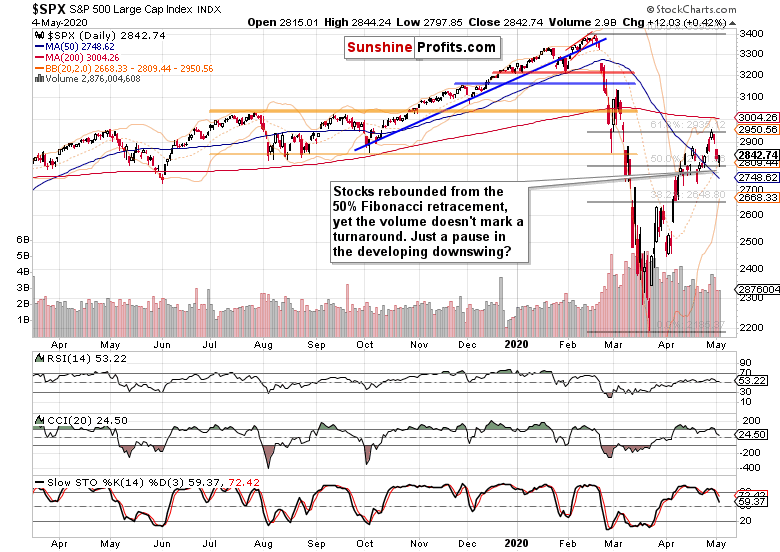

Stocks opened yesterday with a bearish gap, yet the 50% Fibonacci retracement withstood the test, and the bulls staged a comeback. Let’s dig deeper into the health of the comeback – does it mark a reversal?

SPY 500 in the Short-Run

We’ll start with the daily chart analysis (charts courtesy of http://stockcharts.com):

Friday’s bearish momentum continued into yesterday’s premarket session, but the bulls gradually repaired the damage and closed the opening gap in the final two-hourly candles of yesterday’s trading. So, the 50% Fibonacci retracement withstood yesterday’s test.

However, the rebound didn’t happen on volume levels that would be consistent with turnarounds, and instead gives an impression of a short-term pause in the downswing. The daily indicators’ sell signals have also been unaffected by yesterday’s price action.

Our yesterday’s observations on volume hold true also today:

(…) In all likelihood, the lower volume just shows that a larger move is underway, and that the bulls don’t find the setup interesting enough to step in and buy with conviction. Similarly the bears don’t find it a good time or place to get out of their positions just yet.

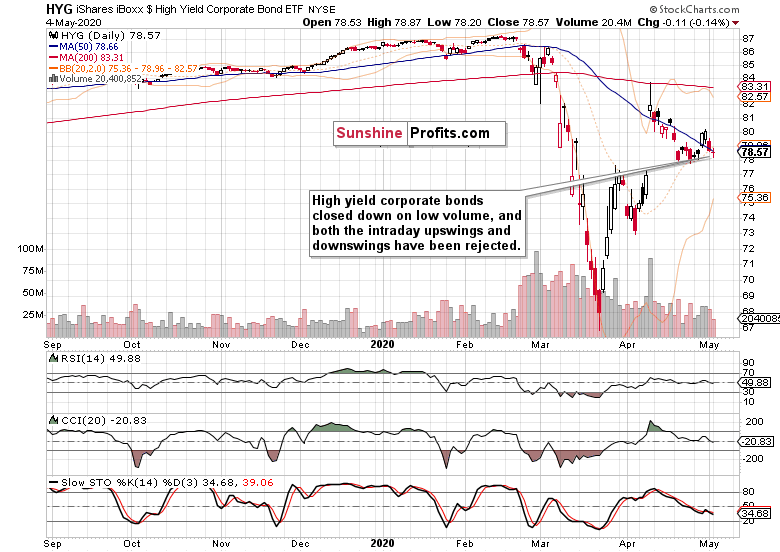

As credit leads stocks, how did the debt markets do yesterday?

