The news from Maruti (MARUTI.NS) is disgusting. I have been curiously watching how the stock market takes it in:

That Maruti has serious labour problems has been known for a long time. But the brutality that unfolded in recent days was out of the world. It was news. When I read about it on Thursday, it seemed to me that Maruti was facing a Tata Motors (TATAMOTOR.NS) style situation: of suffering the fixed cost of closing down the existing plant and relocating to a state with better governance. The costs faced in this would be substantial. In that case, a 6 per cent decline of the stock price seemed pretty modest. I watched the small recovery on Friday with surprise. Surely, the cost and complexity of moving out of Manesar is worse than 5%.

Yesterday, on Monday, the market has shifted from a less sanguine assessment to a 10% drop in the stock price. I wonder if this is new information or a modified judgment about how this will play out. Were the speculators on late Friday evening just wrong, or did some new information break?

Bad macroeconomic outcomes and social stress

I would conjecture that poor macroeconomic performance -- low GDP growth and high inflation -- is correlated with greater stress of this nature. With inflation, the logic is straightforward: The worker who had a nominal wage contract finds the need to renegotiate when the value of the rupee changes. This links back to the earlier discussion here on why solving India's inflation crisis is important. Too often, we in India are cavalier about inflation. But we should see inflation as an acid that corrodes all nominal contracts, whether stated or unstated. Renegotiation is costly.

Turning to GDP growth, most people that I know seem to think that a couple of per cent of real per capita GDP growth is important for keeping the peace. A lot of people become a lot more unhappy when growth slows. Indian democracy does a pretty good job of containing the angst. There will be no revolution here. But life is substantially easier if the engine of GDP growth is purring. When it stalls -- as it appears to have done in 2012 -- a whole host of social problems erupt.

Law and order as the fundamental foundation of civilisation

This is a reminder to us about how law and order is the fundamental precondition of civilisation. The most important public good of all, the first claim on the resources of the State including the time and attention of the senior leadership, is police, courts and laws. The entire story of the market economy and high GDP growth can only come about when safety of life and property is guaranteed. The events in Maruti are an important reminder to every investor about the weaknesses of governance in Haryana.

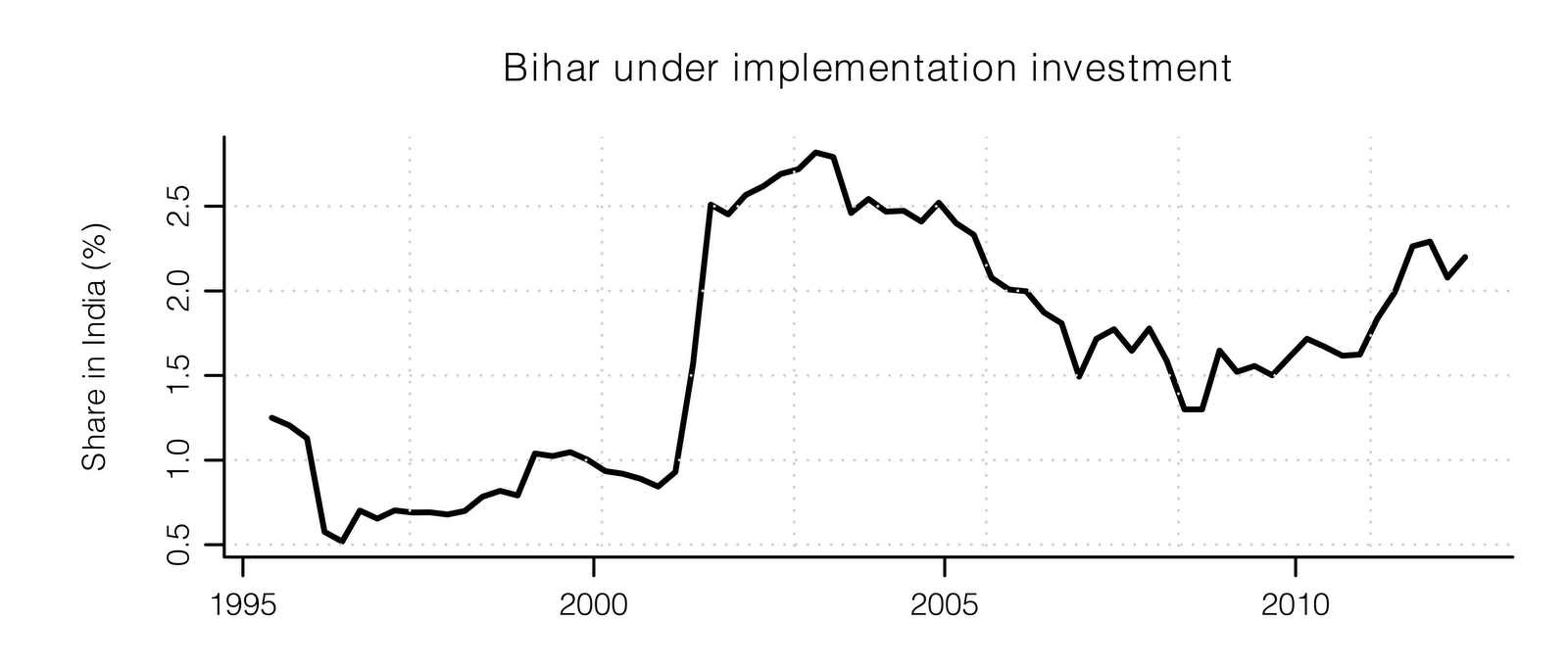

In tracking conditions in any state, I find it useful to watch the time-series of the share of the state in the overall all-India investments outstanding, that are `under implementation', in the CMIE Capex database. Here's an example, for Bihar:

November 2005 is the date that Nitish Kumar became the new CM of Bihar. He is widely reputed to have made important progress on improving law and order. At first, the share of Bihar (in all-India under implementation investment) continued to drop. I am sure the changes brought about by Nitish took time; Rome wasn't built in a day. And, after improvements come about, skeptical investors would take some time in making up their minds that conditions are now better. From 2009 onwards, it appears that there is some upward movement. The overall gain seems to be roughly 1 per cent of the all-India total, which is a significant change.

