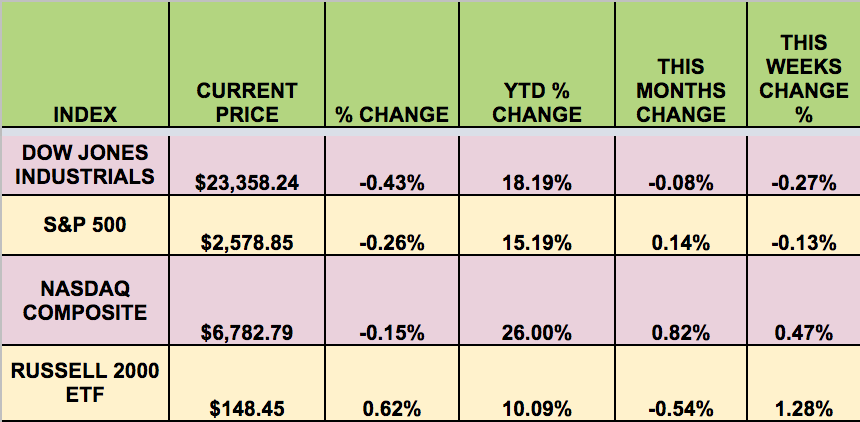

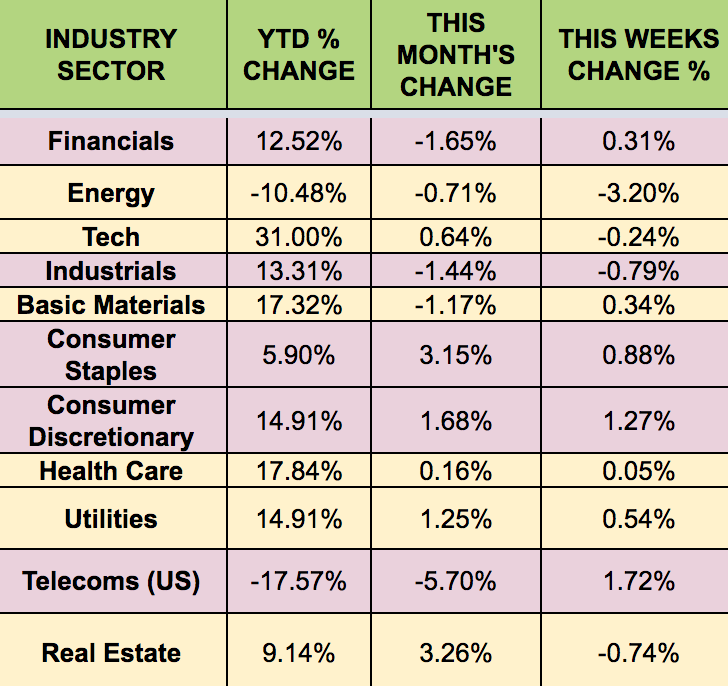

Markets: It was a split market this week, with the DOW and the S&P 500 down, and the NASDAQ and small caps rising, as investors continued to worry about the future of promised corporate tax cuts. Stocks had their best day since Sept. on Thursday, after passage of the House tax bill.

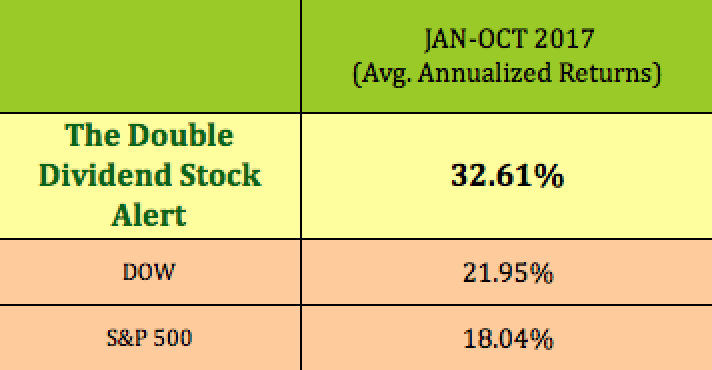

Dividend Stocks Update: These high dividend stocks go ex-dividend this coming week: Apollo Global Management LLC Class A (NYSE:APO), Capitala Finance Corp (NASDAQ:CPTA), Main Street Capital Corporation (NYSE:MAIN), Medley Capital Corporation (NYSE:MCC), Solar Senior Capital Ltd (NASDAQ:SUNS), Harvest Capital Credit Corporation (NASDAQ:HCAP),

Tax Bill Update:

