Warren Buffett is confused about retail trade stating "retailing is tough for me to figure out". Not only is the retail model changing - but consumer spending and inflation trends are changing also.

Follow up:

Mr. Buffett was lamenting about missing the Amazon (NASDAQ:AMZN) investing train - not understanding that the retail model was changing from the box stores to internet purchasing. But it is not just the trend towards online purchasing occurring in retail - but other significant fundamentals are changing also.

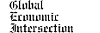

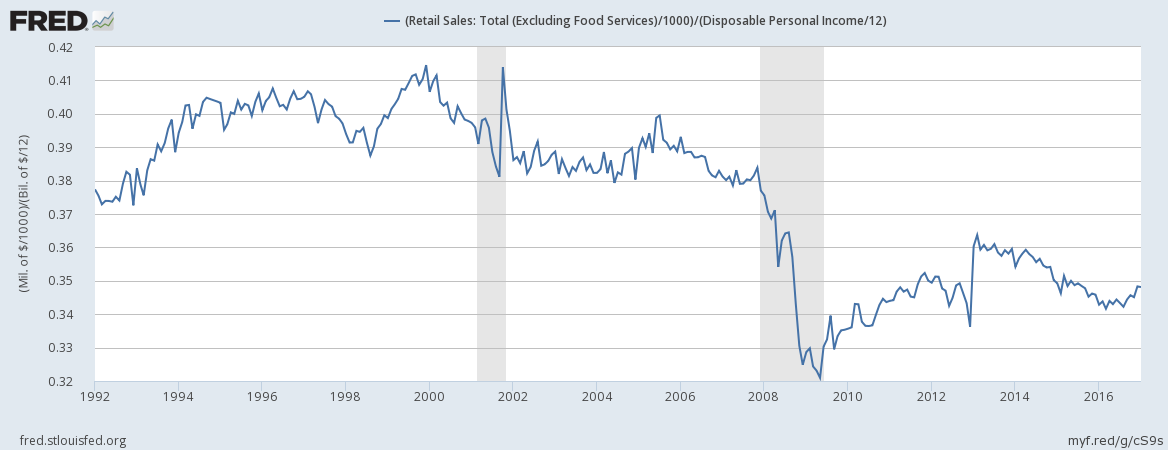

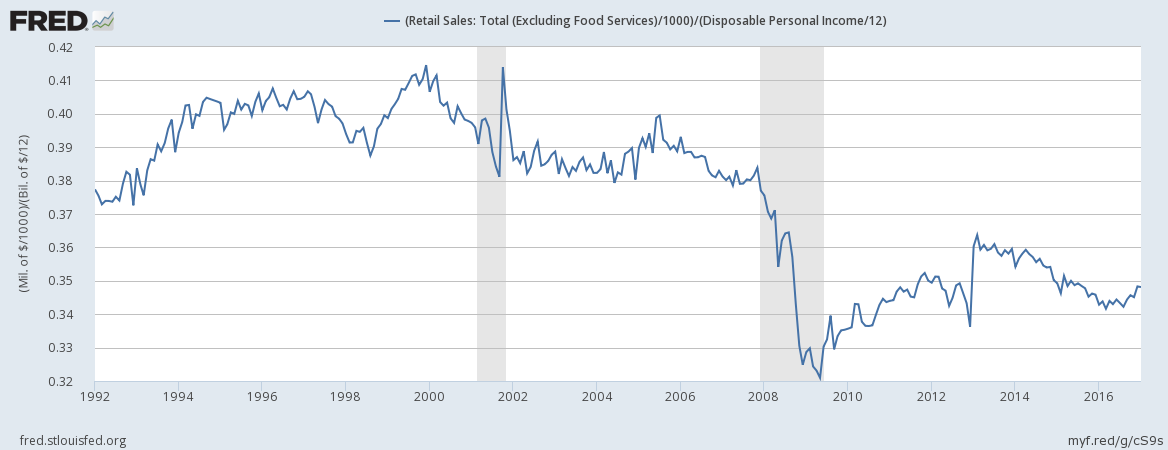

One development is that retail purchases have become a smaller component of disposable income.

Does it come as any surprise that the old brick and mortar stores are in trouble with increased competition (profit margin squeeze) from Amazon et al - as well as retail's shrinking proportion of consumer spending.

There are three major components of retail - durable goods, non-durable (soft) goods, and services. This post is concentrating on durable and non-durable goods which is what Mr. Buffett was discussing.

This evokes discussion of inflation in the retail sector.

The red line on the above graph is durable goods (items which have more than a three year lifespan). In the last 30 years, durable goods have seen little inflation. On the other hand, non-durables (green line) have been inflating at roughly the same rate as the consumer price index (CPI-U - blue line).

Roughly non-durable goods expenditures are double durable goods expenditures.

What is driving retail is the services sector with double the expenditures of the goods sector - with housing, utilities and health care over half of the services expenditures.

Bottom Line

The goods sector is the easiest to automate - and the lowest cost retail model will continue to dominate (Amazon et al). Currently it is durables with the lowest cost model, but over the last several years inflation has moderated in the non-durable goods suggesting automation is starting to mitigate inflation.

This all suggests that any goods retailing business not undergoing significant automation and/or cost reduction is likely doomed. This is not groundbreaking news as it has been taught in Business 101 for the last 100 years.

Investing EARLY in any company with cutting edge automation and cost reduction at a significantly higher level than its competitors is fundamental.

What we have yet to see is any impact of automation in the services sector - but this too will change in our lifetimes.

Other Economic News this Week:

The Econintersect Economic Index for March 2017 improvement trend continues although the value remains in the territory of weak growth. The index remains below the median levels seen since the end of the Great Recession. The data continues to suggest better dynamics in the future. Six-month employment growth forecast indicates modest improvement in the rate of growth.

Bankruptcies this Week from bankruptcydata.com: Privately-held BCBG Max Azria Group, Privately-held California Proton Treatment Center

Click here to view the scorecard table below with active hyperlinks

Weekly Economic Release Scorecard: