Stock market today: S&P 500 climbs as ongoing AI-led rebound pushes tech higher

Summary

The global economy is entering a period of "synchronized stagnation," according to a study by the Financial Times and the Brookings Institution (emphasis added):

A worldwide slowdown is giving way to a synchronized stagnation characterized by weak growth in some major economies and essentially no growth or even mild contraction in others. Fears of an imminent global recession seem premature, but policymakers seem at a loss about how to revive growth, with little appetite for fundamental reforms and limited room for effective macroeconomic stimulus.

Global manufacturing PMIs provide the strongest evidence of these trends, with most currently just under 50, signaling a mild contraction. Topline GDP data also reveals some of the slowdown: China's GDP, while still high by developed market standards, continues to move lower; German GDP, like China's, is also grinding lower; the UK's is barely positive. Central banks have started to cut rates as a preventative economic measure. The article argues that "[p]ersistent trade tensions, political instability, geopolitical risks, and concerns about the limited efficacy of monetary stimulus." You'll get no argument from me on that.

Will the UK pull out a Brexit victory? (emphasis added)

Britain’s faltering Brexit negotiations with the European Union got a lifeline on Thursday from an unexpectedly upbeat meeting between the leaders of Britain and Ireland, with both saying they could see “a pathway to a possible deal” to handle issues over Northern Ireland.

Meeting at a hotel outside Liverpool, England, Prime Minister Boris Johnson and Prime Minister Leo Varadkar discussed Britain’s proposal, which would take Northern Ireland out of the European customs union, along with Britain, but leave it aligned with many other European Union regulations.

The UK Parliament passed a bill requiring the UK to obtain an extension from the EU if a deal is not reached by October 19 -- a concession the EU may not give. Brexit will come down to the wire with the market guessing as to what will eventually happen.

Earnings season is quickly approaching. Don't expect the numbers to be exciting. From Factset.com (emphasis added):

For Q3 2019, the estimated earnings decline for the S&P 500 is -4.1%. If -4.1% is the actual decline for the quarter, it will mark the first time the index has reported three straight quarters of year-over-year earnings declines since Q4 2015 through Q2 2016.

And from Zacks (emphasis added):

Total Q3 earnings for the S&P 500 index are expected to be down -5.1% from the same period last year on +4.2% higher revenues. Driving this weak growth picture is tough comparisons to last year when earnings were boosted by the tax reform.

As always, take all these predictions with the largest grain of salt possible. The most important data will come from earnings conference calls where companies will discuss the macroeconomic and business climate.

Let's turn to today's performance table:

Remember this is a holiday weakened trading day. The main news to take from today's activity is that the Treasury market rallied. Yes, large-caps were up and small-caps were down but the former only rallied marginally while the latter was down, at most, 0.5%. All-in-all, this was a nothing day overall.