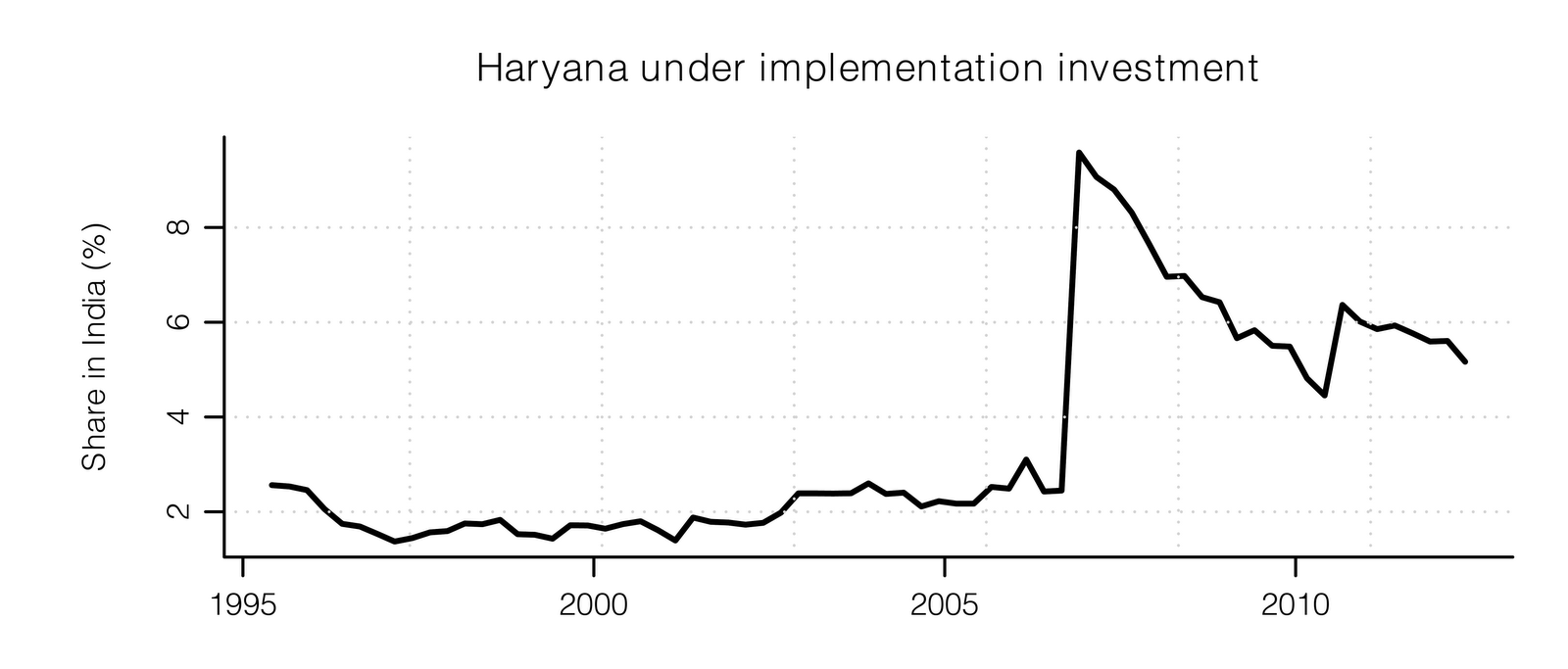

Compare this with Haryana:

There was a big spurt in the share of Haryana in the overall under-implementation investment in India. After that, the numbers have steadily trended down. Is Haryana suffering from a resource curse in terms of proximity to Delhi?

Rethinking labour law

In the early decades about independence, India constructed a remarkable legal framework which was strongly pro-trade-union. Few countries have enshrined trade unions into laws on the scale that India has done. In those years, trade unions were primarily led by socialist/communist parties. While we may disagree with their views, there was a fundamental decency about them. Some of the best human beings in India, in the 1950s and 1960s, were communist. Perhaps this coloured our thinking, and encouraged us to respect and empower trade unions strongly in the legal framework which fell into place over the 1960s and the dark days of the 1970s.

Today, a hyper-empowered trade union is a potent tool for extortion in the hands of local goons. To solve this problem, it is important to rethink the checks and balances embedded in labour law, which have gone too far in the direction of making trade unions strong. Now that we know that the people in trade unions are most likely local goons, do we want to hyper-empower them through labour law?

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

The Disaster At Maruti

Published 07/24/2012, 02:37 AM

Updated 07/09/2023, 06:31 AM

The Disaster At Maruti

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or

remove ads

.

Latest comments

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.