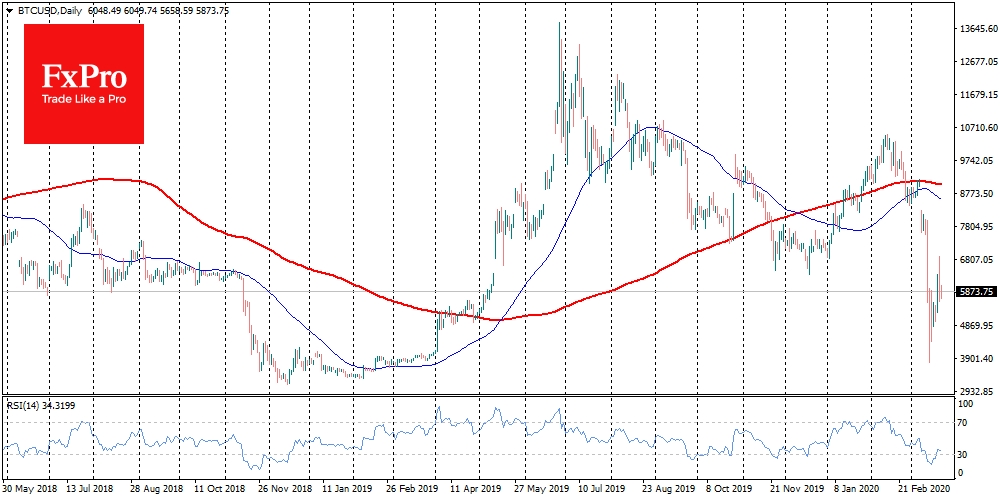

The Bitcoin’s attempts to reverse the trend encountered resistance near $6,800. As a result, at the beginning of the working week first cryptocurrency loses more than 7% and changes hands around $5,800. A decrease below the round level at $6,000 provoked increased sales. Altcoins follow the benchmark coin and are declining on a similar scale.

The Crypto Fear & Greed Index is a very accurate reflection of what is happening in the crypto market, remaining in the “extreme fear” area. This index did not go up even at the moment of the market bounce attempt. The RSI index showed growth along with the price; however, it barely bounced back from the oversold area.

Why is this happening? Bitcoin was sold out when overall market fears peaked. But after a crushing decline, Bitcoin was expected to be counterbalance to what is happening in traditional markets. And now we are witnessing stocks and oil falling again, followed by Bitcoin.

A crypto-miracle did not happen. Investors have an extreme level of fear about all assets at once, while triggering margin calls in the financial industry is forcing institutional investors to exit with cash without looking at prices.

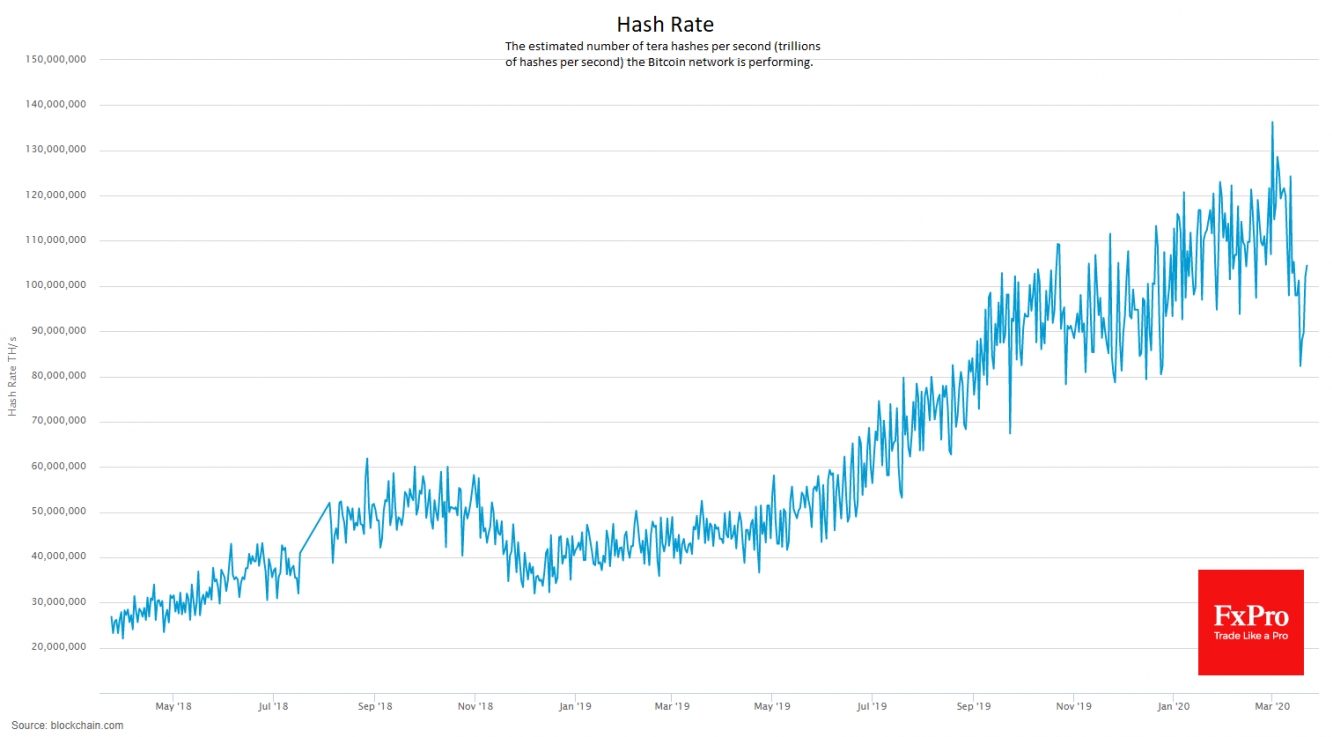

Finally, with the bitcoin price falling in March, there was a reversal in the hash rate. The miners were massively shutting down their ASICs, with the price falling below $7,500. Now when the price is close to the levels of May 2019, the hash rate has increased again. Massive shutting down occurred against the backdrop of a twofold drop in the price in less than a month. The last time such moves in price and complexity of mining we observed at the end of 2018. A sharp collapse was then followed by three months at the bottom of both the hash rate and the price.

Nevertheless, the speculative interest did not go anywhere. Demand can lead to a sharp increase and decrease in the price, but the real driving force can only be retail demand and use in payments around the world. The planet is well on its way to self-isolation, but the need for exchange between countries won’t disappear, which can be considered positive for the crypto market.

The FxPro Analyst Team

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

The Crypto-Miracle Didn’t Happen As Assets Drop Together

Published 03/23/2020, 10:47 AM

Updated 03/21/2024, 07:45 AM

The Crypto-Miracle Didn’t Happen As Assets Drop Together

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or

remove ads

.

Latest comments

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.