The Credit Markets’ Point of View

Just as its ratio to short-term Treasuries (HYG:SHY), high yield corporate debt also opened lower, yet refused to decline further. As it were rising, we closed our profitable Friday’s short position, while stocks were still consolidating. Let’s quote from yesterday’s intraday Stock Trading Alert:

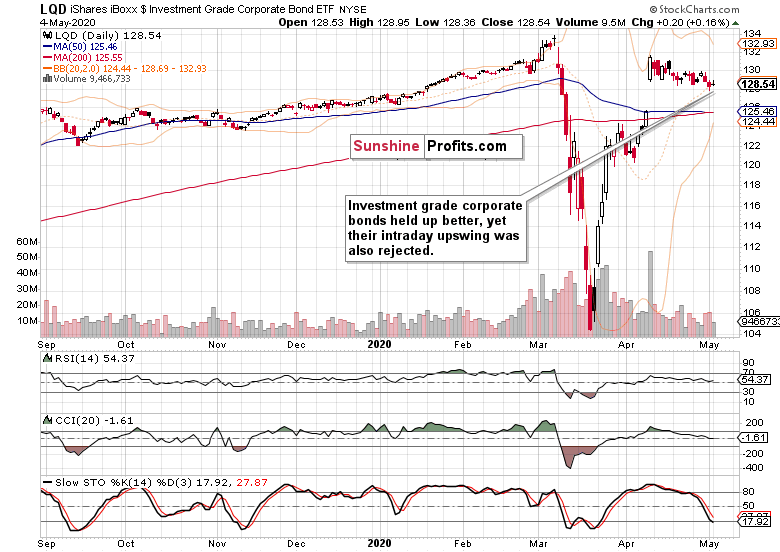

(…) The S&P 500 bulls didn’t take advantage of the price recovery from overnight lows just above 2770 to well over 2815, and the credit markets (HYG ETF and LQD ETF) are losing steam. This increases the likelihood that we’re not to see their immediate rebound in the session, but rather bobbing above and around their last week’s lows – and that doesn’t bode well for any S&P (NYSE:SPY) 500 upswing in the short-term.

Since then, the HYG ETF declined a bit more only to revert to trading close to unchanged on the day, while stocks lagged. This prompted us to reenter the short position at a better risk-reward ratio thanks to the preceding credit markets action. Stocks rose strongly only in the final 75 minutes of trading, while corporate junk bonds saw their upswing attempt rejected during the same time window. Unless credit markets (yes, we mean the LQD ETF as well) perform strongly later today, stocks are getting ahead of themselves in a way.

Investment grade corporate bonds didn’t experience a selling wave after the open, yet they also refused to move up during the day. The same is true about its ratio to the longer-dated Treasuries (LQD:IEI).

Importantly, just as with the HYG ETF, the LQD ETF session was characterized by lower volume, and thus lacks implications of any kind of reversal. Unless both ETFs’ moves lower are reversed, the credit markets aren’t really on the bulls’ side right now.

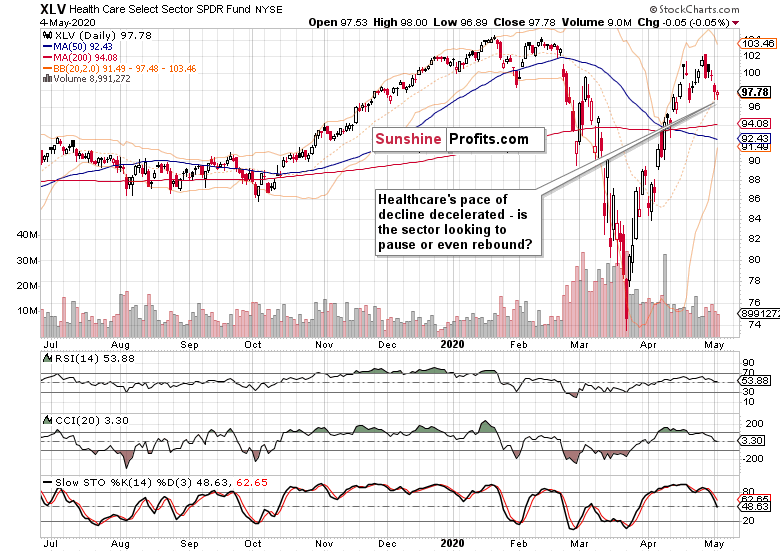

Key S&P 500 Sectors in Focus

The tech sector erased its opening losses, and cut deep into Friday’s bearish gap. But the volume of the upswing didn’t outshine that of the preceding downswing. Given that the S&P 500 futures trade at around 2850 as we speak, technology will surely open higher later today and attempt to resume leadership.