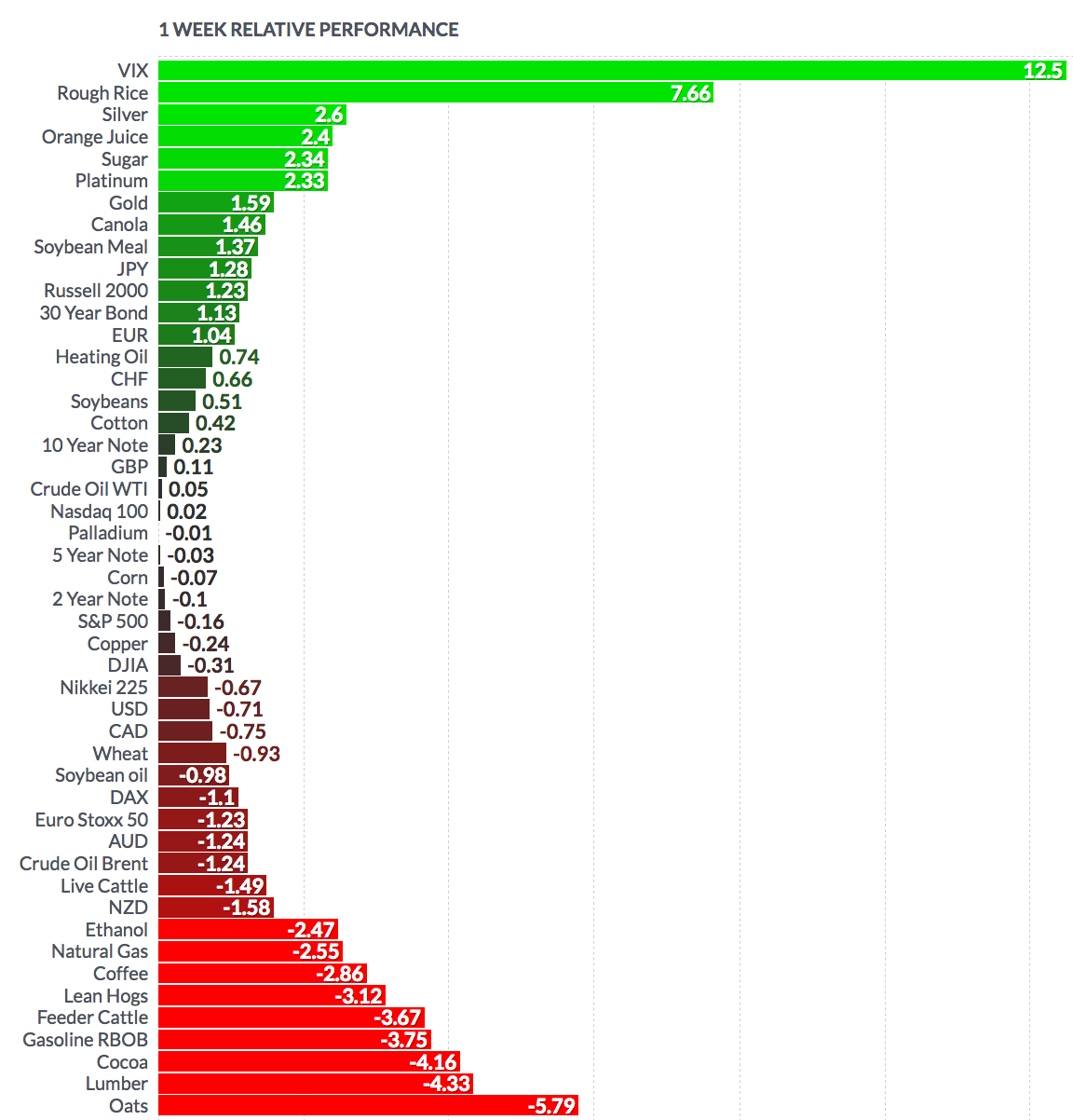

Volatility: The VIX was up as high as $14.51 this week, and finished at $11.43, virtually flat.

