If I look around at moves markets and the overnight news flow one thing that really stands out is the strong buying in European equities, with Italian banks off to the races. I have been quite upbeat on the price action in the Italian MIB and stand by that call, as the index is flying and has to be on the radar, as its going higher in my opinion. The German DAX had looked vulnerable for a deeper pullback, but the bulls have waded back in overnight and supported prices, and it looks as though new highs are on the cards here too. Europe is where all the action is and this is where I would be looking to express a positive or bullish bias right now.

US equities are getting the lion's share of attention though, with the Dow Jones index trading 45 points shy of the 20,000 level. It should break this level before Christmas and certainly before New Year, as every dip has been shallow and (as mentioned in prior reports) everyone is chasing this rally now. Volumes have been quite impressive too in the blue-chip index and some 20% above the 20-day average. By way of a guide for Asia, the S&P 500 has seen strong buying in tech, energy and consumer discretionary names, while materials names have lost some ground and this should flow through to the Aussie open.

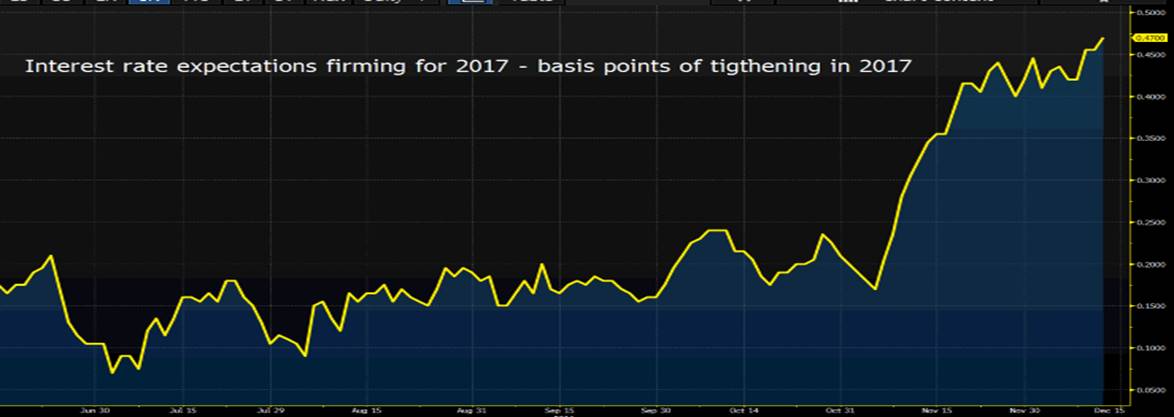

It’s interesting to see US interest rate expectations firm and while we haven’t really seen any move in US Treasuries (further out than five-year maturities), if we look at the interest rate markets we can see the fed fund futures have moved higher all the way out across the curve. To provide perspective, the interest rate market currently has a 94% probability of two hikes in 2017, and this has firmed up from a 68% probability of just one hike in early November. This pricing structure seems fair and we go into the New Year with the market and the Fed on the same page in terms of where rates are going in the shorter-term. This is a positive development, but everyone really wants to know whether the Fed raise their 2018 fed funds (or “Dot Plot”) projections from their current call of 1.875%. From an ultra-simplistic standpoint, I guess this is what the USD will key off this week.

Despite the increased rate hike expectations going out for the next couple of years, we haven’t seen much of a move in FX land. The USD is largely unchanged, with AUD/USD still eyeing a close above $0.7500. On the session, AUD/USD has traded in a range of $0.7476 to $0.7523, but is struggling to find the conviction to make any kind of move in either direction. The pair just looks very comfortable right here and one suspects today’s event risk in the shape of Westpac consumer confidence (at 10:30 AEDT) will have absolutely no bearing on price at all. Keep an eye on US retail sales (00:30 AEDT) though, as the recent upbeat sentiment (specifically in global equities) has not just been about what “Trumponomics” could bring to inflation and growth, but we are genuinely seeing an improvement in the economic data flow in many developed markets, right here, right now. The economist’s consensus is for a 0.3% gain in the November retail sales report.

