Although my market missives tend to meander a bit at times, this week, I'd like to cut directly to the chase. So here goes. Although the action has been more than a little crazy lately, and there are a ton of moving parts, the bottom line is I believe the market just might be in the midst of a bottoming process.

To be clear, I am NOT saying we've seen the low. Nor am I saying that it will be clear sailing from here. What I am saying is that it looks to me like the market is in the process of "getting comfortable" with the current environment. You know, the Fed's tough stance, the weakening economic data, the potential for things to break along the way, etc.

I'm a firm believer in the idea that markets can "handle" just about anything, given enough time and data. And since this bear cycle has been with us going on for ten months now, it occurs to me that most of the scary stuff might be known/discounted by now.

Think about it. The markets have been treated to a bunch of bad news lately. The U.K. bond market debacle. Talk of serious liquidity issues in the U.S. Treasury market. Jamie Dimon's storm clouds. A seemingly endless advance in rates. The growth/earnings downgrades. Trucker loads are falling off a cliff. The unrelenting hawkish Fed commentary ("Higher for longer!"). Sticky inflation data. The decline in housing data. The war in Ukraine. Expectations for recession (or worse, across the pond). And so on, and so on.

And what has been the stock market's response over the past month? As of this writing, the major indices are moving higher and appear to be working on breaking out of the latest downtrend. Fingers crossed.

Sure, the primary trend remains down. However, the optimist in me wants to point out that stocks have actually held up fairly nicely, given all the negative inputs traders have had to deal with. As such, one could argue that the bar is now lower for good news than bad, as stocks haven't made any downward progress despite the dour headlines.

Perhaps I'm guilty of something called recency bias here. After all, it was just a week or so ago that traders were freaking out about the Fed's new "terminal point" as rates spiked to new highs. However, as WSJ reporter and purported "Fed whisperer," Nick Timiraos noted on Friday, it looks like the Fed may be ready to tone things down a bit after next week's 75 basis point hike.

No, going from a 75-basis point rate hike to a 50-bps hike is not exactly a hard "pivot." However, it is progress; thus, the end may be in sight! The thinking here is the faster the Fed stops aggressively hiking rates, the better the odds are that the economy will survive this inflation battle.

Put another way, the odds of a big mistake or something "breaking along the way" improve once Powell & Co take their foot off the gas. And since the economy - as defined by unemployment and service sector activity - is still in decent shape, the bulls contend that a soft(ish) landing is certainly possible. And this, dear readers, is a good thing.

Now mix in the extreme oversold conditions and the "bombed out" sentiment readings, and voila, you've got the makings of a rally. Heck, even Morgan Stanley)'s Mike Wilson, who has been correctly bearish for eons, admits that the bulls could enjoy some time in the sun here into year-end.

And lest we forget, markets are now entering what has historically been the most favorable time of year. So, if we can avoid a calamity (and/or another surge in rates) in the near term, I will argue that maybe, just maybe, stocks have entered the bottoming phase.

On that note, it is important to remember that bear market bottoms tend to be a process and not an "event." Unless the Fed is going to ride in on their white horses to save the day like they have so many times over the past decade, it is going to take time for investors to regain their confidence.

But with surveys showing fund managers holding the highest levels of cash since early 2009, one can argue that once some confidence is restored, money is likely to come back into the market.

So, if we can survive the big earnings week and corporate America starts buying back stock again, the bulls just might have a chance at some point in the near future. We shall see.

Now let's review the "state of the market" through the lens of our market models...

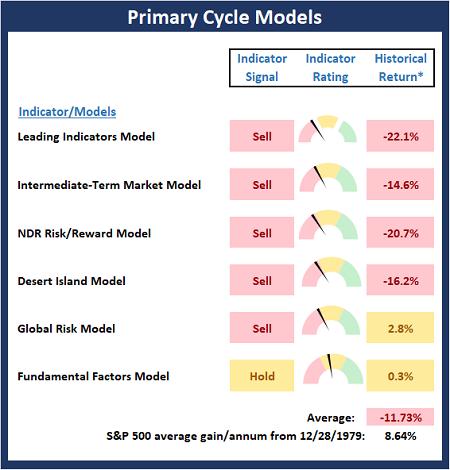

Big-Picture Market Models

We start with six of our favorite long-term market models. These models are designed to help determine the "state" of the overall market.

