the indices were still unsure of what to do next.

While the market was looking hopeful, areas related to increasing inflation were also gaining momentum.

For instance, the SPDR® Gold Shares (NYSE:GLD) ETF was entering its range from mid-November of last year around the $172-174 area. If GLD can clear and hold over $174, watch for a new uptrend to form.

Soft commodities have also begun to perk up with the Invesco DB Agriculture Fund (NYSE:DBA) holding over its pivotal $20.00 price level. Now we can watch for DBA to clear its next resistance point at $20.37.

As the Russia-Ukraine situation heats up, food and precious metals aren’t the only commodities to outperform.

Oil (NYSE:USO) has also continued its uptrend and is currently holding near highs. Therefore, as we watch for the great rotation into commodities to continue, we can keep an eye on the short-term market picture for quick stock plays.

However, we must remember that increasing inflation and rate hikes control the longer-term market picture.

ETF Summary

- S&P 500 (SPY) 440.38 to clear.

- Russell 2000 (IWM) Inside day. 202.39 to clear.

- Dow (DIA) 340 needs to hold.

- NASDAQ (QQQ) Inside day. 354 to clear.

- KRE (Regional Banks) Needs a close over the 50-DMA at 72.58.

- SMH (Semiconductors) Inside day. Could not hold over the 200-DMA at 269.30.

- IYT (Transportation) Inside day. 248.85 new support.

- IBB (Biotechnology) 122.94 new support.

- XRT (Retail) 82.42 the 10-DMA to clear.

- Junk Bonds (JNK) 106.48 pivotal.

- SLV (Silver) Bounced off the 10-DMA at 21.82. 22.83 resistance.

- USO (US Oil Fund) 58 support

- TLT (iShares 20+ Year Treasuries) 140 support.

- DBA (Agriculture) 20.37 resistance area.