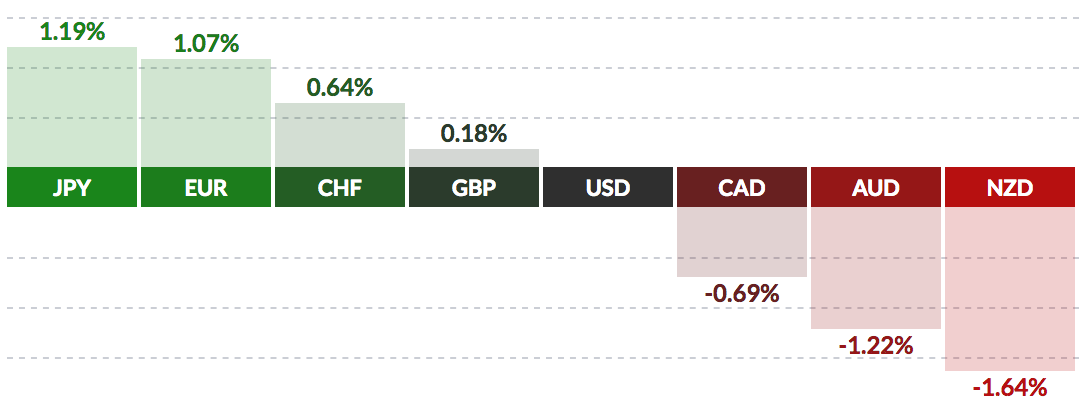

Currency: The $ fell vs. the Yen, Euro, and the Swiss Franc this week, and rose vs. the Canadian, Australian, and NZ $.

Market Breadth: 13 of the DOW 30 stocks rose this week, vs. 16 last week. 60% of the S&P 500 rose, vs. 53% last week.

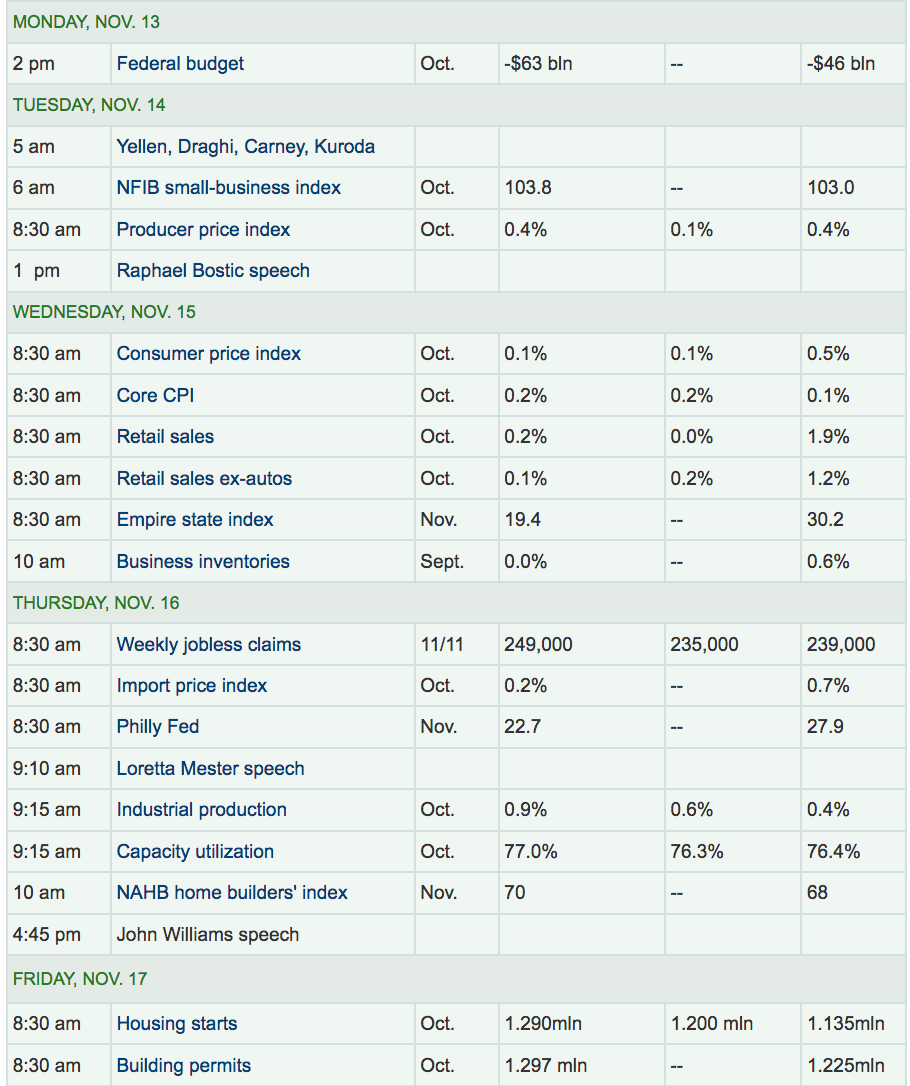

Economic News: Industrial Production rose .9%, higher than forecast. Inflation, as measured by Core CPI, was flat, at .2%. However, Producer Prices rose .4% in October, more than forecast. Housing Starts and Building Permits both increased.

San Francisco Fed President John Williams told reporters on Thursday that a December rate hike was perfectly reasonable,. Markets see a greater than 90% chance of a rate hike at the Dec. 12-13 meeting.

This would be the fourth rate hike in the past year, a much faster pace that the one rate hike over the prior 12 months. The Fed last met earlier this month and held interest rates steady. Minutes of that meeting will come on Wednesday.