Source: Ned Davis Research (NDR) as of the date of publication. Historical returns are hypothetical average annual performances calculated by NDR.

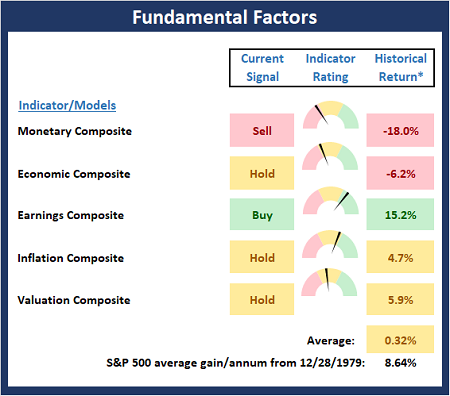

The Fundamental Backdrop

Next, we review the market's fundamental factors including interest rates, the economy, earnings, inflation, and valuations.

Source: Ned Davis Research (NDR) as of the date of publication. Historical returns are hypothetical average annual performances calculated by NDR.

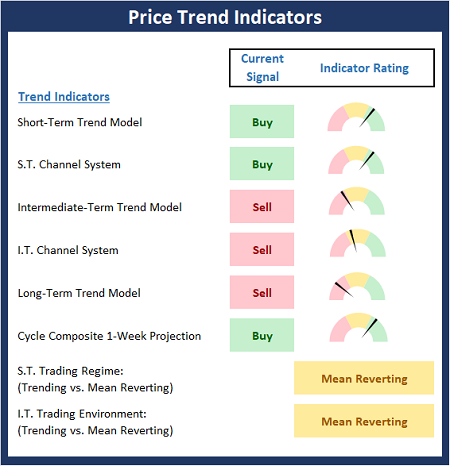

The State Of The Trend

After reviewing the big-picture models and the fundamental backdrop, I like to look at the state of the current trend. This board of indicators is designed to tell us about the overall technical health of the market's trend.

Source: Ned Davis Research (NDR) as of the date of publication.

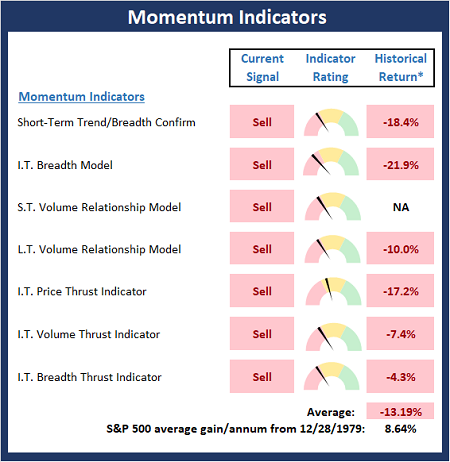

The State Of Internal Momentum

Next, we analyze the momentum indicators/models to determine if there is any "oomph" behind the current move.

Source: Ned Davis Research (NDR) as of the date of publication.

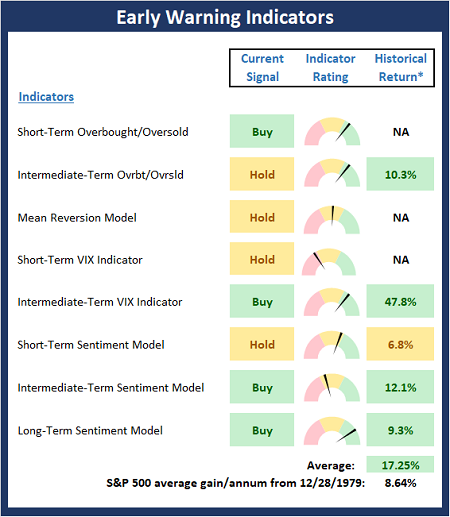

Early Warning Indicators

Finally, we look at our early warning indicators to gauge the potential for countertrend moves. This batch of indicators is designed to suggest when the table is set for the trend to "go the other way."

Source: Ned Davis Research (NDR) as of the date of publication. Historical returns are hypothetical average annual performances calculated by NDR.

Thought for the Day:

It's difficult to follow your dream. It's a tragedy not to. -Unknown