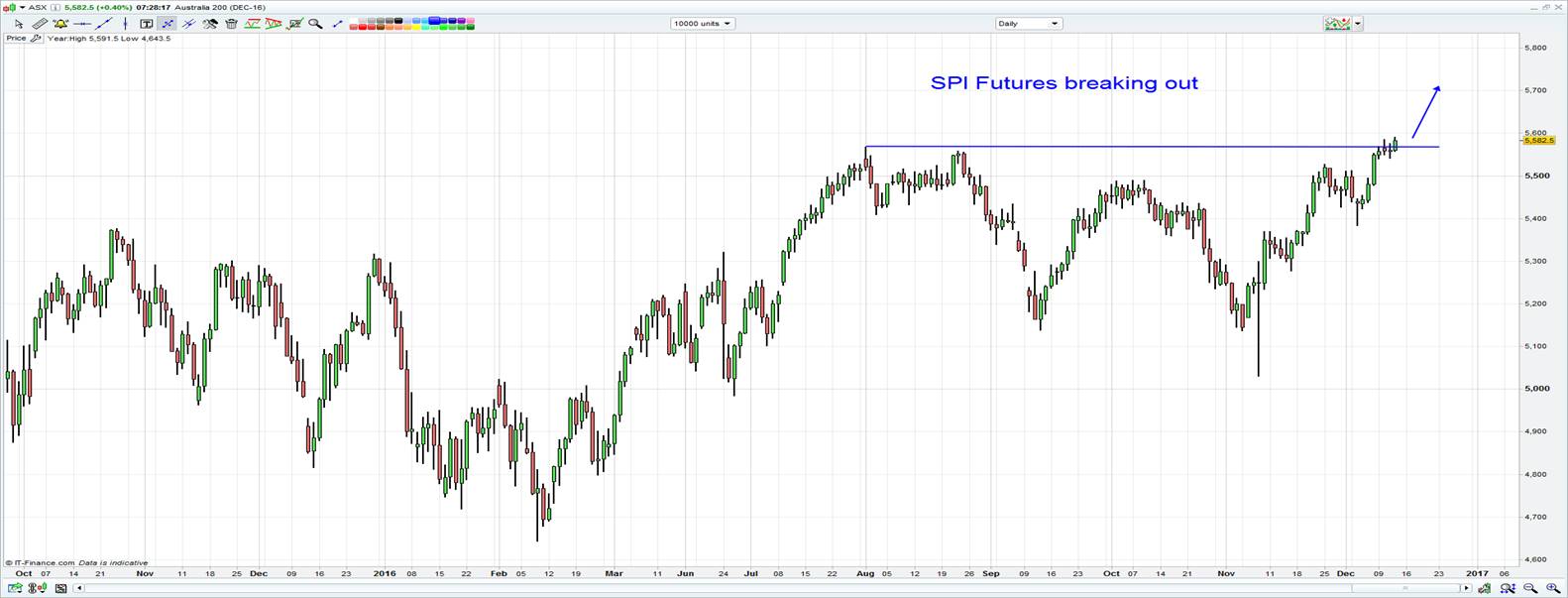

Here in Asia, we should see a fairly upbeat open to the various equity markets, with the ASX 200 called to open at 5582 (+0.6%) and the Nikkei 225 at 19325 (0.4%). In Australia, we have seen the SPI futures push up 32 points in the overnight (SYCOM) session and have broken out to the highest levels since August 2015. This is clearly a positive development and the ASX 200 should feed off that sentiment, with the 1st August high of 5611 looking increasingly achievable before New Year. As mentioned, my preference is European markets, but if I had to choose a direction to be positioned in the Aussie equity market it would be for higher levels.

Interestingly, the lead in for materials stocks is not that flash. US crude is a touch higher though and the S&P 500 energy sub-sector is up 1.4% so this may support oil plays (and BHP to an extent), with the key story being the International Energy Agency (IEA) report that forecasts the global oil market moving from surplus to deficit in the first half of 2017 as a direct result of the proposed production cuts from OPEC and non-OPEC nations. Bulk commodities though as quite soft and may cause some selling in the pure plays, with iron ore and steel futures (traded on the Dalian exchange in China) losing 4.6% and 1.6% respectively.