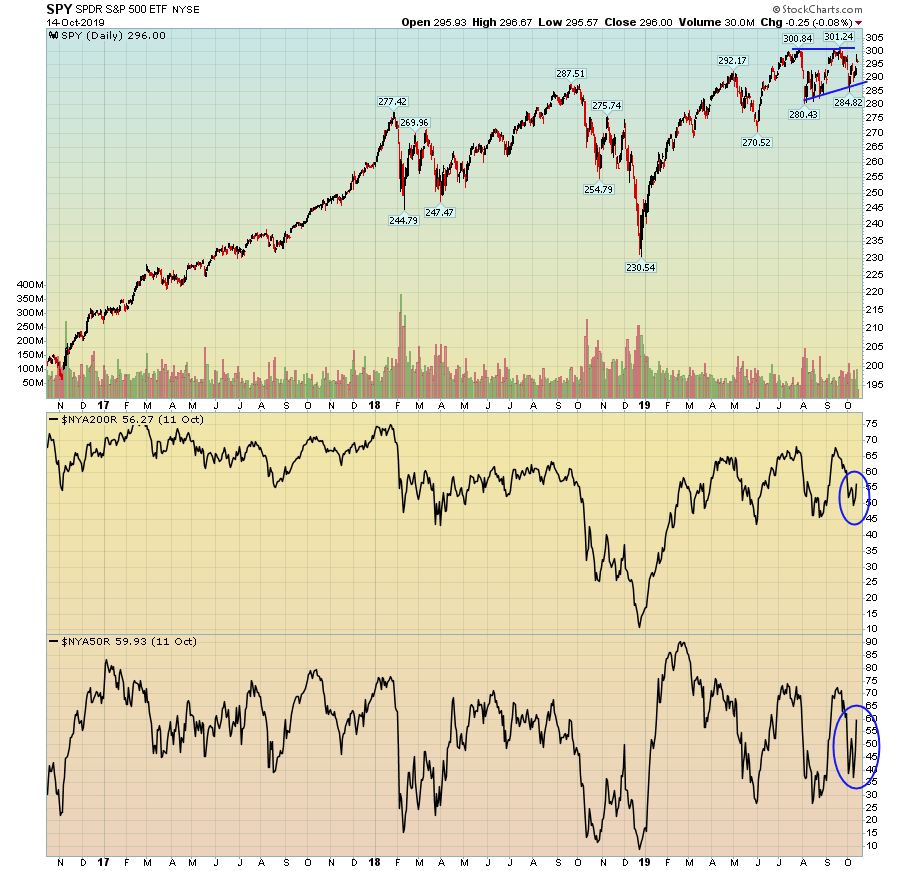

But, it's possible to argue that the markets are at least aligned for an upside breakout:

The top panel shows the SPY, which is consolidating in a triangle pattern. The bottom two panels show the percentage of stocks above their 200-day EMA (middle panel) and the percentage of stocks above their 50-day EMA (bottom panel). The bottom two panels indicate there is upside room for the markets to rally if given a sufficient reason.

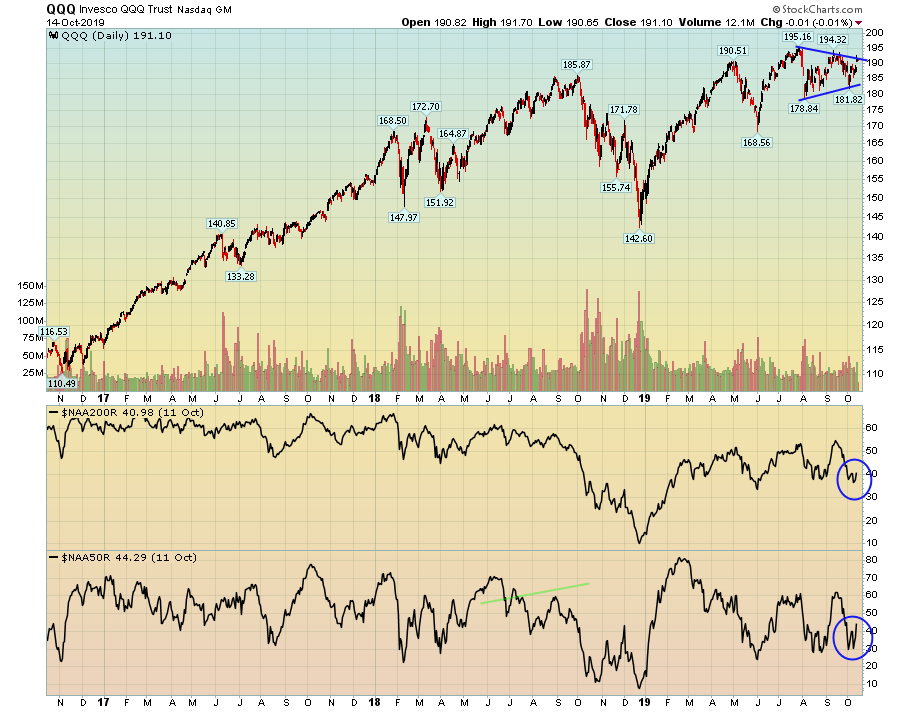

The QQQ has the same technical backdrop:

This does not mean it will happen, only that the technical table has been set.