As we noted in Tuesday’s FOMC preview report, the US central bank was never going to make any immediate changes to policy, leaving traders to read Powell and Company’s tea leaves for implications about future tweaks. As it turns out, the tea leaves were clear: The Fed has become suddenly dovish.

Even relative to the market’s dovish expectations, the FOMC came off as worried about the US economy:

- The median policymaker now expects US GDP to rise just 2.1% in 2019 (down from 2.3% in December)

- The median CPI forecast for 2019 was also cut to 1.8% (from 1.9% in December)

- The median interest-rate forecast for the end of the year is 2.25-2.50%, unchanged from current levels. 11 of the 17 potential voters now anticipate that the central bank will remain on hold until 2020.

- Only one rate hike is expected in 2020, according to the median “dot.”

- The central bank will end its balance-sheet runoff at the end of September.

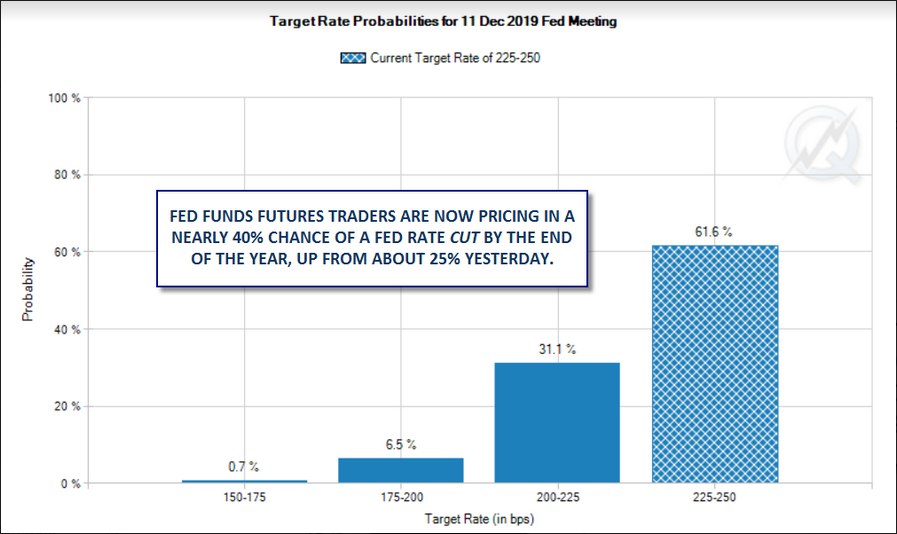

All of these tweaks signal that the central bank is concerned about the US economy and traders have taken notice. According to the CME’s FedWatch tool, the market is pricing in nearly a 40% chance of a rate cut this year, up from around 25% yesterday. Given the scope of the Fed’s negative revisions, we wouldn’t be surprised to see this number rise further in the coming days.

Source: TradingView, FOREX.com

Market Reaction

Not surprisingly, the big shift in the market’s outlook about Fed policy is also being felt in more traditional markets. The US dollar has fallen by at least 60 pips against all its major rivals, with the US dollar index shedding -0.60% as of writing. Gold and oil have caught a bid on the weakness in the greenback, while major US stock indices have recovered into positive territory on the prospect for lower interest rates in the future.

The biggest move has been in the bond market: The 10-year US Treasury yield is dropping a full 9bps on the day to 2.53%; a close here would mark the largest single-day rally in bonds (fall in yields) since last May. Meanwhile, the 2-year Treasury bond is trading off by 8bps itself to yield just 2.40%.

While we believe that economic data in the coming months may show that the Fed’s dramatic shift is an overreaction, we wouldn’t be surprised to see continued weakness in the buck, strength in stocks and commodities and further drops in yields while the market “catches up” to the central bank’s new posture.

If you have any questions, a colleague who may be interested in receiving this analysis or if you no longer wish to receive market commentary from us, please do not hesitate to contact me!

Cheers