Healthcare merely managed to slow its pace of decline yesterday, but the lower knots of two preceding sessions reveal where the bears are meeting buying interest. With that in mind, a short-term upswing isn’t out of the question. That’s fine because no market goes up or down in a straight line.

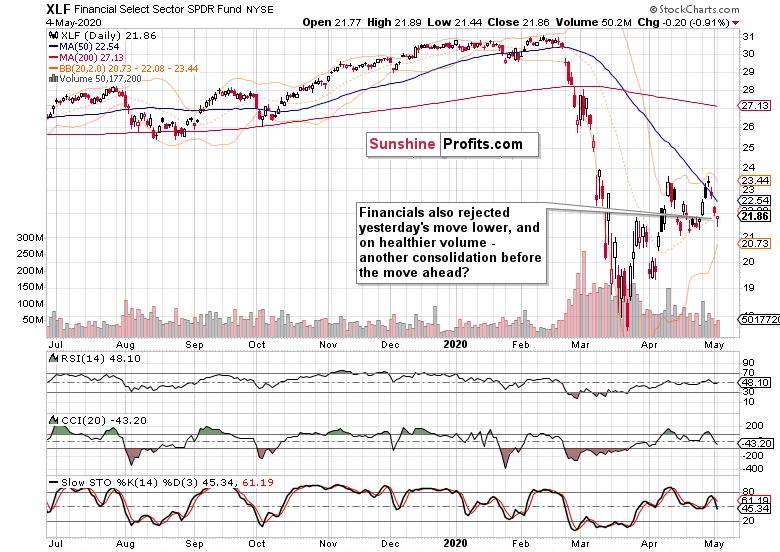

As the credit markets stood relatively unchanged, how did that reflect upon the financials?

The financials also largely refused to decline during the day, and their move happened on larger volume than Friday’s downswing. It means that a short-term rebound can’t be ruled out, regardless of the daily indicators of all these three S&P 500 heavyweights favoring a move lower.

Next, let’s discuss the stealth bull market trio of sectors (energy, materials and industrials) that are supposed to lead the index higher, if we are in a bull market, that is.

Energy ETF (NYSE:XLE) moved up, closing just below its Friday’s open, on not too bad a volume – but still trades well below its local peak. So did the materials (XLB ETF), but given their larger Friday’s gap, the implications aren’t as bullish as in the case of energy. Industrials (XLI ETF) performed along the lines of financials, which means that they just refused to decline on the day, and couldn’t bring themselves up to closing even their Monday’s gap, let alone the Friday’s one.

Overall, the sectoral analysis speaks in favor of a short-term pause in the S&P 500 downswing, and the $64,000 question is when will the move lower continue in earnest.

Later today, we’re getting the ISM non-manufacturing PMI. While it’s likely the reading will come in at above expectations, stocks might meet a buy-the-rumor-sell-the-news reaction.

The Fundamental S&P 500 Outlook

Stating the obvious, the reopening euphoria keeps being a major theme. As it’s a long process, its veracity will be continually reassessed, and we’re of the opinion that the market is assigning too high a probability to a V-shaped outcome, which should drive disappointment.

The rally we’ve seen from the Mar 23 bottom, has been a sharp one, and a multi-week affair on top. But it’s within the bear markets where the strongest rallies happen – and they might take a time to reverse. First meekly, then more profoundly. Even if the stealth bull market sectors regain the pool position and overcome their local highs down the road, the current consolidation with a bearish bias still hasn’t run its course in our opinion.

The credit markets are the places to watch right now. Once they break below their local lows (and it’s more likely than not that they will), stocks will catch up with vengeance.

Summary

Summing up, stocks rebounded from the 50% Fibonacci retracement, but the credit markets and sectoral performance are giving mixed signals. Stocks are getting ahead of themselves unless the corporate debt markets reverse higher. On balance, it appears we’re in the early stages of the S&P 500 downswing and our short position remains justified.

Disclaimer: All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.