It looks like there may be some changes in the Fed’s planning strategies:

Cleveland Fed President Loretta Mester told reporters that Fed should follow the lead of the Bank of Canada, which formally reviews its strategy and policy tool every five years.

We’ve been through the crisis. We know the challenges it posed to monetary policy, she said.

John Williams of the San Francisco Fed has taken the lead on the policy re-think.

History teaches us that a recession will come at some point, and prudence demands we use this time of relative economic calm to plan for the storms ahead, Williams said in a speech on Thursday.

Williams wants the Fed to change its strategy to price-level targeting which would see the central bank allow inflation to remain above the 2% target to make up for periods when it was too low.

It would help combat a recession because financial markets would be convinced the Fed was going to keep rates lower for longer and refrain from running up longer-term Treasury yields at the first sign of a recovery. (Source: Reuters)

“Remember how used-car prices looked due for a big drop? It isnt happening, thanks in part to demand from people who are replacing hundreds of thousands of hurricane-damaged vehicles, as a Wall Street Journal report notes.

Buoyant prices are good for auto makers, dealers and rental-car companies, but the trend is not going to be helpful for used-car buyers who dont want to bust their budget.” (Source: WSJ)

“Theres plenty of turkey for second helpings this Thanksgiving.Supplies will be plentiful after a recent production boom. Add that to stagnant U.S. demand and youve got the recipe for cheaper birds. According to an annual survey from the American Farm Bureau Federation, a 16-pound turkey will cost about 1.6 percent less than last year, and the whole meal will be the cheapest since 2013. (Source: Bloomberg)

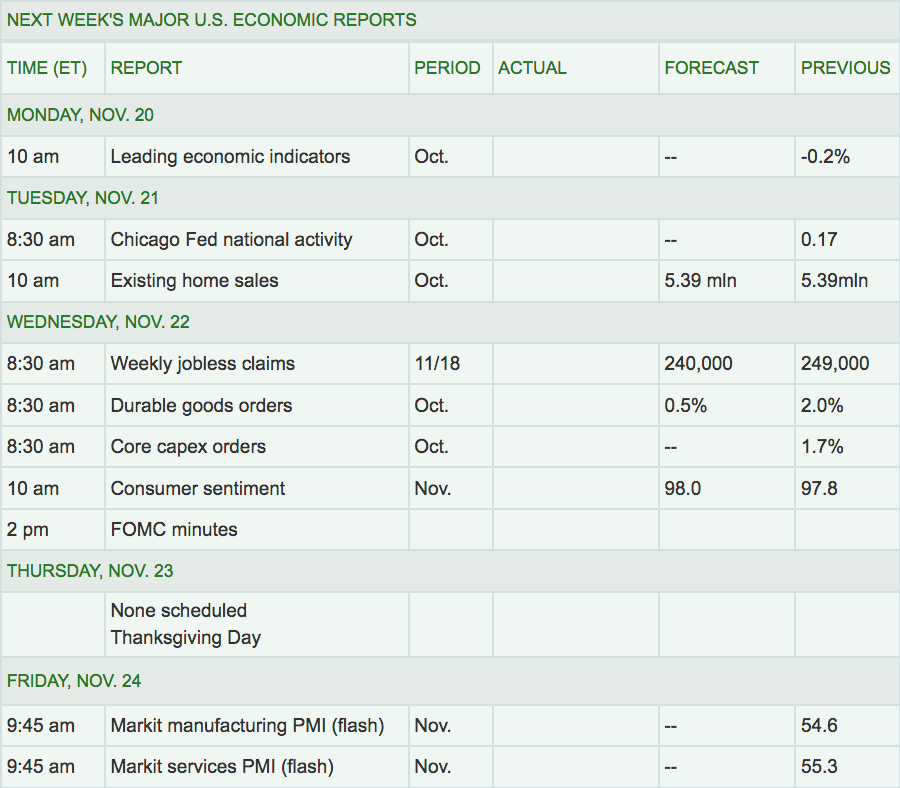

Week Ahead Highlights: It’ll be a short week, with US markets closed on Thursday, for the Thanksgiving holiday feast.

Next Week’s US Economic Reports: It’ll also be a slow week for economic data next week, although we will get a look at leading economic indicators, Home Sales, and the Fed minutes from the last meeting, which may give a bit more color as to future rate hikes.

Sectors: The Telecom and Consumer Discretionary sectors led this week, with Energy trailing.

Futures: WTI Crude finished flat this week, saved from a loss by a surge to $56.80 on Friday. Natural gas fell 2.5%. Oil rose Friday on speculation that there may be further cuts announced at the 11/30/17 OPEC meeting.