It never ceases to amaze me how tone deaf those with power are. Turkish President Recep Tayyip Erdogan is in serious trouble for the first time in his political career. He’s a man staring at a massive electoral problem coming this fall.

Erdogan is currently presiding over an economy in complete freefall. With recent reports of food riots over government handouts of potatoes and onions the news only seems to be getting worse there on the eve of national elections.

Turkey is emblematic of what happens to a country systemically mismanaged because of its geopolitical importance. A man like Erdogan is able to maintain power because he’s constantly schmoozing both sides of the Bosporus to get subsidies to fuel his personal ambitions.

This is part of the reason why Turkey has the largest army in NATO while the private economy has the worst foreign capital liabilities position of any major emerging market.

And it looks like Erdogan may have finally overplayed his hand too many times in the last year.

He has made multiple major missteps on the geopolitical stage, attempting to assert Turkey as a regional powerhouse only to be thwarted at every turn by Russia. Be it Libya, Cyprus, Syria, Azerbaijan, or Iraq, Putin has outplayed Erdogan at every turn.

With each of these setbacks his gambits become more and more desperate. And he is egged on by the U.S. and the EU to make these gambits as he hides behind the shield of Turkey’s membership in NATO.

Anyone else who wasn’t so strategically important who made this many major geopolitical and military blunders would have already been overthrown. But now it looks like he’s run his full course.

This puts him in the position of thinking he can play Russia off the U.S. to his advantage and then turn around and play the U.S. off Russia for his advantage. In all instances he only sees the upside and never the down.

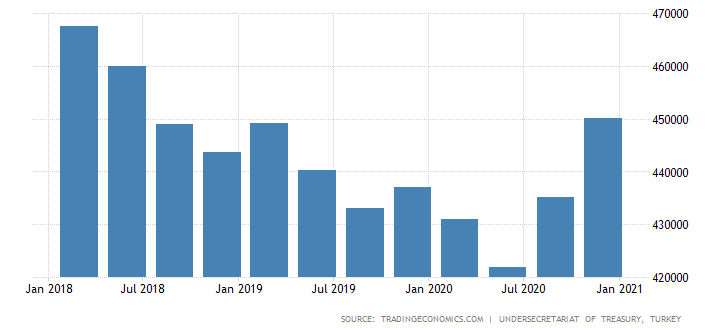

His real weakness is Turkey’s foreign currency deficit which cannot be serviced nor is there any incentive for it to resolve itself because Erdogan constantly bites the hand that feeds him. China and Russia are more than wealthy enough to have helped Erdogan balance Turkey’s books since the U.S. first attacked him financially in 2018. I've written about this extensively.

But Erdogan always turns on the person who last helped him thinking he’s a bigger player than he is.

And now with President Biden acknowledging the Armenian Genocide, one of the few things Turkey and Israel have agreed on for decades, Erdogan is being told he’s no longer needed by the U.S. Erdogan has maintained power through aggressive nationalist domestic policy. His Neo-Ottoman ambitions played well at home for nearly two decades but with the Turkish economy now hollowed out by his adventurism and mismanagement of the lira he’s in serious trouble politically in a way he hasn’t ever been.

There’s many angles to Biden’s Armenian Genocide move here. It’s a clear rebuke of Israel while the U.S. and Iran are in deep negotiations about bringing back the JCPOA, which have made significant progress. Remember, the WEF and Europe want the JCPOA, Israel does not. And this week’s fireworks between Iran and Israel point to a dangerous future the closer we get to its reinstatement and Iran rejoining the global economy.

This leaves Turkey with almost no friends anymore as it is clear the JCPOA is supposed to be the carrot to Iran while maximum isolation stick is transferred to Russia. This is a very high-stakes game which is as much a power play by Europe against Israel and the U.K. as it is anything else.

And that leaves Turkey with a decision to make.

Today, Turkey’s foreign debt position is only marginally better than it was in 2018 and it got worse over 2020. Deleveraging in dollar terms improved and then it got worse once the Fed went back to the zero-bound after the Coronapocalypse and Erdogan let go of control of Turkey’s Central Bank.

If you are playing a game this big and understand the rules of it at the level Erdogan does, then I cannot understand why he let the Bank of Turkey reverse course after his scathing attacks on the IMF in 2018, which, to be fair were spot on and, in my opinion, the right course of action for Turkey to free itself from the vaster powers.

But it didn’t work out that way and the situation in Turkey today is worse than it was in 2018 because now he can no longer count on Putin and/or Xi to bail him out. All of the major powers are now tired of him and his game and are allowing him the big fall from grace.

This is why the lira is exploding and it’s why Erdogan is trying to save himself by backing the U.S.’s play in Ukraine and announcing the banning of Bitcoin for payment services in Turkey.

I’m sure the WEF and the Biden administration are happy with him for this.

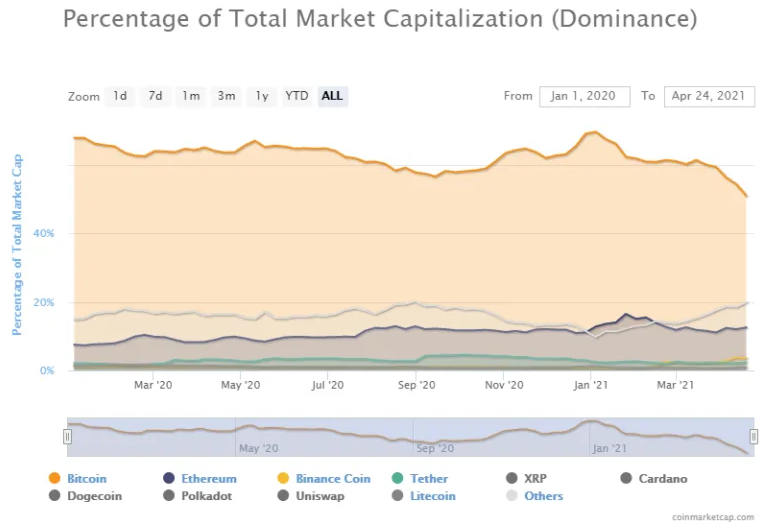

The timing of this announcement was done to stifle the latest breakout to a new high in Bitcoin and undermine the Coinbas (NASDAQ:COIN) IPO, which was very successful especially when you remember Facebook’s IPO back in 2012. Since then it’s been one attack after another on the crypto market as I talked about in a recent post.

And it looks like it’s finally been successful in slowing down Bitcoin’s momentum. First causing a big breakout in high-quality altcoins. DASH hit $400, Decred hit $250, Litecoin went past $300, Monero threatened $375. ARRR $15.00, And DOGE hit a truly staggering $0.45.

They have all since finally succumbed to the same loss of momentum which is shaping up to being a significant top, possibly now, for the rest of 2021. There’s been sufficient stabilization of the U.S. Treasury market with good demand for the long-end of the yield curve, evidenced by a solid 20-year auction this week, to warrant some consolidation of 2021’s immense gains.

The important thing to remember here, isn’t that Bitcoin is or even was in a bubble, but that this rotation into altcoins occurred because people no longer want to rotate back to USDs or EURs. They want custody.

And that brings me back to the counter-move by China who threw Turkey’s banks a lifeline by announcing that China’s banks can now import gold for the first time since 2019.

Since Turkey’s banks can hold gold as reserves, the languishing gold price has really harmed them and Turkey’s financial position. Because if a new rally in gold starts with last week’s move up in gold prices, then watch Turkey’s foreign debt position improve as well.

It won’t quell the rampant inflation, soaring food prices and any of Turkey’s other societal problems in time for elections later this year. Turks, by the look of the current polling, are beginning to see that Erdogan doesn’t have any real answers nor does he have any friends.

If they have to swallow being the only country left to refuse to admit to their own history this will be a moment of memetic collapse for them about just how far their position has fallen thanks to Erdogan’s failed adventures and failed stewardship of their wealth.

The suppression of gold was important to try and keep a lid on institutional money moving into Bitcoin. China enabling some stability in gold prices should mitigate some of the downward momentum in the crypto-space, depending on how much leverage is still out there. With the U.S. economy getting an artificial boost from all the ridiculous stimulus money flowing out from D.C. in the most unsustainable way, the Fed is under no compunction to bail out emerging markets, like Turkey, short of dollars.

Erdogan had to take steps to stem the tide against the lira. Making a public move against Bitcoin was the easiest thing, and obviously done to appease his partners in the West who then stabbed him in the back less than a week later. But it won’t be enough and this move may have been the strongest signal yet of how powerful Bitcoin’s ability to find weaknesses in the financial system is.

Erdogan wouldn’t have made this announcement against Bitcoin and cryptos if it didn’t pose a real threat to the lira. In a world where US dollar stablecoins are paying 10+% and can be bought and sold for nearly nothing, what could a Turkish bank possibly offer Turks at this point other than an unsafe place to park their money?

Turkey is rapidly approaching a serious decision point as is Erdogan. His pride has led him to places he should have never went and having bit the hands that fed him too many times, his future along with his government’s is looking grim. Thankfully for his victims there are solutions available to protect them from him.

UPDATE: Erdogan’s goons have now gone after the 2nd Bitcoin exchange in Turkey in less than a week. These are the moves of a desperate leader.